Comparison between U.S. GAAP and International ... - Grant Thornton

Comparison between U.S. GAAP and International ... - Grant Thornton

Comparison between U.S. GAAP and International ... - Grant Thornton

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

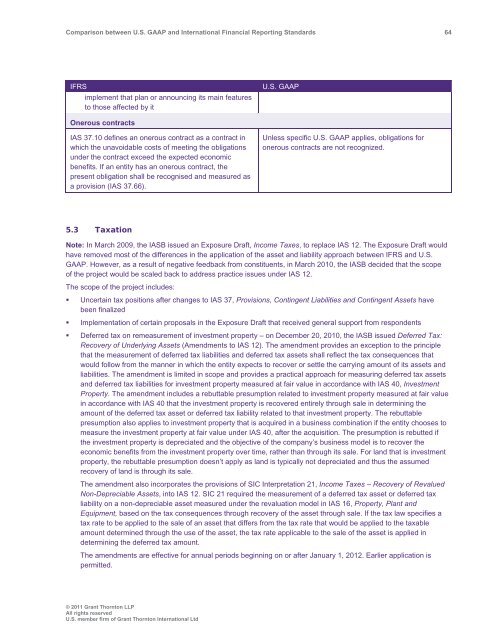

<strong>Comparison</strong> <strong>between</strong> U.S. <strong>GAAP</strong> <strong>and</strong> <strong>International</strong> Financial Reporting St<strong>and</strong>ards 64<br />

IFRS<br />

implement that plan or announcing its main features<br />

to those affected by it<br />

U.S. <strong>GAAP</strong><br />

Onerous contracts<br />

IAS 37.10 defines an onerous contract as a contract in<br />

which the unavoidable costs of meeting the obligations<br />

under the contract exceed the expected economic<br />

benefits. If an entity has an onerous contract, the<br />

present obligation shall be recognised <strong>and</strong> measured as<br />

a provision (IAS 37.66).<br />

Unless specific U.S. <strong>GAAP</strong> applies, obligations for<br />

onerous contracts are not recognized.<br />

5.3 Taxation<br />

Note: In March 2009, the IASB issued an Exposure Draft, Income Taxes, to replace IAS 12. The Exposure Draft would<br />

have removed most of the differences in the application of the asset <strong>and</strong> liability approach <strong>between</strong> IFRS <strong>and</strong> U.S.<br />

<strong>GAAP</strong>. However, as a result of negative feedback from constituents, in March 2010, the IASB decided that the scope<br />

of the project would be scaled back to address practice issues under IAS 12.<br />

The scope of the project includes:<br />

• Uncertain tax positions after changes to IAS 37, Provisions, Contingent Liabilities <strong>and</strong> Contingent Assets have<br />

been finalized<br />

• Implementation of certain proposals in the Exposure Draft that received general support from respondents<br />

• Deferred tax on remeasurement of investment property – on December 20, 2010, the IASB issued Deferred Tax:<br />

Recovery of Underlying Assets (Amendments to IAS 12). The amendment provides an exception to the principle<br />

that the measurement of deferred tax liabilities <strong>and</strong> deferred tax assets shall reflect the tax consequences that<br />

would follow from the manner in which the entity expects to recover or settle the carrying amount of its assets <strong>and</strong><br />

liabilities. The amendment is limited in scope <strong>and</strong> provides a practical approach for measuring deferred tax assets<br />

<strong>and</strong> deferred tax liabilities for investment property measured at fair value in accordance with IAS 40, Investment<br />

Property. The amendment includes a rebuttable presumption related to investment property measured at fair value<br />

in accordance with IAS 40 that the investment property is recovered entirely through sale in determining the<br />

amount of the deferred tax asset or deferred tax liability related to that investment property. The rebuttable<br />

presumption also applies to investment property that is acquired in a business combination if the entity chooses to<br />

measure the investment property at fair value under IAS 40, after the acquisition. The presumption is rebutted if<br />

the investment property is depreciated <strong>and</strong> the objective of the company’s business model is to recover the<br />

economic benefits from the investment property over time, rather than through its sale. For l<strong>and</strong> that is investment<br />

property, the rebuttable presumption doesn’t apply as l<strong>and</strong> is typically not depreciated <strong>and</strong> thus the assumed<br />

recovery of l<strong>and</strong> is through its sale.<br />

The amendment also incorporates the provisions of SIC Interpretation 21, Income Taxes – Recovery of Revalued<br />

Non-Depreciable Assets, into IAS 12. SIC 21 required the measurement of a deferred tax asset or deferred tax<br />

liability on a non-depreciable asset measured under the revaluation model in IAS 16, Property, Plant <strong>and</strong><br />

Equipment, based on the tax consequences through recovery of the asset through sale. If the tax law specifies a<br />

tax rate to be applied to the sale of an asset that differs from the tax rate that would be applied to the taxable<br />

amount determined through the use of the asset, the tax rate applicable to the sale of the asset is applied in<br />

determining the deferred tax amount.<br />

The amendments are effective for annual periods beginning on or after January 1, 2012. Earlier application is<br />

permitted.<br />

© 2011 <strong>Grant</strong> <strong>Thornton</strong> LLP<br />

All rights reserved<br />

U.S. member firm of <strong>Grant</strong> <strong>Thornton</strong> <strong>International</strong> Ltd