Comparison between U.S. GAAP and International ... - Grant Thornton

Comparison between U.S. GAAP and International ... - Grant Thornton

Comparison between U.S. GAAP and International ... - Grant Thornton

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

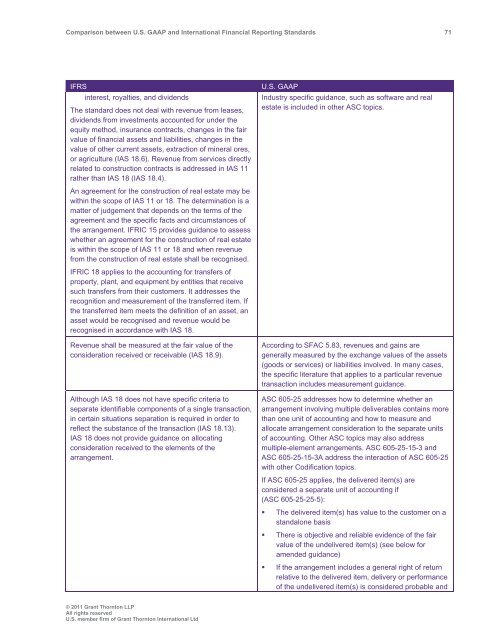

<strong>Comparison</strong> <strong>between</strong> U.S. <strong>GAAP</strong> <strong>and</strong> <strong>International</strong> Financial Reporting St<strong>and</strong>ards 71<br />

IFRS<br />

interest, royalties, <strong>and</strong> dividends<br />

The st<strong>and</strong>ard does not deal with revenue from leases,<br />

dividends from investments accounted for under the<br />

equity method, insurance contracts, changes in the fair<br />

value of financial assets <strong>and</strong> liabilities, changes in the<br />

value of other current assets, extraction of mineral ores,<br />

or agriculture (IAS 18.6). Revenue from services directly<br />

related to construction contracts is addressed in IAS 11<br />

rather than IAS 18 (IAS 18.4).<br />

An agreement for the construction of real estate may be<br />

within the scope of IAS 11 or 18. The determination is a<br />

matter of judgement that depends on the terms of the<br />

agreement <strong>and</strong> the specific facts <strong>and</strong> circumstances of<br />

the arrangement. IFRIC 15 provides guidance to assess<br />

whether an agreement for the construction of real estate<br />

is within the scope of IAS 11 or 18 <strong>and</strong> when revenue<br />

from the construction of real estate shall be recognised.<br />

IFRIC 18 applies to the accounting for transfers of<br />

property, plant, <strong>and</strong> equipment by entities that receive<br />

such transfers from their customers. It addresses the<br />

recognition <strong>and</strong> measurement of the transferred item. If<br />

the transferred item meets the definition of an asset, an<br />

asset would be recognised <strong>and</strong> revenue would be<br />

recognised in accordance with IAS 18.<br />

Revenue shall be measured at the fair value of the<br />

consideration received or receivable (IAS 18.9).<br />

Although IAS 18 does not have specific criteria to<br />

separate identifiable components of a single transaction,<br />

in certain situations separation is required in order to<br />

reflect the substance of the transaction (IAS 18.13).<br />

IAS 18 does not provide guidance on allocating<br />

consideration received to the elements of the<br />

arrangement.<br />

U.S. <strong>GAAP</strong><br />

Industry specific guidance, such as software <strong>and</strong> real<br />

estate is included in other ASC topics.<br />

According to SFAC 5.83, revenues <strong>and</strong> gains are<br />

generally measured by the exchange values of the assets<br />

(goods or services) or liabilities involved. In many cases,<br />

the specific literature that applies to a particular revenue<br />

transaction includes measurement guidance.<br />

ASC 605-25 addresses how to determine whether an<br />

arrangement involving multiple deliverables contains more<br />

than one unit of accounting <strong>and</strong> how to measure <strong>and</strong><br />

allocate arrangement consideration to the separate units<br />

of accounting. Other ASC topics may also address<br />

multiple-element arrangements. ASC 605-25-15-3 <strong>and</strong><br />

ASC 605-25-15-3A address the interaction of ASC 605-25<br />

with other Codification topics.<br />

If ASC 605-25 applies, the delivered item(s) are<br />

considered a separate unit of accounting if<br />

(ASC 605-25-25-5):<br />

• The delivered item(s) has value to the customer on a<br />

st<strong>and</strong>alone basis<br />

• There is objective <strong>and</strong> reliable evidence of the fair<br />

value of the undelivered item(s) (see below for<br />

amended guidance)<br />

• If the arrangement includes a general right of return<br />

relative to the delivered item, delivery or performance<br />

of the undelivered item(s) is considered probable <strong>and</strong><br />

© 2011 <strong>Grant</strong> <strong>Thornton</strong> LLP<br />

All rights reserved<br />

U.S. member firm of <strong>Grant</strong> <strong>Thornton</strong> <strong>International</strong> Ltd