Comparison between U.S. GAAP and International ... - Grant Thornton

Comparison between U.S. GAAP and International ... - Grant Thornton

Comparison between U.S. GAAP and International ... - Grant Thornton

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

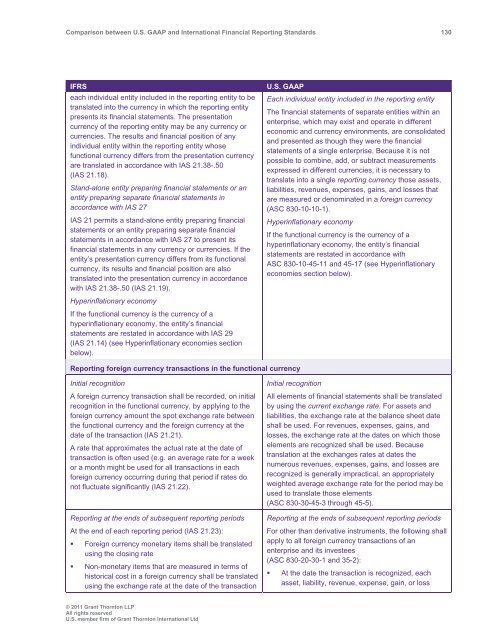

<strong>Comparison</strong> <strong>between</strong> U.S. <strong>GAAP</strong> <strong>and</strong> <strong>International</strong> Financial Reporting St<strong>and</strong>ards 130<br />

IFRS<br />

each individual entity included in the reporting entity to be<br />

translated into the currency in which the reporting entity<br />

presents its financial statements. The presentation<br />

currency of the reporting entity may be any currency or<br />

currencies. The results <strong>and</strong> financial position of any<br />

individual entity within the reporting entity whose<br />

functional currency differs from the presentation currency<br />

are translated in accordance with IAS 21.38-.50<br />

(IAS 21.18).<br />

St<strong>and</strong>-alone entity preparing financial statements or an<br />

entity preparing separate financial statements in<br />

accordance with IAS 27<br />

IAS 21 permits a st<strong>and</strong>-alone entity preparing financial<br />

statements or an entity preparing separate financial<br />

statements in accordance with IAS 27 to present its<br />

financial statements in any currency or currencies. If the<br />

entity’s presentation currency differs from its functional<br />

currency, its results <strong>and</strong> financial position are also<br />

translated into the presentation currency in accordance<br />

with IAS 21.38-.50 (IAS 21.19).<br />

Hyperinflationary economy<br />

If the functional currency is the currency of a<br />

hyperinflationary economy, the entity’s financial<br />

statements are restated in accordance with IAS 29<br />

(IAS 21.14) (see Hyperinflationary economies section<br />

below).<br />

U.S. <strong>GAAP</strong><br />

Each individual entity included in the reporting entity<br />

The financial statements of separate entities within an<br />

enterprise, which may exist <strong>and</strong> operate in different<br />

economic <strong>and</strong> currency environments, are consolidated<br />

<strong>and</strong> presented as though they were the financial<br />

statements of a single enterprise. Because it is not<br />

possible to combine, add, or subtract measurements<br />

expressed in different currencies, it is necessary to<br />

translate into a single reporting currency those assets,<br />

liabilities, revenues, expenses, gains, <strong>and</strong> losses that<br />

are measured or denominated in a foreign currency<br />

(ASC 830-10-10-1).<br />

Hyperinflationary economy<br />

If the functional currency is the currency of a<br />

hyperinflationary economy, the entity’s financial<br />

statements are restated in accordance with<br />

ASC 830-10-45-11 <strong>and</strong> 45-17 (see Hyperinflationary<br />

economies section below).<br />

Reporting foreign currency transactions in the functional currency<br />

Initial recognition<br />

A foreign currency transaction shall be recorded, on initial<br />

recognition in the functional currency, by applying to the<br />

foreign currency amount the spot exchange rate <strong>between</strong><br />

the functional currency <strong>and</strong> the foreign currency at the<br />

date of the transaction (IAS 21.21).<br />

A rate that approximates the actual rate at the date of<br />

transaction is often used (e.g. an average rate for a week<br />

or a month might be used for all transactions in each<br />

foreign currency occurring during that period if rates do<br />

not fluctuate significantly (IAS 21.22).<br />

Reporting at the ends of subsequent reporting periods<br />

At the end of each reporting period (IAS 21.23):<br />

• Foreign currency monetary items shall be translated<br />

using the closing rate<br />

• Non-monetary items that are measured in terms of<br />

historical cost in a foreign currency shall be translated<br />

using the exchange rate at the date of the transaction<br />

Initial recognition<br />

All elements of financial statements shall be translated<br />

by using the current exchange rate. For assets <strong>and</strong><br />

liabilities, the exchange rate at the balance sheet date<br />

shall be used. For revenues, expenses, gains, <strong>and</strong><br />

losses, the exchange rate at the dates on which those<br />

elements are recognized shall be used. Because<br />

translation at the exchanges rates at dates the<br />

numerous revenues, expenses, gains, <strong>and</strong> losses are<br />

recognized is generally impractical, an appropriately<br />

weighted average exchange rate for the period may be<br />

used to translate those elements<br />

(ASC 830-30-45-3 through 45-5).<br />

Reporting at the ends of subsequent reporting periods<br />

For other than derivative instruments, the following shall<br />

apply to all foreign currency transactions of an<br />

enterprise <strong>and</strong> its investees<br />

(ASC 830-20-30-1 <strong>and</strong> 35-2):<br />

• At the date the transaction is recognized, each<br />

asset, liability, revenue, expense, gain, or loss<br />

© 2011 <strong>Grant</strong> <strong>Thornton</strong> LLP<br />

All rights reserved<br />

U.S. member firm of <strong>Grant</strong> <strong>Thornton</strong> <strong>International</strong> Ltd