Comparison between U.S. GAAP and International ... - Grant Thornton

Comparison between U.S. GAAP and International ... - Grant Thornton

Comparison between U.S. GAAP and International ... - Grant Thornton

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

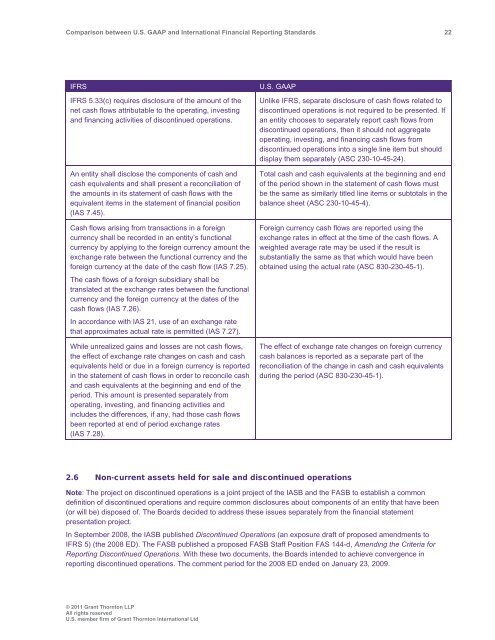

<strong>Comparison</strong> <strong>between</strong> U.S. <strong>GAAP</strong> <strong>and</strong> <strong>International</strong> Financial Reporting St<strong>and</strong>ards 22<br />

IFRS<br />

IFRS 5.33(c) requires disclosure of the amount of the<br />

net cash flows attributable to the operating, investing<br />

<strong>and</strong> financing activities of discontinued operations.<br />

An entity shall disclose the components of cash <strong>and</strong><br />

cash equivalents <strong>and</strong> shall present a reconciliation of<br />

the amounts in its statement of cash flows with the<br />

equivalent items in the statement of financial position<br />

(IAS 7.45).<br />

Cash flows arising from transactions in a foreign<br />

currency shall be recorded in an entity’s functional<br />

currency by applying to the foreign currency amount the<br />

exchange rate <strong>between</strong> the functional currency <strong>and</strong> the<br />

foreign currency at the date of the cash flow (IAS 7.25).<br />

The cash flows of a foreign subsidiary shall be<br />

translated at the exchange rates <strong>between</strong> the functional<br />

currency <strong>and</strong> the foreign currency at the dates of the<br />

cash flows (IAS 7.26).<br />

In accordance with IAS 21, use of an exchange rate<br />

that approximates actual rate is permitted (IAS 7.27).<br />

While unrealized gains <strong>and</strong> losses are not cash flows,<br />

the effect of exchange rate changes on cash <strong>and</strong> cash<br />

equivalents held or due in a foreign currency is reported<br />

in the statement of cash flows in order to reconcile cash<br />

<strong>and</strong> cash equivalents at the beginning <strong>and</strong> end of the<br />

period. This amount is presented separately from<br />

operating, investing, <strong>and</strong> financing activities <strong>and</strong><br />

includes the differences, if any, had those cash flows<br />

been reported at end of period exchange rates<br />

(IAS 7.28).<br />

U.S. <strong>GAAP</strong><br />

Unlike IFRS, separate disclosure of cash flows related to<br />

discontinued operations is not required to be presented. If<br />

an entity chooses to separately report cash flows from<br />

discontinued operations, then it should not aggregate<br />

operating, investing, <strong>and</strong> financing cash flows from<br />

discontinued operations into a single line item but should<br />

display them separately (ASC 230-10-45-24).<br />

Total cash <strong>and</strong> cash equivalents at the beginning <strong>and</strong> end<br />

of the period shown in the statement of cash flows must<br />

be the same as similarly titled line items or subtotals in the<br />

balance sheet (ASC 230-10-45-4).<br />

Foreign currency cash flows are reported using the<br />

exchange rates in effect at the time of the cash flows. A<br />

weighted average rate may be used if the result is<br />

substantially the same as that which would have been<br />

obtained using the actual rate (ASC 830-230-45-1).<br />

The effect of exchange rate changes on foreign currency<br />

cash balances is reported as a separate part of the<br />

reconciliation of the change in cash <strong>and</strong> cash equivalents<br />

during the period (ASC 830-230-45-1).<br />

2.6 Non-current assets held for sale <strong>and</strong> discontinued operations<br />

Note: The project on discontinued operations is a joint project of the IASB <strong>and</strong> the FASB to establish a common<br />

definition of discontinued operations <strong>and</strong> require common disclosures about components of an entity that have been<br />

(or will be) disposed of. The Boards decided to address these issues separately from the financial statement<br />

presentation project.<br />

In September 2008, the IASB published Discontinued Operations (an exposure draft of proposed amendments to<br />

IFRS 5) (the 2008 ED). The FASB published a proposed FASB Staff Position FAS 144-d, Amending the Criteria for<br />

Reporting Discontinued Operations. With these two documents, the Boards intended to achieve convergence in<br />

reporting discontinued operations. The comment period for the 2008 ED ended on January 23, 2009.<br />

© 2011 <strong>Grant</strong> <strong>Thornton</strong> LLP<br />

All rights reserved<br />

U.S. member firm of <strong>Grant</strong> <strong>Thornton</strong> <strong>International</strong> Ltd