Comparison between U.S. GAAP and International ... - Grant Thornton

Comparison between U.S. GAAP and International ... - Grant Thornton

Comparison between U.S. GAAP and International ... - Grant Thornton

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

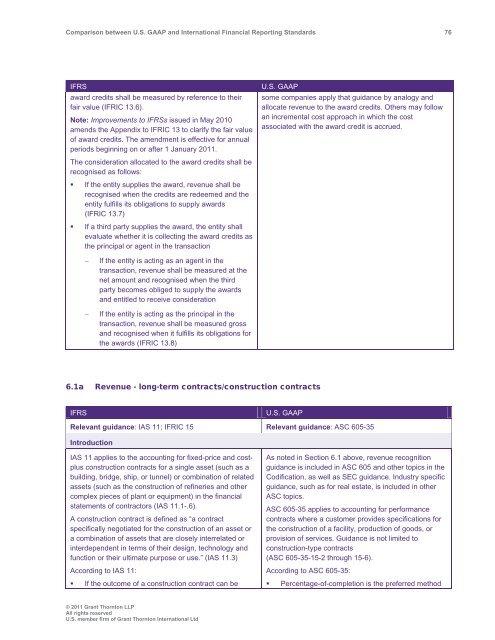

<strong>Comparison</strong> <strong>between</strong> U.S. <strong>GAAP</strong> <strong>and</strong> <strong>International</strong> Financial Reporting St<strong>and</strong>ards 76<br />

IFRS<br />

award credits shall be measured by reference to their<br />

fair value (IFRIC 13.6).<br />

Note: Improvements to IFRSs issued in May 2010<br />

amends the Appendix to IFRIC 13 to clarify the fair value<br />

of award credits. The amendment is effective for annual<br />

periods beginning on or after 1 January 2011.<br />

The consideration allocated to the award credits shall be<br />

recognised as follows:<br />

• If the entity supplies the award, revenue shall be<br />

recognised when the credits are redeemed <strong>and</strong> the<br />

entity fulfills its obligations to supply awards<br />

(IFRIC 13.7)<br />

• If a third party supplies the award, the entity shall<br />

evaluate whether it is collecting the award credits as<br />

the principal or agent in the transaction<br />

U.S. <strong>GAAP</strong><br />

some companies apply that guidance by analogy <strong>and</strong><br />

allocate revenue to the award credits. Others may follow<br />

an incremental cost approach in which the cost<br />

associated with the award credit is accrued.<br />

<br />

<br />

If the entity is acting as an agent in the<br />

transaction, revenue shall be measured at the<br />

net amount <strong>and</strong> recognised when the third<br />

party becomes obliged to supply the awards<br />

<strong>and</strong> entitled to receive consideration<br />

If the entity is acting as the principal in the<br />

transaction, revenue shall be measured gross<br />

<strong>and</strong> recognised when it fulfills its obligations for<br />

the awards (IFRIC 13.8)<br />

6.1a Revenue - long-term contracts/construction contracts<br />

IFRS<br />

U.S. <strong>GAAP</strong><br />

Relevant guidance: IAS 11; IFRIC 15 Relevant guidance: ASC 605-35<br />

Introduction<br />

IAS 11 applies to the accounting for fixed-price <strong>and</strong> costplus<br />

construction contracts for a single asset (such as a<br />

building, bridge, ship, or tunnel) or combination of related<br />

assets (such as the construction of refineries <strong>and</strong> other<br />

complex pieces of plant or equipment) in the financial<br />

statements of contractors (IAS 11.1-.6).<br />

A construction contract is defined as “a contract<br />

specifically negotiated for the construction of an asset or<br />

a combination of assets that are closely interrelated or<br />

interdependent in terms of their design, technology <strong>and</strong><br />

function or their ultimate purpose or use.” (IAS 11.3)<br />

According to IAS 11:<br />

• If the outcome of a construction contract can be<br />

As noted in Section 6.1 above, revenue recognition<br />

guidance is included in ASC 605 <strong>and</strong> other topics in the<br />

Codification, as well as SEC guidance. Industry specific<br />

guidance, such as for real estate, is included in other<br />

ASC topics.<br />

ASC 605-35 applies to accounting for performance<br />

contracts where a customer provides specifications for<br />

the construction of a facility, production of goods, or<br />

provision of services. Guidance is not limited to<br />

construction-type contracts<br />

(ASC 605-35-15-2 through 15-6).<br />

According to ASC 605-35:<br />

• Percentage-of-completion is the preferred method<br />

© 2011 <strong>Grant</strong> <strong>Thornton</strong> LLP<br />

All rights reserved<br />

U.S. member firm of <strong>Grant</strong> <strong>Thornton</strong> <strong>International</strong> Ltd