Comparison between U.S. GAAP and International ... - Grant Thornton

Comparison between U.S. GAAP and International ... - Grant Thornton

Comparison between U.S. GAAP and International ... - Grant Thornton

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

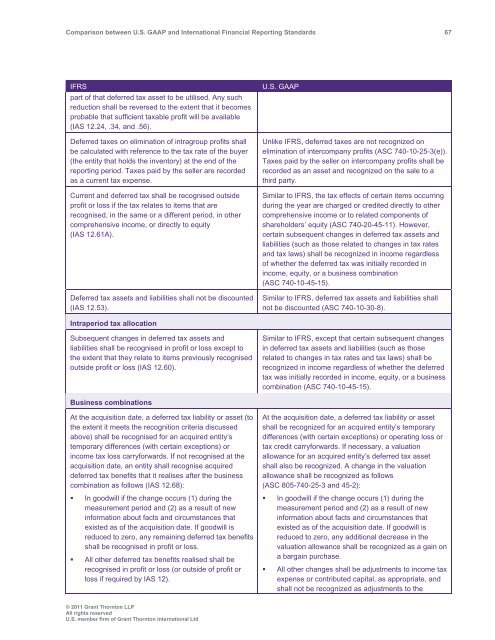

<strong>Comparison</strong> <strong>between</strong> U.S. <strong>GAAP</strong> <strong>and</strong> <strong>International</strong> Financial Reporting St<strong>and</strong>ards 67<br />

IFRS<br />

part of that deferred tax asset to be utilised. Any such<br />

reduction shall be reversed to the extent that it becomes<br />

probable that sufficient taxable profit will be available<br />

(IAS 12.24, .34, <strong>and</strong> .56).<br />

Deferred taxes on elimination of intragroup profits shall<br />

be calculated with reference to the tax rate of the buyer<br />

(the entity that holds the inventory) at the end of the<br />

reporting period. Taxes paid by the seller are recorded<br />

as a current tax expense.<br />

Current <strong>and</strong> deferred tax shall be recognised outside<br />

profit or loss if the tax relates to items that are<br />

recognised, in the same or a different period, in other<br />

comprehensive income, or directly to equity<br />

(IAS 12.61A).<br />

Deferred tax assets <strong>and</strong> liabilities shall not be discounted<br />

(IAS 12.53).<br />

U.S. <strong>GAAP</strong><br />

Unlike IFRS, deferred taxes are not recognized on<br />

elimination of intercompany profits (ASC 740-10-25-3(e)).<br />

Taxes paid by the seller on intercompany profits shall be<br />

recorded as an asset <strong>and</strong> recognized on the sale to a<br />

third party.<br />

Similar to IFRS, the tax effects of certain items occurring<br />

during the year are charged or credited directly to other<br />

comprehensive income or to related components of<br />

shareholders’ equity (ASC 740-20-45-11). However,<br />

certain subsequent changes in deferred tax assets <strong>and</strong><br />

liabilities (such as those related to changes in tax rates<br />

<strong>and</strong> tax laws) shall be recognized in income regardless<br />

of whether the deferred tax was initially recorded in<br />

income, equity, or a business combination<br />

(ASC 740-10-45-15).<br />

Similar to IFRS, deferred tax assets <strong>and</strong> liabilities shall<br />

not be discounted (ASC 740-10-30-8).<br />

Intraperiod tax allocation<br />

Subsequent changes in deferred tax assets <strong>and</strong><br />

liabilities shall be recognised in profit or loss except to<br />

the extent that they relate to items previously recognised<br />

outside profit or loss (IAS 12.60).<br />

Similar to IFRS, except that certain subsequent changes<br />

in deferred tax assets <strong>and</strong> liabilities (such as those<br />

related to changes in tax rates <strong>and</strong> tax laws) shall be<br />

recognized in income regardless of whether the deferred<br />

tax was initially recorded in income, equity, or a business<br />

combination (ASC 740-10-45-15).<br />

Business combinations<br />

At the acquisition date, a deferred tax liability or asset (to<br />

the extent it meets the recognition criteria discussed<br />

above) shall be recognised for an acquired entity’s<br />

temporary differences (with certain exceptions) or<br />

income tax loss carryforwards. If not recognised at the<br />

acquisition date, an entity shall recognise acquired<br />

deferred tax benefits that it realises after the business<br />

combination as follows (IAS 12.68):<br />

• In goodwill if the change occurs (1) during the<br />

measurement period <strong>and</strong> (2) as a result of new<br />

information about facts <strong>and</strong> circumstances that<br />

existed as of the acquisition date. If goodwill is<br />

reduced to zero, any remaining deferred tax benefits<br />

shall be recognised in profit or loss.<br />

• All other deferred tax benefits realised shall be<br />

recognised in profit or loss (or outside of profit or<br />

loss if required by IAS 12).<br />

At the acquisition date, a deferred tax liability or asset<br />

shall be recognized for an acquired entity’s temporary<br />

differences (with certain exceptions) or operating loss or<br />

tax credit carryforwards. If necessary, a valuation<br />

allowance for an acquired entity’s deferred tax asset<br />

shall also be recognized. A change in the valuation<br />

allowance shall be recognized as follows<br />

(ASC 805-740-25-3 <strong>and</strong> 45-2):<br />

• In goodwill if the change occurs (1) during the<br />

measurement period <strong>and</strong> (2) as a result of new<br />

information about facts <strong>and</strong> circumstances that<br />

existed as of the acquisition date. If goodwill is<br />

reduced to zero, any additional decrease in the<br />

valuation allowance shall be recognized as a gain on<br />

a bargain purchase.<br />

• All other changes shall be adjustments to income tax<br />

expense or contributed capital, as appropriate, <strong>and</strong><br />

shall not be recognized as adjustments to the<br />

© 2011 <strong>Grant</strong> <strong>Thornton</strong> LLP<br />

All rights reserved<br />

U.S. member firm of <strong>Grant</strong> <strong>Thornton</strong> <strong>International</strong> Ltd