Comparison between U.S. GAAP and International ... - Grant Thornton

Comparison between U.S. GAAP and International ... - Grant Thornton

Comparison between U.S. GAAP and International ... - Grant Thornton

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

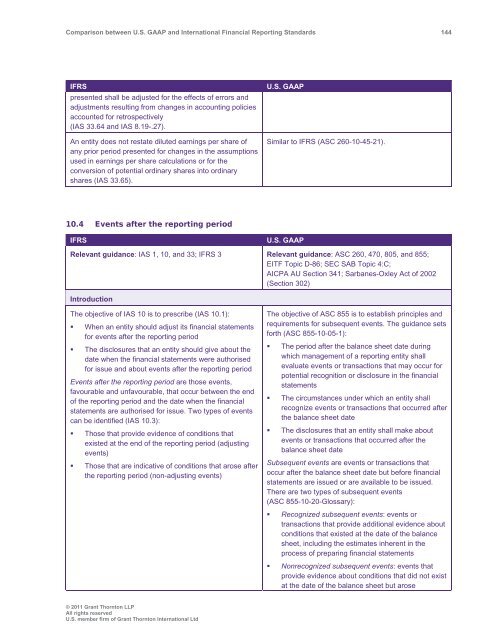

<strong>Comparison</strong> <strong>between</strong> U.S. <strong>GAAP</strong> <strong>and</strong> <strong>International</strong> Financial Reporting St<strong>and</strong>ards 144<br />

IFRS<br />

presented shall be adjusted for the effects of errors <strong>and</strong><br />

adjustments resulting from changes in accounting policies<br />

accounted for retrospectively<br />

(IAS 33.64 <strong>and</strong> IAS 8.19-.27).<br />

An entity does not restate diluted earnings per share of<br />

any prior period presented for changes in the assumptions<br />

used in earnings per share calculations or for the<br />

conversion of potential ordinary shares into ordinary<br />

shares (IAS 33.65).<br />

U.S. <strong>GAAP</strong><br />

Similar to IFRS (ASC 260-10-45-21).<br />

10.4 Events after the reporting period<br />

IFRS<br />

U.S. <strong>GAAP</strong><br />

Relevant guidance: IAS 1, 10, <strong>and</strong> 33; IFRS 3 Relevant guidance: ASC 260, 470, 805, <strong>and</strong> 855;<br />

EITF Topic D-86; SEC SAB Topic 4:C;<br />

AICPA AU Section 341; Sarbanes-Oxley Act of 2002<br />

(Section 302)<br />

Introduction<br />

The objective of IAS 10 is to prescribe (IAS 10.1):<br />

• When an entity should adjust its financial statements<br />

for events after the reporting period<br />

• The disclosures that an entity should give about the<br />

date when the financial statements were authorised<br />

for issue <strong>and</strong> about events after the reporting period<br />

Events after the reporting period are those events,<br />

favourable <strong>and</strong> unfavourable, that occur <strong>between</strong> the end<br />

of the reporting period <strong>and</strong> the date when the financial<br />

statements are authorised for issue. Two types of events<br />

can be identified (IAS 10.3):<br />

• Those that provide evidence of conditions that<br />

existed at the end of the reporting period (adjusting<br />

events)<br />

• Those that are indicative of conditions that arose after<br />

the reporting period (non-adjusting events)<br />

The objective of ASC 855 is to establish principles <strong>and</strong><br />

requirements for subsequent events. The guidance sets<br />

forth (ASC 855-10-05-1):<br />

• The period after the balance sheet date during<br />

which management of a reporting entity shall<br />

evaluate events or transactions that may occur for<br />

potential recognition or disclosure in the financial<br />

statements<br />

• The circumstances under which an entity shall<br />

recognize events or transactions that occurred after<br />

the balance sheet date<br />

• The disclosures that an entity shall make about<br />

events or transactions that occurred after the<br />

balance sheet date<br />

Subsequent events are events or transactions that<br />

occur after the balance sheet date but before financial<br />

statements are issued or are available to be issued.<br />

There are two types of subsequent events<br />

(ASC 855-10-20-Glossary):<br />

• Recognized subsequent events: events or<br />

transactions that provide additional evidence about<br />

conditions that existed at the date of the balance<br />

sheet, including the estimates inherent in the<br />

process of preparing financial statements<br />

• Nonrecognized subsequent events: events that<br />

provide evidence about conditions that did not exist<br />

at the date of the balance sheet but arose<br />

© 2011 <strong>Grant</strong> <strong>Thornton</strong> LLP<br />

All rights reserved<br />

U.S. member firm of <strong>Grant</strong> <strong>Thornton</strong> <strong>International</strong> Ltd