Comparison between U.S. GAAP and International ... - Grant Thornton

Comparison between U.S. GAAP and International ... - Grant Thornton

Comparison between U.S. GAAP and International ... - Grant Thornton

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

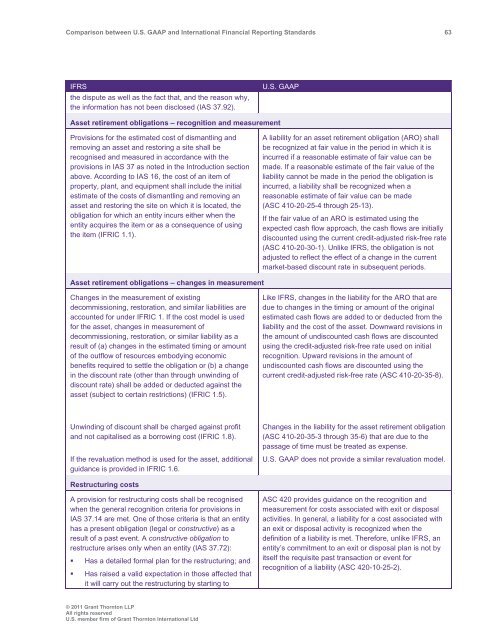

<strong>Comparison</strong> <strong>between</strong> U.S. <strong>GAAP</strong> <strong>and</strong> <strong>International</strong> Financial Reporting St<strong>and</strong>ards 63<br />

IFRS<br />

the dispute as well as the fact that, <strong>and</strong> the reason why,<br />

the information has not been disclosed (IAS 37.92).<br />

U.S. <strong>GAAP</strong><br />

Asset retirement obligations – recognition <strong>and</strong> measurement<br />

Provisions for the estimated cost of dismantling <strong>and</strong><br />

removing an asset <strong>and</strong> restoring a site shall be<br />

recognised <strong>and</strong> measured in accordance with the<br />

provisions in IAS 37 as noted in the Introduction section<br />

above. According to IAS 16, the cost of an item of<br />

property, plant, <strong>and</strong> equipment shall include the initial<br />

estimate of the costs of dismantling <strong>and</strong> removing an<br />

asset <strong>and</strong> restoring the site on which it is located, the<br />

obligation for which an entity incurs either when the<br />

entity acquires the item or as a consequence of using<br />

the item (IFRIC 1.1).<br />

A liability for an asset retirement obligation (ARO) shall<br />

be recognized at fair value in the period in which it is<br />

incurred if a reasonable estimate of fair value can be<br />

made. If a reasonable estimate of the fair value of the<br />

liability cannot be made in the period the obligation is<br />

incurred, a liability shall be recognized when a<br />

reasonable estimate of fair value can be made<br />

(ASC 410-20-25-4 through 25-13).<br />

If the fair value of an ARO is estimated using the<br />

expected cash flow approach, the cash flows are initially<br />

discounted using the current credit-adjusted risk-free rate<br />

(ASC 410-20-30-1). Unlike IFRS, the obligation is not<br />

adjusted to reflect the effect of a change in the current<br />

market-based discount rate in subsequent periods.<br />

Asset retirement obligations – changes in measurement<br />

Changes in the measurement of existing<br />

decommissioning, restoration, <strong>and</strong> similar liabilities are<br />

accounted for under IFRIC 1. If the cost model is used<br />

for the asset, changes in measurement of<br />

decommissioning, restoration, or similar liability as a<br />

result of (a) changes in the estimated timing or amount<br />

of the outflow of resources embodying economic<br />

benefits required to settle the obligation or (b) a change<br />

in the discount rate (other than through unwinding of<br />

discount rate) shall be added or deducted against the<br />

asset (subject to certain restrictions) (IFRIC 1.5).<br />

Like IFRS, changes in the liability for the ARO that are<br />

due to changes in the timing or amount of the original<br />

estimated cash flows are added to or deducted from the<br />

liability <strong>and</strong> the cost of the asset. Downward revisions in<br />

the amount of undiscounted cash flows are discounted<br />

using the credit-adjusted risk-free rate used on initial<br />

recognition. Upward revisions in the amount of<br />

undiscounted cash flows are discounted using the<br />

current credit-adjusted risk-free rate (ASC 410-20-35-8).<br />

Unwinding of discount shall be charged against profit<br />

<strong>and</strong> not capitalised as a borrowing cost (IFRIC 1.8).<br />

If the revaluation method is used for the asset, additional<br />

guidance is provided in IFRIC 1.6.<br />

Changes in the liability for the asset retirement obligation<br />

(ASC 410-20-35-3 through 35-6) that are due to the<br />

passage of time must be treated as expense.<br />

U.S. <strong>GAAP</strong> does not provide a similar revaluation model.<br />

Restructuring costs<br />

A provision for restructuring costs shall be recognised<br />

when the general recognition criteria for provisions in<br />

IAS 37.14 are met. One of those criteria is that an entity<br />

has a present obligation (legal or constructive) as a<br />

result of a past event. A constructive obligation to<br />

restructure arises only when an entity (IAS 37.72):<br />

• Has a detailed formal plan for the restructuring; <strong>and</strong><br />

• Has raised a valid expectation in those affected that<br />

it will carry out the restructuring by starting to<br />

ASC 420 provides guidance on the recognition <strong>and</strong><br />

measurement for costs associated with exit or disposal<br />

activities. In general, a liability for a cost associated with<br />

an exit or disposal activity is recognized when the<br />

definition of a liability is met. Therefore, unlike IFRS, an<br />

entity’s commitment to an exit or disposal plan is not by<br />

itself the requisite past transaction or event for<br />

recognition of a liability (ASC 420-10-25-2).<br />

© 2011 <strong>Grant</strong> <strong>Thornton</strong> LLP<br />

All rights reserved<br />

U.S. member firm of <strong>Grant</strong> <strong>Thornton</strong> <strong>International</strong> Ltd