Comparison between U.S. GAAP and International ... - Grant Thornton

Comparison between U.S. GAAP and International ... - Grant Thornton

Comparison between U.S. GAAP and International ... - Grant Thornton

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

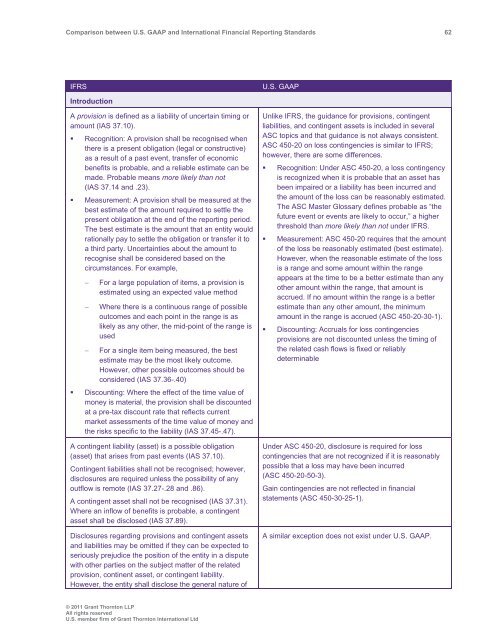

<strong>Comparison</strong> <strong>between</strong> U.S. <strong>GAAP</strong> <strong>and</strong> <strong>International</strong> Financial Reporting St<strong>and</strong>ards 62<br />

IFRS<br />

U.S. <strong>GAAP</strong><br />

Introduction<br />

A provision is defined as a liability of uncertain timing or<br />

amount (IAS 37.10).<br />

• Recognition: A provision shall be recognised when<br />

there is a present obligation (legal or constructive)<br />

as a result of a past event, transfer of economic<br />

benefits is probable, <strong>and</strong> a reliable estimate can be<br />

made. Probable means more likely than not<br />

(IAS 37.14 <strong>and</strong> .23).<br />

• Measurement: A provision shall be measured at the<br />

best estimate of the amount required to settle the<br />

present obligation at the end of the reporting period.<br />

The best estimate is the amount that an entity would<br />

rationally pay to settle the obligation or transfer it to<br />

a third party. Uncertainties about the amount to<br />

recognise shall be considered based on the<br />

circumstances. For example,<br />

<br />

<br />

For a large population of items, a provision is<br />

estimated using an expected value method<br />

Where there is a continuous range of possible<br />

outcomes <strong>and</strong> each point in the range is as<br />

likely as any other, the mid-point of the range is<br />

used<br />

For a single item being measured, the best<br />

estimate may be the most likely outcome.<br />

However, other possible outcomes should be<br />

considered (IAS 37.36-.40)<br />

• Discounting: Where the effect of the time value of<br />

money is material, the provision shall be discounted<br />

at a pre-tax discount rate that reflects current<br />

market assessments of the time value of money <strong>and</strong><br />

the risks specific to the liability (IAS 37.45-.47).<br />

A contingent liability (asset) is a possible obligation<br />

(asset) that arises from past events (IAS 37.10).<br />

Contingent liabilities shall not be recognised; however,<br />

disclosures are required unless the possibility of any<br />

outflow is remote (IAS 37.27-.28 <strong>and</strong> .86).<br />

A contingent asset shall not be recognised (IAS 37.31).<br />

Where an inflow of benefits is probable, a contingent<br />

asset shall be disclosed (IAS 37.89).<br />

Disclosures regarding provisions <strong>and</strong> contingent assets<br />

<strong>and</strong> liabilities may be omitted if they can be expected to<br />

seriously prejudice the position of the entity in a dispute<br />

with other parties on the subject matter of the related<br />

provision, continent asset, or contingent liability.<br />

However, the entity shall disclose the general nature of<br />

Unlike IFRS, the guidance for provisions, contingent<br />

liabilities, <strong>and</strong> contingent assets is included in several<br />

ASC topics <strong>and</strong> that guidance is not always consistent.<br />

ASC 450-20 on loss contingencies is similar to IFRS;<br />

however, there are some differences.<br />

• Recognition: Under ASC 450-20, a loss contingency<br />

is recognized when it is probable that an asset has<br />

been impaired or a liability has been incurred <strong>and</strong><br />

the amount of the loss can be reasonably estimated.<br />

The ASC Master Glossary defines probable as “the<br />

future event or events are likely to occur,” a higher<br />

threshold than more likely than not under IFRS.<br />

• Measurement: ASC 450-20 requires that the amount<br />

of the loss be reasonably estimated (best estimate).<br />

However, when the reasonable estimate of the loss<br />

is a range <strong>and</strong> some amount within the range<br />

appears at the time to be a better estimate than any<br />

other amount within the range, that amount is<br />

accrued. If no amount within the range is a better<br />

estimate than any other amount, the minimum<br />

amount in the range is accrued (ASC 450-20-30-1).<br />

• Discounting: Accruals for loss contingencies<br />

provisions are not discounted unless the timing of<br />

the related cash flows is fixed or reliably<br />

determinable<br />

Under ASC 450-20, disclosure is required for loss<br />

contingencies that are not recognized if it is reasonably<br />

possible that a loss may have been incurred<br />

(ASC 450-20-50-3).<br />

Gain contingencies are not reflected in financial<br />

statements (ASC 450-30-25-1).<br />

A similar exception does not exist under U.S. <strong>GAAP</strong>.<br />

© 2011 <strong>Grant</strong> <strong>Thornton</strong> LLP<br />

All rights reserved<br />

U.S. member firm of <strong>Grant</strong> <strong>Thornton</strong> <strong>International</strong> Ltd