Comparison between U.S. GAAP and International ... - Grant Thornton

Comparison between U.S. GAAP and International ... - Grant Thornton

Comparison between U.S. GAAP and International ... - Grant Thornton

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

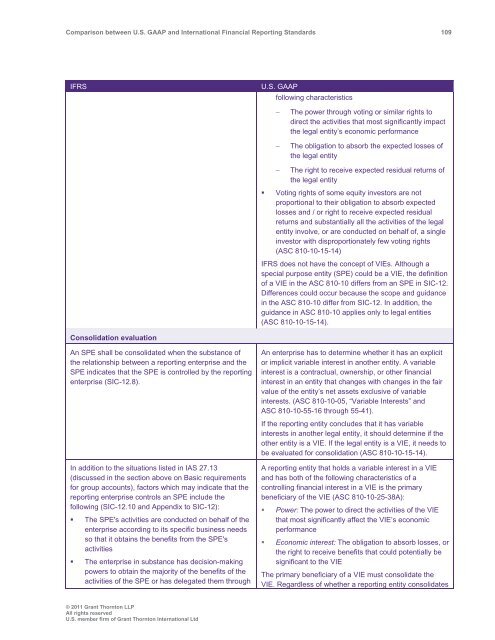

<strong>Comparison</strong> <strong>between</strong> U.S. <strong>GAAP</strong> <strong>and</strong> <strong>International</strong> Financial Reporting St<strong>and</strong>ards 109<br />

IFRS<br />

U.S. <strong>GAAP</strong><br />

following characteristics<br />

<br />

<br />

The power through voting or similar rights to<br />

direct the activities that most significantly impact<br />

the legal entity’s economic performance<br />

The obligation to absorb the expected losses of<br />

the legal entity<br />

The right to receive expected residual returns of<br />

the legal entity<br />

• Voting rights of some equity investors are not<br />

proportional to their obligation to absorb expected<br />

losses <strong>and</strong> / or right to receive expected residual<br />

returns <strong>and</strong> substantially all the activities of the legal<br />

entity involve, or are conducted on behalf of, a single<br />

investor with disproportionately few voting rights<br />

(ASC 810-10-15-14)<br />

IFRS does not have the concept of VIEs. Although a<br />

special purpose entity (SPE) could be a VIE, the definition<br />

of a VIE in the ASC 810-10 differs from an SPE in SIC-12.<br />

Differences could occur because the scope <strong>and</strong> guidance<br />

in the ASC 810-10 differ from SIC-12. In addition, the<br />

guidance in ASC 810-10 applies only to legal entities<br />

(ASC 810-10-15-14).<br />

Consolidation evaluation<br />

An SPE shall be consolidated when the substance of<br />

the relationship <strong>between</strong> a reporting enterprise <strong>and</strong> the<br />

SPE indicates that the SPE is controlled by the reporting<br />

enterprise (SIC-12.8).<br />

In addition to the situations listed in IAS 27.13<br />

(discussed in the section above on Basic requirements<br />

for group accounts), factors which may indicate that the<br />

reporting enterprise controls an SPE include the<br />

following (SIC-12.10 <strong>and</strong> Appendix to SIC-12):<br />

• The SPE's activities are conducted on behalf of the<br />

enterprise according to its specific business needs<br />

so that it obtains the benefits from the SPE's<br />

activities<br />

• The enterprise in substance has decision-making<br />

powers to obtain the majority of the benefits of the<br />

activities of the SPE or has delegated them through<br />

An enterprise has to determine whether it has an explicit<br />

or implicit variable interest in another entity. A variable<br />

interest is a contractual, ownership, or other financial<br />

interest in an entity that changes with changes in the fair<br />

value of the entity’s net assets exclusive of variable<br />

interests. (ASC 810-10-05, “Variable Interests” <strong>and</strong><br />

ASC 810-10-55-16 through 55-41).<br />

If the reporting entity concludes that it has variable<br />

interests in another legal entity, it should determine if the<br />

other entity is a VIE. If the legal entity is a VIE, it needs to<br />

be evaluated for consolidation (ASC 810-10-15-14).<br />

A reporting entity that holds a variable interest in a VIE<br />

<strong>and</strong> has both of the following characteristics of a<br />

controlling financial interest in a VIE is the primary<br />

beneficiary of the VIE (ASC 810-10-25-38A):<br />

• Power: The power to direct the activities of the VIE<br />

that most significantly affect the VIE’s economic<br />

performance<br />

• Economic interest: The obligation to absorb losses, or<br />

the right to receive benefits that could potentially be<br />

significant to the VIE<br />

The primary beneficiary of a VIE must consolidate the<br />

VIE. Regardless of whether a reporting entity consolidates<br />

© 2011 <strong>Grant</strong> <strong>Thornton</strong> LLP<br />

All rights reserved<br />

U.S. member firm of <strong>Grant</strong> <strong>Thornton</strong> <strong>International</strong> Ltd