Comparison between U.S. GAAP and International ... - Grant Thornton

Comparison between U.S. GAAP and International ... - Grant Thornton

Comparison between U.S. GAAP and International ... - Grant Thornton

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

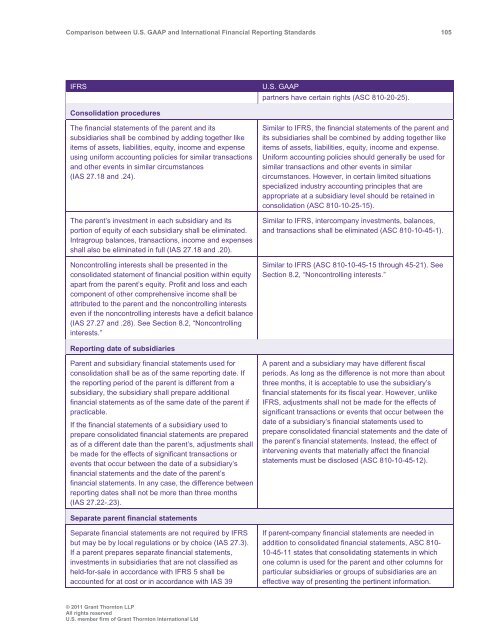

<strong>Comparison</strong> <strong>between</strong> U.S. <strong>GAAP</strong> <strong>and</strong> <strong>International</strong> Financial Reporting St<strong>and</strong>ards 105<br />

IFRS<br />

U.S. <strong>GAAP</strong><br />

partners have certain rights (ASC 810-20-25).<br />

Consolidation procedures<br />

The financial statements of the parent <strong>and</strong> its<br />

subsidiaries shall be combined by adding together like<br />

items of assets, liabilities, equity, income <strong>and</strong> expense<br />

using uniform accounting policies for similar transactions<br />

<strong>and</strong> other events in similar circumstances<br />

(IAS 27.18 <strong>and</strong> .24).<br />

The parent’s investment in each subsidiary <strong>and</strong> its<br />

portion of equity of each subsidiary shall be eliminated.<br />

Intragroup balances, transactions, income <strong>and</strong> expenses<br />

shall also be eliminated in full (IAS 27.18 <strong>and</strong> .20).<br />

Noncontrolling interests shall be presented in the<br />

consolidated statement of financial position within equity<br />

apart from the parent’s equity. Profit <strong>and</strong> loss <strong>and</strong> each<br />

component of other comprehensive income shall be<br />

attributed to the parent <strong>and</strong> the noncontrolling interests<br />

even if the noncontrolling interests have a deficit balance<br />

(IAS 27.27 <strong>and</strong> .28). See Section 8.2, “Noncontrolling<br />

interests.”<br />

Similar to IFRS, the financial statements of the parent <strong>and</strong><br />

its subsidiaries shall be combined by adding together like<br />

items of assets, liabilities, equity, income <strong>and</strong> expense.<br />

Uniform accounting policies should generally be used for<br />

similar transactions <strong>and</strong> other events in similar<br />

circumstances. However, in certain limited situations<br />

specialized industry accounting principles that are<br />

appropriate at a subsidiary level should be retained in<br />

consolidation (ASC 810-10-25-15).<br />

Similar to IFRS, intercompany investments, balances,<br />

<strong>and</strong> transactions shall be eliminated (ASC 810-10-45-1).<br />

Similar to IFRS (ASC 810-10-45-15 through 45-21). See<br />

Section 8.2, “Noncontrolling interests.”<br />

Reporting date of subsidiaries<br />

Parent <strong>and</strong> subsidiary financial statements used for<br />

consolidation shall be as of the same reporting date. If<br />

the reporting period of the parent is different from a<br />

subsidiary, the subsidiary shall prepare additional<br />

financial statements as of the same date of the parent if<br />

practicable.<br />

If the financial statements of a subsidiary used to<br />

prepare consolidated financial statements are prepared<br />

as of a different date than the parent’s, adjustments shall<br />

be made for the effects of significant transactions or<br />

events that occur <strong>between</strong> the date of a subsidiary’s<br />

financial statements <strong>and</strong> the date of the parent’s<br />

financial statements. In any case, the difference <strong>between</strong><br />

reporting dates shall not be more than three months<br />

(IAS 27.22-.23).<br />

A parent <strong>and</strong> a subsidiary may have different fiscal<br />

periods. As long as the difference is not more than about<br />

three months, it is acceptable to use the subsidiary’s<br />

financial statements for its fiscal year. However, unlike<br />

IFRS, adjustments shall not be made for the effects of<br />

significant transactions or events that occur <strong>between</strong> the<br />

date of a subsidiary’s financial statements used to<br />

prepare consolidated financial statements <strong>and</strong> the date of<br />

the parent’s financial statements. Instead, the effect of<br />

intervening events that materially affect the financial<br />

statements must be disclosed (ASC 810-10-45-12).<br />

Separate parent financial statements<br />

Separate financial statements are not required by IFRS<br />

but may be by local regulations or by choice (IAS 27.3).<br />

If a parent prepares separate financial statements,<br />

investments in subsidiaries that are not classified as<br />

held-for-sale in accordance with IFRS 5 shall be<br />

accounted for at cost or in accordance with IAS 39<br />

If parent-company financial statements are needed in<br />

addition to consolidated financial statements, ASC 810-<br />

10-45-11 states that consolidating statements in which<br />

one column is used for the parent <strong>and</strong> other columns for<br />

particular subsidiaries or groups of subsidiaries are an<br />

effective way of presenting the pertinent information.<br />

© 2011 <strong>Grant</strong> <strong>Thornton</strong> LLP<br />

All rights reserved<br />

U.S. member firm of <strong>Grant</strong> <strong>Thornton</strong> <strong>International</strong> Ltd