Comparison between U.S. GAAP and International ... - Grant Thornton

Comparison between U.S. GAAP and International ... - Grant Thornton

Comparison between U.S. GAAP and International ... - Grant Thornton

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

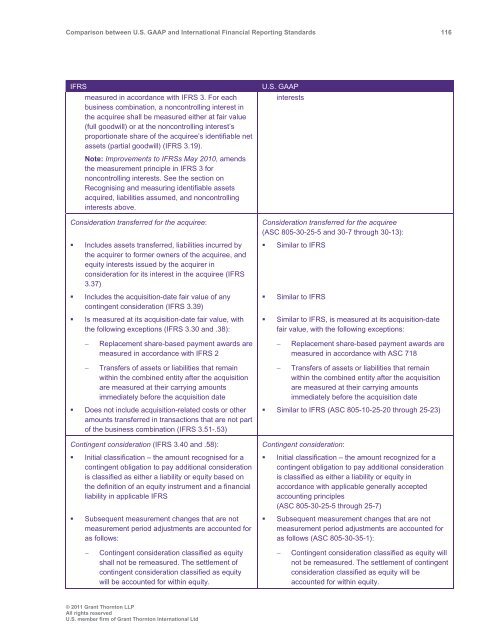

<strong>Comparison</strong> <strong>between</strong> U.S. <strong>GAAP</strong> <strong>and</strong> <strong>International</strong> Financial Reporting St<strong>and</strong>ards 116<br />

IFRS<br />

measured in accordance with IFRS 3. For each<br />

business combination, a noncontrolling interest in<br />

the acquiree shall be measured either at fair value<br />

(full goodwill) or at the noncontrolling interest’s<br />

proportionate share of the acquiree’s identifiable net<br />

assets (partial goodwill) (IFRS 3.19).<br />

Note: Improvements to IFRSs May 2010, amends<br />

the measurement principle in IFRS 3 for<br />

noncontrolling interests. See the section on<br />

Recognising <strong>and</strong> measuring identifiable assets<br />

acquired, liabilities assumed, <strong>and</strong> noncontrolling<br />

interests above.<br />

Consideration transferred for the acquiree:<br />

• Includes assets transferred, liabilities incurred by<br />

the acquirer to former owners of the acquiree, <strong>and</strong><br />

equity interests issued by the acquirer in<br />

consideration for its interest in the acquiree (IFRS<br />

3.37)<br />

• Includes the acquisition-date fair value of any<br />

contingent consideration (IFRS 3.39)<br />

• Is measured at its acquisition-date fair value, with<br />

the following exceptions (IFRS 3.30 <strong>and</strong> .38):<br />

U.S. <strong>GAAP</strong><br />

interests<br />

Consideration transferred for the acquiree<br />

(ASC 805-30-25-5 <strong>and</strong> 30-7 through 30-13):<br />

• Similar to IFRS<br />

• Similar to IFRS<br />

• Similar to IFRS, is measured at its acquisition-date<br />

fair value, with the following exceptions:<br />

<br />

Replacement share-based payment awards are<br />

measured in accordance with IFRS 2<br />

<br />

Replacement share-based payment awards are<br />

measured in accordance with ASC 718<br />

Transfers of assets or liabilities that remain<br />

within the combined entity after the acquisition<br />

are measured at their carrying amounts<br />

immediately before the acquisition date<br />

• Does not include acquisition-related costs or other<br />

amounts transferred in transactions that are not part<br />

of the business combination (IFRS 3.51-.53)<br />

Contingent consideration (IFRS 3.40 <strong>and</strong> .58):<br />

• Initial classification – the amount recognised for a<br />

contingent obligation to pay additional consideration<br />

is classified as either a liability or equity based on<br />

the definition of an equity instrument <strong>and</strong> a financial<br />

liability in applicable IFRS<br />

• Subsequent measurement changes that are not<br />

measurement period adjustments are accounted for<br />

as follows:<br />

Transfers of assets or liabilities that remain<br />

within the combined entity after the acquisition<br />

are measured at their carrying amounts<br />

immediately before the acquisition date<br />

• Similar to IFRS (ASC 805-10-25-20 through 25-23)<br />

Contingent consideration:<br />

• Initial classification – the amount recognized for a<br />

contingent obligation to pay additional consideration<br />

is classified as either a liability or equity in<br />

accordance with applicable generally accepted<br />

accounting principles<br />

(ASC 805-30-25-5 through 25-7)<br />

• Subsequent measurement changes that are not<br />

measurement period adjustments are accounted for<br />

as follows (ASC 805-30-35-1):<br />

<br />

Contingent consideration classified as equity<br />

shall not be remeasured. The settlement of<br />

contingent consideration classified as equity<br />

will be accounted for within equity.<br />

<br />

Contingent consideration classified as equity will<br />

not be remeasured. The settlement of contingent<br />

consideration classified as equity will be<br />

accounted for within equity.<br />

© 2011 <strong>Grant</strong> <strong>Thornton</strong> LLP<br />

All rights reserved<br />

U.S. member firm of <strong>Grant</strong> <strong>Thornton</strong> <strong>International</strong> Ltd