Comparison between U.S. GAAP and International ... - Grant Thornton

Comparison between U.S. GAAP and International ... - Grant Thornton

Comparison between U.S. GAAP and International ... - Grant Thornton

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

<strong>Comparison</strong> <strong>between</strong> U.S. <strong>GAAP</strong> <strong>and</strong> <strong>International</strong> Financial Reporting St<strong>and</strong>ards 94<br />

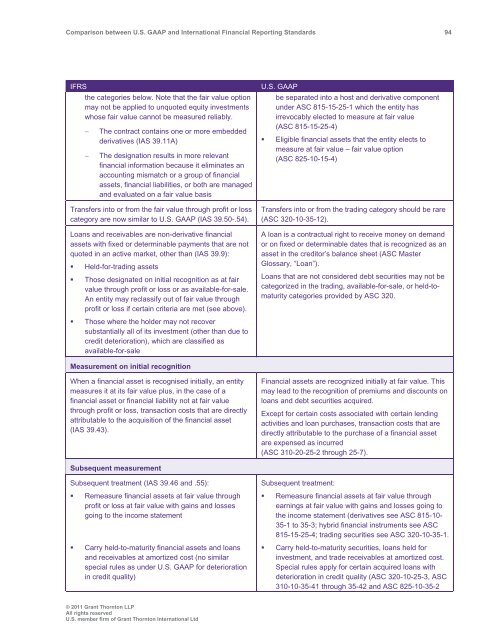

IFRS<br />

the categories below. Note that the fair value option<br />

may not be applied to unquoted equity investments<br />

whose fair value cannot be measured reliably.<br />

<br />

<br />

The contract contains one or more embedded<br />

derivatives (IAS 39.11A)<br />

The designation results in more relevant<br />

financial information because it eliminates an<br />

accounting mismatch or a group of financial<br />

assets, financial liabilities, or both are managed<br />

<strong>and</strong> evaluated on a fair value basis<br />

Transfers into or from the fair value through profit or loss<br />

category are now similar to U.S. <strong>GAAP</strong> (IAS 39.50-.54).<br />

Loans <strong>and</strong> receivables are non-derivative financial<br />

assets with fixed or determinable payments that are not<br />

quoted in an active market, other than (IAS 39.9):<br />

• Held-for-trading assets<br />

• Those designated on initial recognition as at fair<br />

value through profit or loss or as available-for-sale.<br />

An entity may reclassify out of fair value through<br />

profit or loss if certain criteria are met (see above).<br />

• Those where the holder may not recover<br />

substantially all of its investment (other than due to<br />

credit deterioration), which are classified as<br />

available-for-sale<br />

U.S. <strong>GAAP</strong><br />

be separated into a host <strong>and</strong> derivative component<br />

under ASC 815-15-25-1 which the entity has<br />

irrevocably elected to measure at fair value<br />

(ASC 815-15-25-4)<br />

• Eligible financial assets that the entity elects to<br />

measure at fair value – fair value option<br />

(ASC 825-10-15-4)<br />

Transfers into or from the trading category should be rare<br />

(ASC 320-10-35-12).<br />

A loan is a contractual right to receive money on dem<strong>and</strong><br />

or on fixed or determinable dates that is recognized as an<br />

asset in the creditor’s balance sheet (ASC Master<br />

Glossary, “Loan”).<br />

Loans that are not considered debt securities may not be<br />

categorized in the trading, available-for-sale, or held-tomaturity<br />

categories provided by ASC 320.<br />

Measurement on initial recognition<br />

When a financial asset is recognised initially, an entity<br />

measures it at its fair value plus, in the case of a<br />

financial asset or financial liability not at fair value<br />

through profit or loss, transaction costs that are directly<br />

attributable to the acquisition of the financial asset<br />

(IAS 39.43).<br />

Financial assets are recognized initially at fair value. This<br />

may lead to the recognition of premiums <strong>and</strong> discounts on<br />

loans <strong>and</strong> debt securities acquired.<br />

Except for certain costs associated with certain lending<br />

activities <strong>and</strong> loan purchases, transaction costs that are<br />

directly attributable to the purchase of a financial asset<br />

are expensed as incurred<br />

(ASC 310-20-25-2 through 25-7).<br />

Subsequent measurement<br />

Subsequent treatment (IAS 39.46 <strong>and</strong> .55):<br />

• Remeasure financial assets at fair value through<br />

profit or loss at fair value with gains <strong>and</strong> losses<br />

going to the income statement<br />

• Carry held-to-maturity financial assets <strong>and</strong> loans<br />

<strong>and</strong> receivables at amortized cost (no similar<br />

special rules as under U.S. <strong>GAAP</strong> for deterioration<br />

in credit quality)<br />

Subsequent treatment:<br />

• Remeasure financial assets at fair value through<br />

earnings at fair value with gains <strong>and</strong> losses going to<br />

the income statement (derivatives see ASC 815-10-<br />

35-1 to 35-3; hybrid financial instruments see ASC<br />

815-15-25-4; trading securities see ASC 320-10-35-1.<br />

• Carry held-to-maturity securities, loans held for<br />

investment, <strong>and</strong> trade receivables at amortized cost.<br />

Special rules apply for certain acquired loans with<br />

deterioration in credit quality (ASC 320-10-25-3, ASC<br />

310-10-35-41 through 35-42 <strong>and</strong> ASC 825-10-35-2<br />

© 2011 <strong>Grant</strong> <strong>Thornton</strong> LLP<br />

All rights reserved<br />

U.S. member firm of <strong>Grant</strong> <strong>Thornton</strong> <strong>International</strong> Ltd