Comparison between U.S. GAAP and International ... - Grant Thornton

Comparison between U.S. GAAP and International ... - Grant Thornton

Comparison between U.S. GAAP and International ... - Grant Thornton

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

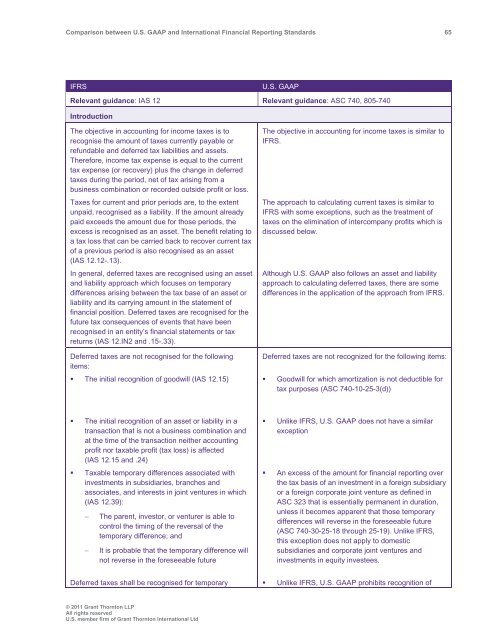

<strong>Comparison</strong> <strong>between</strong> U.S. <strong>GAAP</strong> <strong>and</strong> <strong>International</strong> Financial Reporting St<strong>and</strong>ards 65<br />

IFRS<br />

U.S. <strong>GAAP</strong><br />

Relevant guidance: IAS 12 Relevant guidance: ASC 740, 805-740<br />

Introduction<br />

The objective in accounting for income taxes is to<br />

recognise the amount of taxes currently payable or<br />

refundable <strong>and</strong> deferred tax liabilities <strong>and</strong> assets.<br />

Therefore, income tax expense is equal to the current<br />

tax expense (or recovery) plus the change in deferred<br />

taxes during the period, net of tax arising from a<br />

business combination or recorded outside profit or loss.<br />

Taxes for current <strong>and</strong> prior periods are, to the extent<br />

unpaid, recognised as a liability. If the amount already<br />

paid exceeds the amount due for those periods, the<br />

excess is recognised as an asset. The benefit relating to<br />

a tax loss that can be carried back to recover current tax<br />

of a previous period is also recognised as an asset<br />

(IAS 12.12-.13).<br />

In general, deferred taxes are recognised using an asset<br />

<strong>and</strong> liability approach which focuses on temporary<br />

differences arising <strong>between</strong> the tax base of an asset or<br />

liability <strong>and</strong> its carrying amount in the statement of<br />

financial position. Deferred taxes are recognised for the<br />

future tax consequences of events that have been<br />

recognised in an entity’s financial statements or tax<br />

returns (IAS 12.IN2 <strong>and</strong> .15-.33).<br />

Deferred taxes are not recognised for the following<br />

items:<br />

• The initial recognition of goodwill (IAS 12.15)<br />

The objective in accounting for income taxes is similar to<br />

IFRS.<br />

The approach to calculating current taxes is similar to<br />

IFRS with some exceptions, such as the treatment of<br />

taxes on the elimination of intercompany profits which is<br />

discussed below.<br />

Although U.S. <strong>GAAP</strong> also follows an asset <strong>and</strong> liability<br />

approach to calculating deferred taxes, there are some<br />

differences in the application of the approach from IFRS.<br />

Deferred taxes are not recognized for the following items:<br />

• Goodwill for which amortization is not deductible for<br />

tax purposes (ASC 740-10-25-3(d))<br />

• The initial recognition of an asset or liability in a<br />

transaction that is not a business combination <strong>and</strong><br />

at the time of the transaction neither accounting<br />

profit nor taxable profit (tax loss) is affected<br />

(IAS 12.15 <strong>and</strong> .24)<br />

• Taxable temporary differences associated with<br />

investments in subsidiaries, branches <strong>and</strong><br />

associates, <strong>and</strong> interests in joint ventures in which<br />

(IAS 12.39):<br />

<br />

<br />

The parent, investor, or venturer is able to<br />

control the timing of the reversal of the<br />

temporary difference; <strong>and</strong><br />

It is probable that the temporary difference will<br />

not reverse in the foreseeable future<br />

• Unlike IFRS, U.S. <strong>GAAP</strong> does not have a similar<br />

exception<br />

• An excess of the amount for financial reporting over<br />

the tax basis of an investment in a foreign subsidiary<br />

or a foreign corporate joint venture as defined in<br />

ASC 323 that is essentially permanent in duration,<br />

unless it becomes apparent that those temporary<br />

differences will reverse in the foreseeable future<br />

(ASC 740-30-25-18 through 25-19). Unlike IFRS,<br />

this exception does not apply to domestic<br />

subsidiaries <strong>and</strong> corporate joint ventures <strong>and</strong><br />

investments in equity investees.<br />

Deferred taxes shall be recognised for temporary<br />

• Unlike IFRS, U.S. <strong>GAAP</strong> prohibits recognition of<br />

© 2011 <strong>Grant</strong> <strong>Thornton</strong> LLP<br />

All rights reserved<br />

U.S. member firm of <strong>Grant</strong> <strong>Thornton</strong> <strong>International</strong> Ltd