Comparison between U.S. GAAP and International ... - Grant Thornton

Comparison between U.S. GAAP and International ... - Grant Thornton

Comparison between U.S. GAAP and International ... - Grant Thornton

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

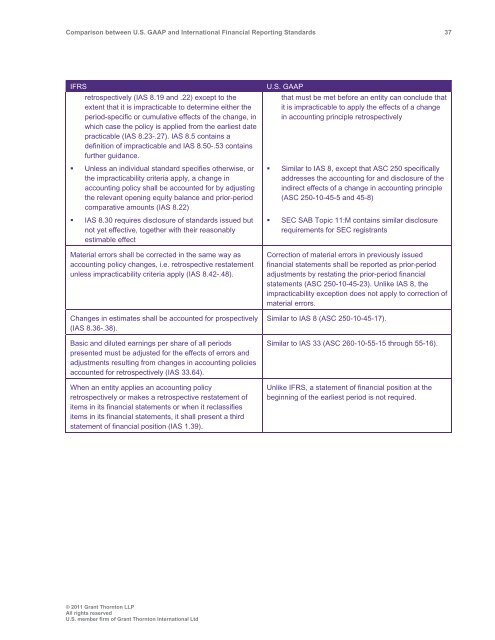

<strong>Comparison</strong> <strong>between</strong> U.S. <strong>GAAP</strong> <strong>and</strong> <strong>International</strong> Financial Reporting St<strong>and</strong>ards 37<br />

IFRS<br />

retrospectively (IAS 8.19 <strong>and</strong> .22) except to the<br />

extent that it is impracticable to determine either the<br />

period-specific or cumulative effects of the change, in<br />

which case the policy is applied from the earliest date<br />

practicable (IAS 8.23-.27). IAS 8.5 contains a<br />

definition of impracticable <strong>and</strong> IAS 8.50-.53 contains<br />

further guidance.<br />

• Unless an individual st<strong>and</strong>ard specifies otherwise, or<br />

the impracticability criteria apply, a change in<br />

accounting policy shall be accounted for by adjusting<br />

the relevant opening equity balance <strong>and</strong> prior-period<br />

comparative amounts (IAS 8.22)<br />

• IAS 8.30 requires disclosure of st<strong>and</strong>ards issued but<br />

not yet effective, together with their reasonably<br />

estimable effect<br />

Material errors shall be corrected in the same way as<br />

accounting policy changes, i.e. retrospective restatement<br />

unless impracticability criteria apply (IAS 8.42-.48).<br />

Changes in estimates shall be accounted for prospectively<br />

(IAS 8.36-.38).<br />

Basic <strong>and</strong> diluted earnings per share of all periods<br />

presented must be adjusted for the effects of errors <strong>and</strong><br />

adjustments resulting from changes in accounting policies<br />

accounted for retrospectively (IAS 33.64).<br />

When an entity applies an accounting policy<br />

retrospectively or makes a retrospective restatement of<br />

items in its financial statements or when it reclassifies<br />

items in its financial statements, it shall present a third<br />

statement of financial position (IAS 1.39).<br />

U.S. <strong>GAAP</strong><br />

that must be met before an entity can conclude that<br />

it is impracticable to apply the effects of a change<br />

in accounting principle retrospectively<br />

• Similar to IAS 8, except that ASC 250 specifically<br />

addresses the accounting for <strong>and</strong> disclosure of the<br />

indirect effects of a change in accounting principle<br />

(ASC 250-10-45-5 <strong>and</strong> 45-8)<br />

• SEC SAB Topic 11:M contains similar disclosure<br />

requirements for SEC registrants<br />

Correction of material errors in previously issued<br />

financial statements shall be reported as prior-period<br />

adjustments by restating the prior-period financial<br />

statements (ASC 250-10-45-23). Unlike IAS 8, the<br />

impracticability exception does not apply to correction of<br />

material errors.<br />

Similar to IAS 8 (ASC 250-10-45-17).<br />

Similar to IAS 33 (ASC 260-10-55-15 through 55-16).<br />

Unlike IFRS, a statement of financial position at the<br />

beginning of the earliest period is not required.<br />

© 2011 <strong>Grant</strong> <strong>Thornton</strong> LLP<br />

All rights reserved<br />

U.S. member firm of <strong>Grant</strong> <strong>Thornton</strong> <strong>International</strong> Ltd