Comparison between U.S. GAAP and International ... - Grant Thornton

Comparison between U.S. GAAP and International ... - Grant Thornton

Comparison between U.S. GAAP and International ... - Grant Thornton

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

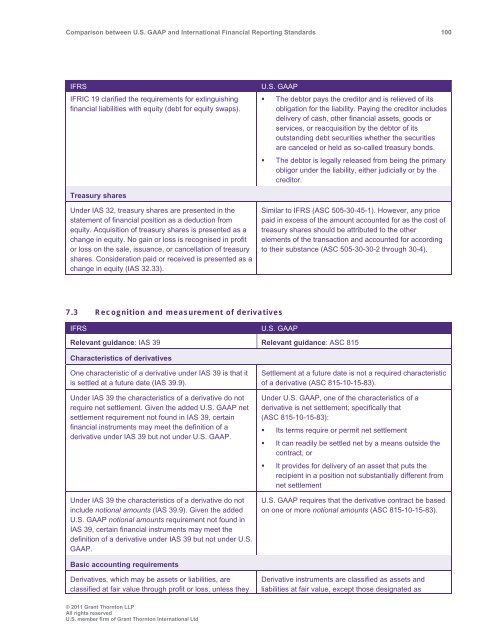

<strong>Comparison</strong> <strong>between</strong> U.S. <strong>GAAP</strong> <strong>and</strong> <strong>International</strong> Financial Reporting St<strong>and</strong>ards 100<br />

IFRS<br />

IFRIC 19 clarified the requirements for extinguishing<br />

financial liabilities with equity (debt for equity swaps).<br />

U.S. <strong>GAAP</strong><br />

• The debtor pays the creditor <strong>and</strong> is relieved of its<br />

obligation for the liability. Paying the creditor includes<br />

delivery of cash, other financial assets, goods or<br />

services, or reacquisition by the debtor of its<br />

outst<strong>and</strong>ing debt securities whether the securities<br />

are canceled or held as so-called treasury bonds.<br />

• The debtor is legally released from being the primary<br />

obligor under the liability, either judicially or by the<br />

creditor.<br />

Treasury shares<br />

Under IAS 32, treasury shares are presented in the<br />

statement of financial position as a deduction from<br />

equity. Acquisition of treasury shares is presented as a<br />

change in equity. No gain or loss is recognised in profit<br />

or loss on the sale, issuance, or cancellation of treasury<br />

shares. Consideration paid or received is presented as a<br />

change in equity (IAS 32.33).<br />

Similar to IFRS (ASC 505-30-45-1). However, any price<br />

paid in excess of the amount accounted for as the cost of<br />

treasury shares should be attributed to the other<br />

elements of the transaction <strong>and</strong> accounted for according<br />

to their substance (ASC 505-30-30-2 through 30-4).<br />

7.3 Recognition <strong>and</strong> measurement of derivatives<br />

IFRS<br />

U.S. <strong>GAAP</strong><br />

Relevant guidance: IAS 39 Relevant guidance: ASC 815<br />

Characteristics of derivatives<br />

One characteristic of a derivative under IAS 39 is that it<br />

is settled at a future date (IAS 39.9).<br />

Under IAS 39 the characteristics of a derivative do not<br />

require net settlement. Given the added U.S. <strong>GAAP</strong> net<br />

settlement requirement not found in IAS 39, certain<br />

financial instruments may meet the definition of a<br />

derivative under IAS 39 but not under U.S. <strong>GAAP</strong>.<br />

Under IAS 39 the characteristics of a derivative do not<br />

include notional amounts (IAS 39.9). Given the added<br />

U.S. <strong>GAAP</strong> notional amounts requirement not found in<br />

IAS 39, certain financial instruments may meet the<br />

definition of a derivative under IAS 39 but not under U.S.<br />

<strong>GAAP</strong>.<br />

Settlement at a future date is not a required characteristic<br />

of a derivative (ASC 815-10-15-83).<br />

Under U.S. <strong>GAAP</strong>, one of the characteristics of a<br />

derivative is net settlement; specifically that<br />

(ASC 815-10-15-83):<br />

• Its terms require or permit net settlement<br />

• It can readily be settled net by a means outside the<br />

contract, or<br />

• It provides for delivery of an asset that puts the<br />

recipient in a position not substantially different from<br />

net settlement<br />

U.S. <strong>GAAP</strong> requires that the derivative contract be based<br />

on one or more notional amounts (ASC 815-10-15-83).<br />

Basic accounting requirements<br />

Derivatives, which may be assets or liabilities, are<br />

classified at fair value through profit or loss, unless they<br />

Derivative instruments are classified as assets <strong>and</strong><br />

liabilities at fair value, except those designated as<br />

© 2011 <strong>Grant</strong> <strong>Thornton</strong> LLP<br />

All rights reserved<br />

U.S. member firm of <strong>Grant</strong> <strong>Thornton</strong> <strong>International</strong> Ltd