Comparison between U.S. GAAP and International ... - Grant Thornton

Comparison between U.S. GAAP and International ... - Grant Thornton

Comparison between U.S. GAAP and International ... - Grant Thornton

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

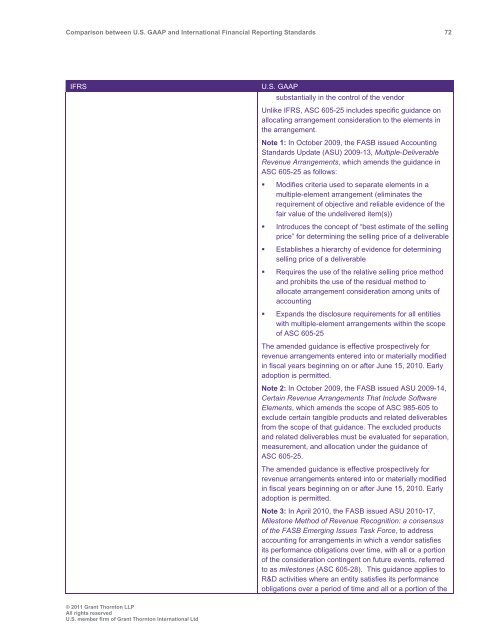

<strong>Comparison</strong> <strong>between</strong> U.S. <strong>GAAP</strong> <strong>and</strong> <strong>International</strong> Financial Reporting St<strong>and</strong>ards 72<br />

IFRS<br />

U.S. <strong>GAAP</strong><br />

substantially in the control of the vendor<br />

Unlike IFRS, ASC 605-25 includes specific guidance on<br />

allocating arrangement consideration to the elements in<br />

the arrangement.<br />

Note 1: In October 2009, the FASB issued Accounting<br />

St<strong>and</strong>ards Update (ASU) 2009-13, Multiple-Deliverable<br />

Revenue Arrangements, which amends the guidance in<br />

ASC 605-25 as follows:<br />

• Modifies criteria used to separate elements in a<br />

multiple-element arrangement (eliminates the<br />

requirement of objective <strong>and</strong> reliable evidence of the<br />

fair value of the undelivered item(s))<br />

• Introduces the concept of “best estimate of the selling<br />

price” for determining the selling price of a deliverable<br />

• Establishes a hierarchy of evidence for determining<br />

selling price of a deliverable<br />

• Requires the use of the relative selling price method<br />

<strong>and</strong> prohibits the use of the residual method to<br />

allocate arrangement consideration among units of<br />

accounting<br />

• Exp<strong>and</strong>s the disclosure requirements for all entities<br />

with multiple-element arrangements within the scope<br />

of ASC 605-25<br />

The amended guidance is effective prospectively for<br />

revenue arrangements entered into or materially modified<br />

in fiscal years beginning on or after June 15, 2010. Early<br />

adoption is permitted.<br />

Note 2: In October 2009, the FASB issued ASU 2009-14,<br />

Certain Revenue Arrangements That Include Software<br />

Elements, which amends the scope of ASC 985-605 to<br />

exclude certain tangible products <strong>and</strong> related deliverables<br />

from the scope of that guidance. The excluded products<br />

<strong>and</strong> related deliverables must be evaluated for separation,<br />

measurement, <strong>and</strong> allocation under the guidance of<br />

ASC 605-25.<br />

The amended guidance is effective prospectively for<br />

revenue arrangements entered into or materially modified<br />

in fiscal years beginning on or after June 15, 2010. Early<br />

adoption is permitted.<br />

Note 3: In April 2010, the FASB issued ASU 2010-17,<br />

Milestone Method of Revenue Recognition: a consensus<br />

of the FASB Emerging Issues Task Force, to address<br />

accounting for arrangements in which a vendor satisfies<br />

its performance obligations over time, with all or a portion<br />

of the consideration contingent on future events, referred<br />

to as milestones (ASC 605-28). This guidance applies to<br />

R&D activities where an entity satisfies its performance<br />

obligations over a period of time <strong>and</strong> all or a portion of the<br />

© 2011 <strong>Grant</strong> <strong>Thornton</strong> LLP<br />

All rights reserved<br />

U.S. member firm of <strong>Grant</strong> <strong>Thornton</strong> <strong>International</strong> Ltd