Comparison between U.S. GAAP and International ... - Grant Thornton

Comparison between U.S. GAAP and International ... - Grant Thornton

Comparison between U.S. GAAP and International ... - Grant Thornton

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

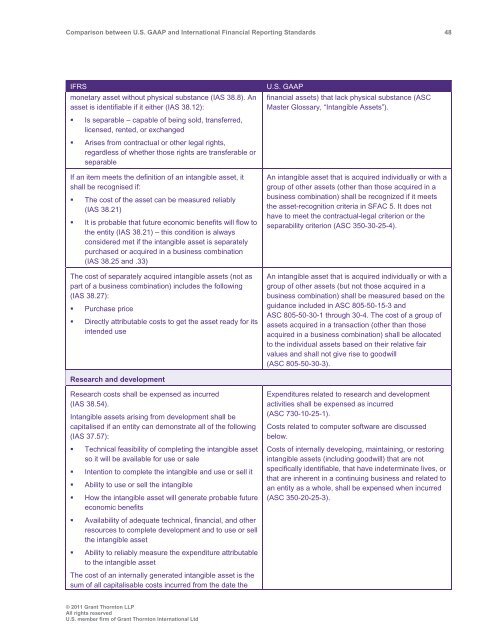

<strong>Comparison</strong> <strong>between</strong> U.S. <strong>GAAP</strong> <strong>and</strong> <strong>International</strong> Financial Reporting St<strong>and</strong>ards 48<br />

IFRS<br />

monetary asset without physical substance (IAS 38.8). An<br />

asset is identifiable if it either (IAS 38.12):<br />

• Is separable – capable of being sold, transferred,<br />

licensed, rented, or exchanged<br />

• Arises from contractual or other legal rights,<br />

regardless of whether those rights are transferable or<br />

separable<br />

If an item meets the definition of an intangible asset, it<br />

shall be recognised if:<br />

• The cost of the asset can be measured reliably<br />

(IAS 38.21)<br />

• It is probable that future economic benefits will flow to<br />

the entity (IAS 38.21) – this condition is always<br />

considered met if the intangible asset is separately<br />

purchased or acquired in a business combination<br />

(IAS 38.25 <strong>and</strong> .33)<br />

The cost of separately acquired intangible assets (not as<br />

part of a business combination) includes the following<br />

(IAS 38.27):<br />

• Purchase price<br />

• Directly attributable costs to get the asset ready for its<br />

intended use<br />

U.S. <strong>GAAP</strong><br />

financial assets) that lack physical substance (ASC<br />

Master Glossary, “Intangible Assets”).<br />

An intangible asset that is acquired individually or with a<br />

group of other assets (other than those acquired in a<br />

business combination) shall be recognized if it meets<br />

the asset-recognition criteria in SFAC 5. It does not<br />

have to meet the contractual-legal criterion or the<br />

separability criterion (ASC 350-30-25-4).<br />

An intangible asset that is acquired individually or with a<br />

group of other assets (but not those acquired in a<br />

business combination) shall be measured based on the<br />

guidance included in ASC 805-50-15-3 <strong>and</strong><br />

ASC 805-50-30-1 through 30-4. The cost of a group of<br />

assets acquired in a transaction (other than those<br />

acquired in a business combination) shall be allocated<br />

to the individual assets based on their relative fair<br />

values <strong>and</strong> shall not give rise to goodwill<br />

(ASC 805-50-30-3).<br />

Research <strong>and</strong> development<br />

Research costs shall be expensed as incurred<br />

(IAS 38.54).<br />

Intangible assets arising from development shall be<br />

capitalised if an entity can demonstrate all of the following<br />

(IAS 37.57):<br />

• Technical feasibility of completing the intangible asset<br />

so it will be available for use or sale<br />

• Intention to complete the intangible <strong>and</strong> use or sell it<br />

• Ability to use or sell the intangible<br />

• How the intangible asset will generate probable future<br />

economic benefits<br />

• Availability of adequate technical, financial, <strong>and</strong> other<br />

resources to complete development <strong>and</strong> to use or sell<br />

the intangible asset<br />

• Ability to reliably measure the expenditure attributable<br />

to the intangible asset<br />

The cost of an internally generated intangible asset is the<br />

sum of all capitalisable costs incurred from the date the<br />

Expenditures related to research <strong>and</strong> development<br />

activities shall be expensed as incurred<br />

(ASC 730-10-25-1).<br />

Costs related to computer software are discussed<br />

below.<br />

Costs of internally developing, maintaining, or restoring<br />

intangible assets (including goodwill) that are not<br />

specifically identifiable, that have indeterminate lives, or<br />

that are inherent in a continuing business <strong>and</strong> related to<br />

an entity as a whole, shall be expensed when incurred<br />

(ASC 350-20-25-3).<br />

© 2011 <strong>Grant</strong> <strong>Thornton</strong> LLP<br />

All rights reserved<br />

U.S. member firm of <strong>Grant</strong> <strong>Thornton</strong> <strong>International</strong> Ltd