Comparison between U.S. GAAP and International ... - Grant Thornton

Comparison between U.S. GAAP and International ... - Grant Thornton

Comparison between U.S. GAAP and International ... - Grant Thornton

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

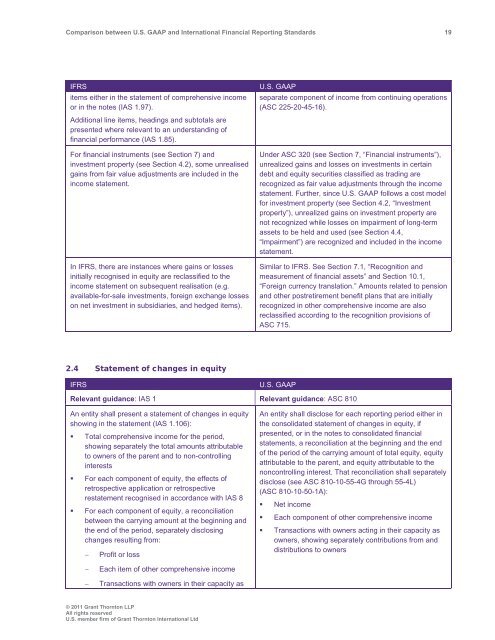

<strong>Comparison</strong> <strong>between</strong> U.S. <strong>GAAP</strong> <strong>and</strong> <strong>International</strong> Financial Reporting St<strong>and</strong>ards 19<br />

IFRS<br />

items either in the statement of comprehensive income<br />

or in the notes (IAS 1.97).<br />

Additional line items, headings <strong>and</strong> subtotals are<br />

presented where relevant to an underst<strong>and</strong>ing of<br />

financial performance (IAS 1.85).<br />

For financial instruments (see Section 7) <strong>and</strong><br />

investment property (see Section 4.2), some unrealised<br />

gains from fair value adjustments are included in the<br />

income statement.<br />

In IFRS, there are instances where gains or losses<br />

initially recognised in equity are reclassified to the<br />

income statement on subsequent realisation (e.g.<br />

available-for-sale investments, foreign exchange losses<br />

on net investment in subsidiaries, <strong>and</strong> hedged items).<br />

U.S. <strong>GAAP</strong><br />

separate component of income from continuing operations<br />

(ASC 225-20-45-16).<br />

Under ASC 320 (see Section 7, “Financial instruments”),<br />

unrealized gains <strong>and</strong> losses on investments in certain<br />

debt <strong>and</strong> equity securities classified as trading are<br />

recognized as fair value adjustments through the income<br />

statement. Further, since U.S. <strong>GAAP</strong> follows a cost model<br />

for investment property (see Section 4.2, “Investment<br />

property”), unrealized gains on investment property are<br />

not recognized while losses on impairment of long-term<br />

assets to be held <strong>and</strong> used (see Section 4.4,<br />

“Impairment”) are recognized <strong>and</strong> included in the income<br />

statement.<br />

Similar to IFRS. See Section 7.1, “Recognition <strong>and</strong><br />

measurement of financial assets” <strong>and</strong> Section 10.1,<br />

“Foreign currency translation.” Amounts related to pension<br />

<strong>and</strong> other postretirement benefit plans that are initially<br />

recognized in other comprehensive income are also<br />

reclassified according to the recognition provisions of<br />

ASC 715.<br />

2.4 Statement of changes in equity<br />

IFRS<br />

U.S. <strong>GAAP</strong><br />

Relevant guidance: IAS 1 Relevant guidance: ASC 810<br />

An entity shall present a statement of changes in equity<br />

showing in the statement (IAS 1.106):<br />

• Total comprehensive income for the period,<br />

showing separately the total amounts attributable<br />

to owners of the parent <strong>and</strong> to non-controlling<br />

interests<br />

• For each component of equity, the effects of<br />

retrospective application or retrospective<br />

restatement recognised in accordance with IAS 8<br />

• For each component of equity, a reconciliation<br />

<strong>between</strong> the carrying amount at the beginning <strong>and</strong><br />

the end of the period, separately disclosing<br />

changes resulting from:<br />

<br />

Profit or loss<br />

An entity shall disclose for each reporting period either in<br />

the consolidated statement of changes in equity, if<br />

presented, or in the notes to consolidated financial<br />

statements, a reconciliation at the beginning <strong>and</strong> the end<br />

of the period of the carrying amount of total equity, equity<br />

attributable to the parent, <strong>and</strong> equity attributable to the<br />

noncontrolling interest. That reconciliation shall separately<br />

disclose (see ASC 810-10-55-4G through 55-4L)<br />

(ASC 810-10-50-1A):<br />

• Net income<br />

• Each component of other comprehensive income<br />

• Transactions with owners acting in their capacity as<br />

owners, showing separately contributions from <strong>and</strong><br />

distributions to owners<br />

<br />

<br />

Each item of other comprehensive income<br />

Transactions with owners in their capacity as<br />

© 2011 <strong>Grant</strong> <strong>Thornton</strong> LLP<br />

All rights reserved<br />

U.S. member firm of <strong>Grant</strong> <strong>Thornton</strong> <strong>International</strong> Ltd