Comparison between U.S. GAAP and International ... - Grant Thornton

Comparison between U.S. GAAP and International ... - Grant Thornton

Comparison between U.S. GAAP and International ... - Grant Thornton

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

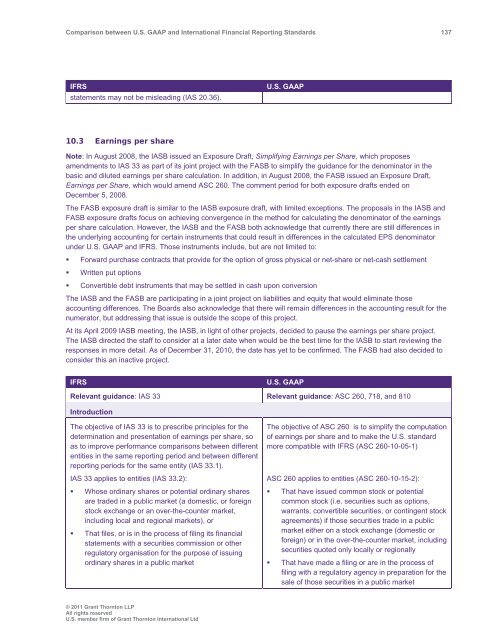

<strong>Comparison</strong> <strong>between</strong> U.S. <strong>GAAP</strong> <strong>and</strong> <strong>International</strong> Financial Reporting St<strong>and</strong>ards 137<br />

IFRS<br />

statements may not be misleading (IAS 20.36).<br />

U.S. <strong>GAAP</strong><br />

10.3 Earnings per share<br />

Note: In August 2008, the IASB issued an Exposure Draft, Simplifying Earnings per Share, which proposes<br />

amendments to IAS 33 as part of its joint project with the FASB to simplify the guidance for the denominator in the<br />

basic <strong>and</strong> diluted earnings per share calculation. In addition, in August 2008, the FASB issued an Exposure Draft,<br />

Earnings per Share, which would amend ASC 260. The comment period for both exposure drafts ended on<br />

December 5, 2008.<br />

The FASB exposure draft is similar to the IASB exposure draft, with limited exceptions. The proposals in the IASB <strong>and</strong><br />

FASB exposure drafts focus on achieving convergence in the method for calculating the denominator of the earnings<br />

per share calculation. However, the IASB <strong>and</strong> the FASB both acknowledge that currently there are still differences in<br />

the underlying accounting for certain instruments that could result in differences in the calculated EPS denominator<br />

under U.S. <strong>GAAP</strong> <strong>and</strong> IFRS. Those instruments include, but are not limited to:<br />

• Forward purchase contracts that provide for the option of gross physical or net-share or net-cash settlement<br />

• Written put options<br />

• Convertible debt instruments that may be settled in cash upon conversion<br />

The IASB <strong>and</strong> the FASB are participating in a joint project on liabilities <strong>and</strong> equity that would eliminate those<br />

accounting differences. The Boards also acknowledge that there will remain differences in the accounting result for the<br />

numerator, but addressing that issue is outside the scope of this project.<br />

At its April 2009 IASB meeting, the IASB, in light of other projects, decided to pause the earnings per share project.<br />

The IASB directed the staff to consider at a later date when would be the best time for the IASB to start reviewing the<br />

responses in more detail. As of December 31, 2010, the date has yet to be confirmed. The FASB had also decided to<br />

consider this an inactive project.<br />

IFRS<br />

U.S. <strong>GAAP</strong><br />

Relevant guidance: IAS 33 Relevant guidance: ASC 260, 718, <strong>and</strong> 810<br />

Introduction<br />

The objective of IAS 33 is to prescribe principles for the<br />

determination <strong>and</strong> presentation of earnings per share, so<br />

as to improve performance comparisons <strong>between</strong> different<br />

entities in the same reporting period <strong>and</strong> <strong>between</strong> different<br />

reporting periods for the same entity (IAS 33.1).<br />

IAS 33 applies to entities (IAS 33.2):<br />

• Whose ordinary shares or potential ordinary shares<br />

are traded in a public market (a domestic, or foreign<br />

stock exchange or an over-the-counter market,<br />

including local <strong>and</strong> regional markets), or<br />

• That files, or is in the process of filing its financial<br />

statements with a securities commission or other<br />

regulatory organisation for the purpose of issuing<br />

ordinary shares in a public market<br />

The objective of ASC 260 is to simplify the computation<br />

of earnings per share <strong>and</strong> to make the U.S. st<strong>and</strong>ard<br />

more compatible with IFRS (ASC 260-10-05-1)<br />

ASC 260 applies to entities (ASC 260-10-15-2):<br />

• That have issued common stock or potential<br />

common stock (i.e. securities such as options,<br />

warrants, convertible securities, or contingent stock<br />

agreements) if those securities trade in a public<br />

market either on a stock exchange (domestic or<br />

foreign) or in the over-the-counter market, including<br />

securities quoted only locally or regionally<br />

• That have made a filing or are in the process of<br />

filing with a regulatory agency in preparation for the<br />

sale of those securities in a public market<br />

© 2011 <strong>Grant</strong> <strong>Thornton</strong> LLP<br />

All rights reserved<br />

U.S. member firm of <strong>Grant</strong> <strong>Thornton</strong> <strong>International</strong> Ltd