Comparison between U.S. GAAP and International ... - Grant Thornton

Comparison between U.S. GAAP and International ... - Grant Thornton

Comparison between U.S. GAAP and International ... - Grant Thornton

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

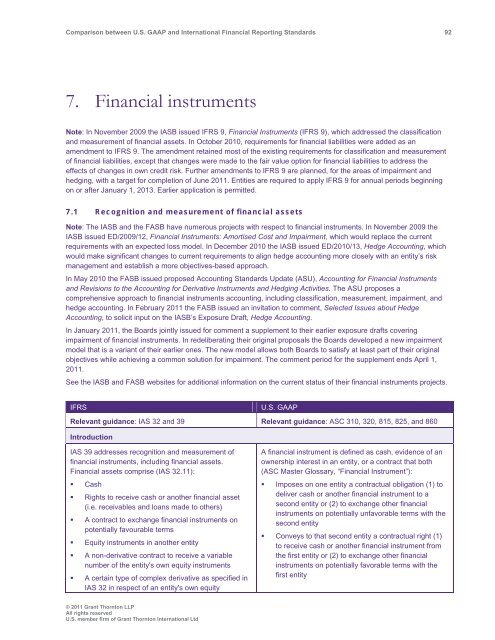

<strong>Comparison</strong> <strong>between</strong> U.S. <strong>GAAP</strong> <strong>and</strong> <strong>International</strong> Financial Reporting St<strong>and</strong>ards 92<br />

7. Financial instruments<br />

Note: In November 2009 the IASB issued IFRS 9, Financial Instruments (IFRS 9), which addressed the classification<br />

<strong>and</strong> measurement of financial assets. In October 2010, requirements for financial liabilities were added as an<br />

amendment to IFRS 9. The amendment retained most of the existing requirements for classification <strong>and</strong> measurement<br />

of financial liabilities, except that changes were made to the fair value option for financial liabilities to address the<br />

effects of changes in own credit risk. Further amendments to IFRS 9 are planned, for the areas of impairment <strong>and</strong><br />

hedging, with a target for completion of June 2011. Entities are required to apply IFRS 9 for annual periods beginning<br />

on or after January 1, 2013. Earlier application is permitted.<br />

7.1 Recognition <strong>and</strong> measurement of financial assets<br />

Note: The IASB <strong>and</strong> the FASB have numerous projects with respect to financial instruments. In November 2009 the<br />

IASB issued ED/2009/12, Financial Instruments: Amortised Cost <strong>and</strong> Impairment, which would replace the current<br />

requirements with an expected loss model. In December 2010 the IASB issued ED/2010/13, Hedge Accounting, which<br />

would make significant changes to current requirements to align hedge accounting more closely with an entity’s risk<br />

management <strong>and</strong> establish a more objectives-based approach.<br />

In May 2010 the FASB issued proposed Accounting St<strong>and</strong>ards Update (ASU), Accounting for Financial Instruments<br />

<strong>and</strong> Revisions to the Accounting for Derivative Instruments <strong>and</strong> Hedging Activities. The ASU proposes a<br />

comprehensive approach to financial instruments accounting, including classification, measurement, impairment, <strong>and</strong><br />

hedge accounting. In February 2011 the FASB issued an invitation to comment, Selected Issues about Hedge<br />

Accounting, to solicit input on the IASB’s Exposure Draft, Hedge Accounting.<br />

In January 2011, the Boards jointly issued for comment a supplement to their earlier exposure drafts covering<br />

impairment of financial instruments. In redeliberating their original proposals the Boards developed a new impairment<br />

model that is a variant of their earlier ones. The new model allows both Boards to satisfy at least part of their original<br />

objectives while achieving a common solution for impairment. The comment period for the supplement ends April 1,<br />

2011.<br />

See the IASB <strong>and</strong> FASB websites for additional information on the current status of their financial instruments projects.<br />

IFRS<br />

U.S. <strong>GAAP</strong><br />

Relevant guidance: IAS 32 <strong>and</strong> 39 Relevant guidance: ASC 310, 320, 815, 825, <strong>and</strong> 860<br />

Introduction<br />

IAS 39 addresses recognition <strong>and</strong> measurement of<br />

financial instruments, including financial assets.<br />

Financial assets comprise (IAS 32.11):<br />

• Cash<br />

• Rights to receive cash or another financial asset<br />

(i.e. receivables <strong>and</strong> loans made to others)<br />

• A contract to exchange financial instruments on<br />

potentially favourable terms<br />

• Equity instruments in another entity<br />

• A non-derivative contract to receive a variable<br />

number of the entity's own equity instruments<br />

• A certain type of complex derivative as specified in<br />

IAS 32 in respect of an entity's own equity<br />

A financial instrument is defined as cash, evidence of an<br />

ownership interest in an entity, or a contract that both<br />

(ASC Master Glossary, “Financial Instrument”):<br />

• Imposes on one entity a contractual obligation (1) to<br />

deliver cash or another financial instrument to a<br />

second entity or (2) to exchange other financial<br />

instruments on potentially unfavorable terms with the<br />

second entity<br />

• Conveys to that second entity a contractual right (1)<br />

to receive cash or another financial instrument from<br />

the first entity or (2) to exchange other financial<br />

instruments on potentially favorable terms with the<br />

first entity<br />

© 2011 <strong>Grant</strong> <strong>Thornton</strong> LLP<br />

All rights reserved<br />

U.S. member firm of <strong>Grant</strong> <strong>Thornton</strong> <strong>International</strong> Ltd