Comparison between U.S. GAAP and International ... - Grant Thornton

Comparison between U.S. GAAP and International ... - Grant Thornton

Comparison between U.S. GAAP and International ... - Grant Thornton

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

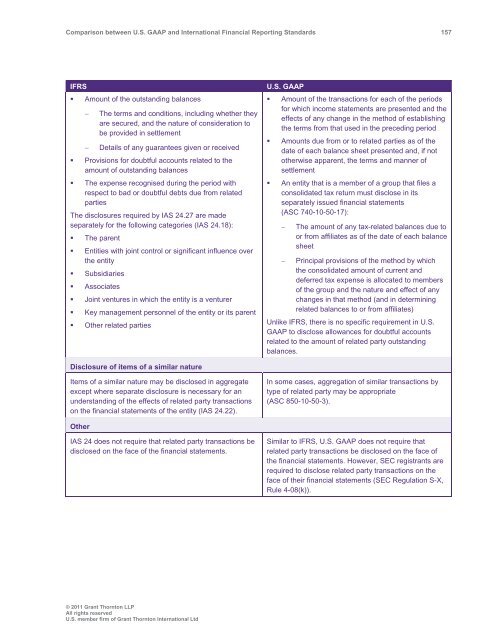

<strong>Comparison</strong> <strong>between</strong> U.S. <strong>GAAP</strong> <strong>and</strong> <strong>International</strong> Financial Reporting St<strong>and</strong>ards 157<br />

IFRS<br />

• Amount of the outst<strong>and</strong>ing balances<br />

<br />

The terms <strong>and</strong> conditions, including whether they<br />

are secured, <strong>and</strong> the nature of consideration to<br />

be provided in settlement<br />

Details of any guarantees given or received<br />

• Provisions for doubtful accounts related to the<br />

amount of outst<strong>and</strong>ing balances<br />

• The expense recognised during the period with<br />

respect to bad or doubtful debts due from related<br />

parties<br />

The disclosures required by IAS 24.27 are made<br />

separately for the following categories (IAS 24.18):<br />

• The parent<br />

• Entities with joint control or significant influence over<br />

the entity<br />

• Subsidiaries<br />

• Associates<br />

• Joint ventures in which the entity is a venturer<br />

• Key management personnel of the entity or its parent<br />

• Other related parties<br />

U.S. <strong>GAAP</strong><br />

• Amount of the transactions for each of the periods<br />

for which income statements are presented <strong>and</strong> the<br />

effects of any change in the method of establishing<br />

the terms from that used in the preceding period<br />

• Amounts due from or to related parties as of the<br />

date of each balance sheet presented <strong>and</strong>, if not<br />

otherwise apparent, the terms <strong>and</strong> manner of<br />

settlement<br />

• An entity that is a member of a group that files a<br />

consolidated tax return must disclose in its<br />

separately issued financial statements<br />

(ASC 740-10-50-17):<br />

<br />

The amount of any tax-related balances due to<br />

or from affiliates as of the date of each balance<br />

sheet<br />

Principal provisions of the method by which<br />

the consolidated amount of current <strong>and</strong><br />

deferred tax expense is allocated to members<br />

of the group <strong>and</strong> the nature <strong>and</strong> effect of any<br />

changes in that method (<strong>and</strong> in determining<br />

related balances to or from affiliates)<br />

Unlike IFRS, there is no specific requirement in U.S.<br />

<strong>GAAP</strong> to disclose allowances for doubtful accounts<br />

related to the amount of related party outst<strong>and</strong>ing<br />

balances.<br />

Disclosure of items of a similar nature<br />

Items of a similar nature may be disclosed in aggregate<br />

except where separate disclosure is necessary for an<br />

underst<strong>and</strong>ing of the effects of related party transactions<br />

on the financial statements of the entity (IAS 24.22).<br />

In some cases, aggregation of similar transactions by<br />

type of related party may be appropriate<br />

(ASC 850-10-50-3).<br />

Other<br />

IAS 24 does not require that related party transactions be<br />

disclosed on the face of the financial statements.<br />

Similar to IFRS, U.S. <strong>GAAP</strong> does not require that<br />

related party transactions be disclosed on the face of<br />

the financial statements. However, SEC registrants are<br />

required to disclose related party transactions on the<br />

face of their financial statements (SEC Regulation S-X,<br />

Rule 4-08(k)).<br />

© 2011 <strong>Grant</strong> <strong>Thornton</strong> LLP<br />

All rights reserved<br />

U.S. member firm of <strong>Grant</strong> <strong>Thornton</strong> <strong>International</strong> Ltd