Comparison between U.S. GAAP and International ... - Grant Thornton

Comparison between U.S. GAAP and International ... - Grant Thornton

Comparison between U.S. GAAP and International ... - Grant Thornton

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

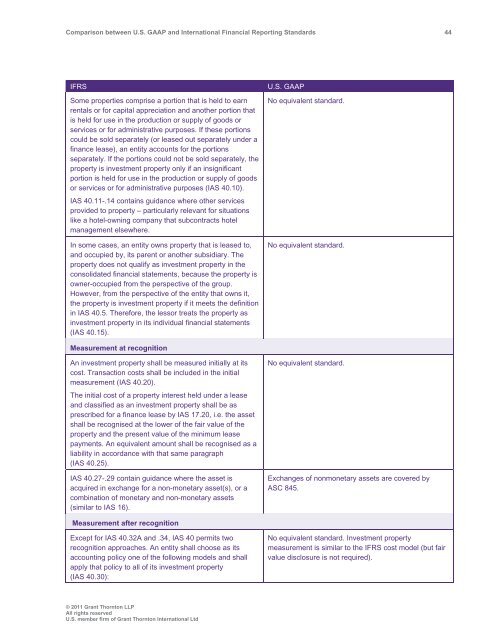

<strong>Comparison</strong> <strong>between</strong> U.S. <strong>GAAP</strong> <strong>and</strong> <strong>International</strong> Financial Reporting St<strong>and</strong>ards 44<br />

IFRS<br />

Some properties comprise a portion that is held to earn<br />

rentals or for capital appreciation <strong>and</strong> another portion that<br />

is held for use in the production or supply of goods or<br />

services or for administrative purposes. If these portions<br />

could be sold separately (or leased out separately under a<br />

finance lease), an entity accounts for the portions<br />

separately. If the portions could not be sold separately, the<br />

property is investment property only if an insignificant<br />

portion is held for use in the production or supply of goods<br />

or services or for administrative purposes (IAS 40.10).<br />

IAS 40.11-.14 contains guidance where other services<br />

provided to property – particularly relevant for situations<br />

like a hotel-owning company that subcontracts hotel<br />

management elsewhere.<br />

In some cases, an entity owns property that is leased to,<br />

<strong>and</strong> occupied by, its parent or another subsidiary. The<br />

property does not qualify as investment property in the<br />

consolidated financial statements, because the property is<br />

owner-occupied from the perspective of the group.<br />

However, from the perspective of the entity that owns it,<br />

the property is investment property if it meets the definition<br />

in IAS 40.5. Therefore, the lessor treats the property as<br />

investment property in its individual financial statements<br />

(IAS 40.15).<br />

U.S. <strong>GAAP</strong><br />

No equivalent st<strong>and</strong>ard.<br />

No equivalent st<strong>and</strong>ard.<br />

Measurement at recognition<br />

An investment property shall be measured initially at its<br />

cost. Transaction costs shall be included in the initial<br />

measurement (IAS 40.20).<br />

The initial cost of a property interest held under a lease<br />

<strong>and</strong> classified as an investment property shall be as<br />

prescribed for a finance lease by IAS 17.20, i.e. the asset<br />

shall be recognised at the lower of the fair value of the<br />

property <strong>and</strong> the present value of the minimum lease<br />

payments. An equivalent amount shall be recognised as a<br />

liability in accordance with that same paragraph<br />

(IAS 40.25).<br />

IAS 40.27-.29 contain guidance where the asset is<br />

acquired in exchange for a non-monetary asset(s), or a<br />

combination of monetary <strong>and</strong> non-monetary assets<br />

(similar to IAS 16).<br />

No equivalent st<strong>and</strong>ard.<br />

Exchanges of nonmonetary assets are covered by<br />

ASC 845.<br />

Measurement after recognition<br />

Except for IAS 40.32A <strong>and</strong> .34, IAS 40 permits two<br />

recognition approaches. An entity shall choose as its<br />

accounting policy one of the following models <strong>and</strong> shall<br />

apply that policy to all of its investment property<br />

(IAS 40.30):<br />

No equivalent st<strong>and</strong>ard. Investment property<br />

measurement is similar to the IFRS cost model (but fair<br />

value disclosure is not required).<br />

© 2011 <strong>Grant</strong> <strong>Thornton</strong> LLP<br />

All rights reserved<br />

U.S. member firm of <strong>Grant</strong> <strong>Thornton</strong> <strong>International</strong> Ltd