Comparison between U.S. GAAP and International ... - Grant Thornton

Comparison between U.S. GAAP and International ... - Grant Thornton

Comparison between U.S. GAAP and International ... - Grant Thornton

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

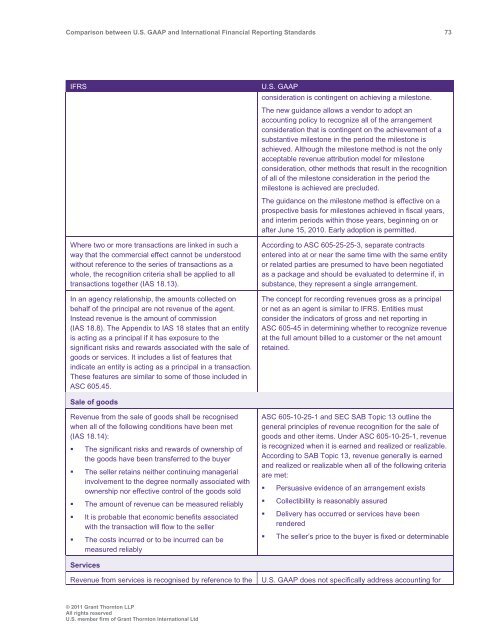

<strong>Comparison</strong> <strong>between</strong> U.S. <strong>GAAP</strong> <strong>and</strong> <strong>International</strong> Financial Reporting St<strong>and</strong>ards 73<br />

IFRS<br />

Where two or more transactions are linked in such a<br />

way that the commercial effect cannot be understood<br />

without reference to the series of transactions as a<br />

whole, the recognition criteria shall be applied to all<br />

transactions together (IAS 18.13).<br />

In an agency relationship, the amounts collected on<br />

behalf of the principal are not revenue of the agent.<br />

Instead revenue is the amount of commission<br />

(IAS 18.8). The Appendix to IAS 18 states that an entity<br />

is acting as a principal if it has exposure to the<br />

significant risks <strong>and</strong> rewards associated with the sale of<br />

goods or services. It includes a list of features that<br />

indicate an entity is acting as a principal in a transaction.<br />

These features are similar to some of those included in<br />

ASC 605.45.<br />

U.S. <strong>GAAP</strong><br />

consideration is contingent on achieving a milestone.<br />

The new guidance allows a vendor to adopt an<br />

accounting policy to recognize all of the arrangement<br />

consideration that is contingent on the achievement of a<br />

substantive milestone in the period the milestone is<br />

achieved. Although the milestone method is not the only<br />

acceptable revenue attribution model for milestone<br />

consideration, other methods that result in the recognition<br />

of all of the milestone consideration in the period the<br />

milestone is achieved are precluded.<br />

The guidance on the milestone method is effective on a<br />

prospective basis for milestones achieved in fiscal years,<br />

<strong>and</strong> interim periods within those years, beginning on or<br />

after June 15, 2010. Early adoption is permitted.<br />

According to ASC 605-25-25-3, separate contracts<br />

entered into at or near the same time with the same entity<br />

or related parties are presumed to have been negotiated<br />

as a package <strong>and</strong> should be evaluated to determine if, in<br />

substance, they represent a single arrangement.<br />

The concept for recording revenues gross as a principal<br />

or net as an agent is similar to IFRS. Entities must<br />

consider the indicators of gross <strong>and</strong> net reporting in<br />

ASC 605-45 in determining whether to recognize revenue<br />

at the full amount billed to a customer or the net amount<br />

retained.<br />

Sale of goods<br />

Revenue from the sale of goods shall be recognised<br />

when all of the following conditions have been met<br />

(IAS 18.14):<br />

• The significant risks <strong>and</strong> rewards of ownership of<br />

the goods have been transferred to the buyer<br />

• The seller retains neither continuing managerial<br />

involvement to the degree normally associated with<br />

ownership nor effective control of the goods sold<br />

• The amount of revenue can be measured reliably<br />

• It is probable that economic benefits associated<br />

with the transaction will flow to the seller<br />

• The costs incurred or to be incurred can be<br />

measured reliably<br />

ASC 605-10-25-1 <strong>and</strong> SEC SAB Topic 13 outline the<br />

general principles of revenue recognition for the sale of<br />

goods <strong>and</strong> other items. Under ASC 605-10-25-1, revenue<br />

is recognized when it is earned <strong>and</strong> realized or realizable.<br />

According to SAB Topic 13, revenue generally is earned<br />

<strong>and</strong> realized or realizable when all of the following criteria<br />

are met:<br />

• Persuasive evidence of an arrangement exists<br />

• Collectibility is reasonably assured<br />

• Delivery has occurred or services have been<br />

rendered<br />

• The seller’s price to the buyer is fixed or determinable<br />

Services<br />

Revenue from services is recognised by reference to the<br />

U.S. <strong>GAAP</strong> does not specifically address accounting for<br />

© 2011 <strong>Grant</strong> <strong>Thornton</strong> LLP<br />

All rights reserved<br />

U.S. member firm of <strong>Grant</strong> <strong>Thornton</strong> <strong>International</strong> Ltd