Comparison between U.S. GAAP and International ... - Grant Thornton

Comparison between U.S. GAAP and International ... - Grant Thornton

Comparison between U.S. GAAP and International ... - Grant Thornton

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

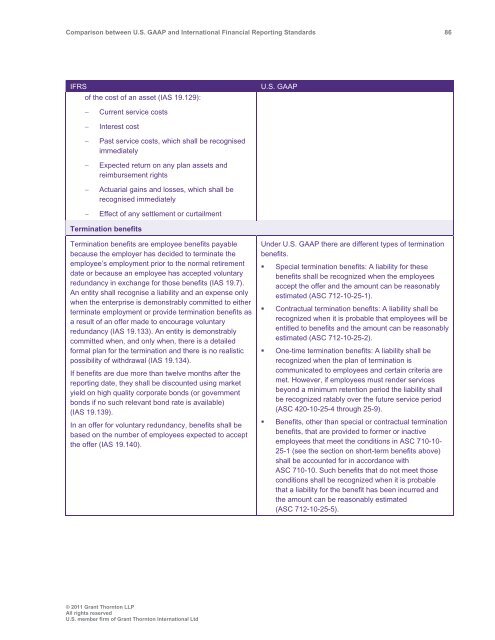

<strong>Comparison</strong> <strong>between</strong> U.S. <strong>GAAP</strong> <strong>and</strong> <strong>International</strong> Financial Reporting St<strong>and</strong>ards 86<br />

IFRS<br />

of the cost of an asset (IAS 19.129):<br />

U.S. <strong>GAAP</strong><br />

<br />

<br />

<br />

<br />

<br />

<br />

Current service costs<br />

Interest cost<br />

Past service costs, which shall be recognised<br />

immediately<br />

Expected return on any plan assets <strong>and</strong><br />

reimbursement rights<br />

Actuarial gains <strong>and</strong> losses, which shall be<br />

recognised immediately<br />

Effect of any settlement or curtailment<br />

Termination benefits<br />

Termination benefits are employee benefits payable<br />

because the employer has decided to terminate the<br />

employee’s employment prior to the normal retirement<br />

date or because an employee has accepted voluntary<br />

redundancy in exchange for those benefits (IAS 19.7).<br />

An entity shall recognise a liability <strong>and</strong> an expense only<br />

when the enterprise is demonstrably committed to either<br />

terminate employment or provide termination benefits as<br />

a result of an offer made to encourage voluntary<br />

redundancy (IAS 19.133). An entity is demonstrably<br />

committed when, <strong>and</strong> only when, there is a detailed<br />

formal plan for the termination <strong>and</strong> there is no realistic<br />

possibility of withdrawal (IAS 19.134).<br />

If benefits are due more than twelve months after the<br />

reporting date, they shall be discounted using market<br />

yield on high quality corporate bonds (or government<br />

bonds if no such relevant bond rate is available)<br />

(IAS 19.139).<br />

In an offer for voluntary redundancy, benefits shall be<br />

based on the number of employees expected to accept<br />

the offer (IAS 19.140).<br />

Under U.S. <strong>GAAP</strong> there are different types of termination<br />

benefits.<br />

• Special termination benefits: A liability for these<br />

benefits shall be recognized when the employees<br />

accept the offer <strong>and</strong> the amount can be reasonably<br />

estimated (ASC 712-10-25-1).<br />

• Contractual termination benefits: A liability shall be<br />

recognized when it is probable that employees will be<br />

entitled to benefits <strong>and</strong> the amount can be reasonably<br />

estimated (ASC 712-10-25-2).<br />

• One-time termination benefits: A liability shall be<br />

recognized when the plan of termination is<br />

communicated to employees <strong>and</strong> certain criteria are<br />

met. However, if employees must render services<br />

beyond a minimum retention period the liability shall<br />

be recognized ratably over the future service period<br />

(ASC 420-10-25-4 through 25-9).<br />

• Benefits, other than special or contractual termination<br />

benefits, that are provided to former or inactive<br />

employees that meet the conditions in ASC 710-10-<br />

25-1 (see the section on short-term benefits above)<br />

shall be accounted for in accordance with<br />

ASC 710-10. Such benefits that do not meet those<br />

conditions shall be recognized when it is probable<br />

that a liability for the benefit has been incurred <strong>and</strong><br />

the amount can be reasonably estimated<br />

(ASC 712-10-25-5).<br />

© 2011 <strong>Grant</strong> <strong>Thornton</strong> LLP<br />

All rights reserved<br />

U.S. member firm of <strong>Grant</strong> <strong>Thornton</strong> <strong>International</strong> Ltd