Comparison between U.S. GAAP and International ... - Grant Thornton

Comparison between U.S. GAAP and International ... - Grant Thornton

Comparison between U.S. GAAP and International ... - Grant Thornton

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

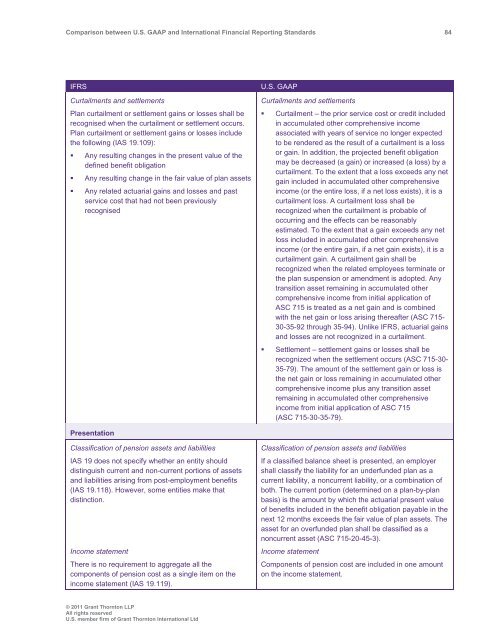

<strong>Comparison</strong> <strong>between</strong> U.S. <strong>GAAP</strong> <strong>and</strong> <strong>International</strong> Financial Reporting St<strong>and</strong>ards 84<br />

IFRS<br />

Curtailments <strong>and</strong> settlements<br />

Plan curtailment or settlement gains or losses shall be<br />

recognised when the curtailment or settlement occurs.<br />

Plan curtailment or settlement gains or losses include<br />

the following (IAS 19.109):<br />

• Any resulting changes in the present value of the<br />

defined benefit obligation<br />

• Any resulting change in the fair value of plan assets<br />

• Any related actuarial gains <strong>and</strong> losses <strong>and</strong> past<br />

service cost that had not been previously<br />

recognised<br />

U.S. <strong>GAAP</strong><br />

Curtailments <strong>and</strong> settlements<br />

• Curtailment – the prior service cost or credit included<br />

in accumulated other comprehensive income<br />

associated with years of service no longer expected<br />

to be rendered as the result of a curtailment is a loss<br />

or gain. In addition, the projected benefit obligation<br />

may be decreased (a gain) or increased (a loss) by a<br />

curtailment. To the extent that a loss exceeds any net<br />

gain included in accumulated other comprehensive<br />

income (or the entire loss, if a net loss exists), it is a<br />

curtailment loss. A curtailment loss shall be<br />

recognized when the curtailment is probable of<br />

occurring <strong>and</strong> the effects can be reasonably<br />

estimated. To the extent that a gain exceeds any net<br />

loss included in accumulated other comprehensive<br />

income (or the entire gain, if a net gain exists), it is a<br />

curtailment gain. A curtailment gain shall be<br />

recognized when the related employees terminate or<br />

the plan suspension or amendment is adopted. Any<br />

transition asset remaining in accumulated other<br />

comprehensive income from initial application of<br />

ASC 715 is treated as a net gain <strong>and</strong> is combined<br />

with the net gain or loss arising thereafter (ASC 715-<br />

30-35-92 through 35-94). Unlike IFRS, actuarial gains<br />

<strong>and</strong> losses are not recognized in a curtailment.<br />

• Settlement – settlement gains or losses shall be<br />

recognized when the settlement occurs (ASC 715-30-<br />

35-79). The amount of the settlement gain or loss is<br />

the net gain or loss remaining in accumulated other<br />

comprehensive income plus any transition asset<br />

remaining in accumulated other comprehensive<br />

income from initial application of ASC 715<br />

(ASC 715-30-35-79).<br />

Presentation<br />

Classification of pension assets <strong>and</strong> liabilities<br />

IAS 19 does not specify whether an entity should<br />

distinguish current <strong>and</strong> non-current portions of assets<br />

<strong>and</strong> liabilities arising from post-employment benefits<br />

(IAS 19.118). However, some entities make that<br />

distinction.<br />

Income statement<br />

There is no requirement to aggregate all the<br />

components of pension cost as a single item on the<br />

income statement (IAS 19.119).<br />

Classification of pension assets <strong>and</strong> liabilities<br />

If a classified balance sheet is presented, an employer<br />

shall classify the liability for an underfunded plan as a<br />

current liability, a noncurrent liability, or a combination of<br />

both. The current portion (determined on a plan-by-plan<br />

basis) is the amount by which the actuarial present value<br />

of benefits included in the benefit obligation payable in the<br />

next 12 months exceeds the fair value of plan assets. The<br />

asset for an overfunded plan shall be classified as a<br />

noncurrent asset (ASC 715-20-45-3).<br />

Income statement<br />

Components of pension cost are included in one amount<br />

on the income statement.<br />

© 2011 <strong>Grant</strong> <strong>Thornton</strong> LLP<br />

All rights reserved<br />

U.S. member firm of <strong>Grant</strong> <strong>Thornton</strong> <strong>International</strong> Ltd