Comparison between U.S. GAAP and International ... - Grant Thornton

Comparison between U.S. GAAP and International ... - Grant Thornton

Comparison between U.S. GAAP and International ... - Grant Thornton

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

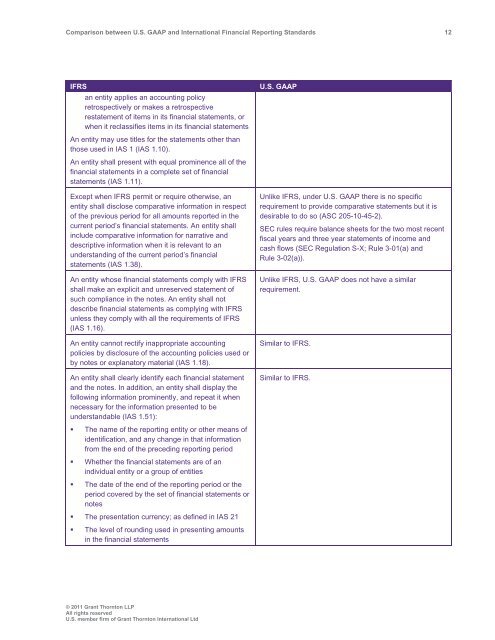

<strong>Comparison</strong> <strong>between</strong> U.S. <strong>GAAP</strong> <strong>and</strong> <strong>International</strong> Financial Reporting St<strong>and</strong>ards 12<br />

IFRS<br />

an entity applies an accounting policy<br />

retrospectively or makes a retrospective<br />

restatement of items in its financial statements, or<br />

when it reclassifies items in its financial statements<br />

An entity may use titles for the statements other than<br />

those used in IAS 1 (IAS 1.10).<br />

An entity shall present with equal prominence all of the<br />

financial statements in a complete set of financial<br />

statements (IAS 1.11).<br />

Except when IFRS permit or require otherwise, an<br />

entity shall disclose comparative information in respect<br />

of the previous period for all amounts reported in the<br />

current period’s financial statements. An entity shall<br />

include comparative information for narrative <strong>and</strong><br />

descriptive information when it is relevant to an<br />

underst<strong>and</strong>ing of the current period’s financial<br />

statements (IAS 1.38).<br />

An entity whose financial statements comply with IFRS<br />

shall make an explicit <strong>and</strong> unreserved statement of<br />

such compliance in the notes. An entity shall not<br />

describe financial statements as complying with IFRS<br />

unless they comply with all the requirements of IFRS<br />

(IAS 1.16).<br />

An entity cannot rectify inappropriate accounting<br />

policies by disclosure of the accounting policies used or<br />

by notes or explanatory material (IAS 1.18).<br />

An entity shall clearly identify each financial statement<br />

<strong>and</strong> the notes. In addition, an entity shall display the<br />

following information prominently, <strong>and</strong> repeat it when<br />

necessary for the information presented to be<br />

underst<strong>and</strong>able (IAS 1.51):<br />

U.S. <strong>GAAP</strong><br />

Unlike IFRS, under U.S. <strong>GAAP</strong> there is no specific<br />

requirement to provide comparative statements but it is<br />

desirable to do so (ASC 205-10-45-2).<br />

SEC rules require balance sheets for the two most recent<br />

fiscal years <strong>and</strong> three year statements of income <strong>and</strong><br />

cash flows (SEC Regulation S-X; Rule 3-01(a) <strong>and</strong><br />

Rule 3-02(a)).<br />

Unlike IFRS, U.S. <strong>GAAP</strong> does not have a similar<br />

requirement.<br />

Similar to IFRS.<br />

Similar to IFRS.<br />

• The name of the reporting entity or other means of<br />

identification, <strong>and</strong> any change in that information<br />

from the end of the preceding reporting period<br />

• Whether the financial statements are of an<br />

individual entity or a group of entities<br />

• The date of the end of the reporting period or the<br />

period covered by the set of financial statements or<br />

notes<br />

• The presentation currency; as defined in IAS 21<br />

• The level of rounding used in presenting amounts<br />

in the financial statements<br />

© 2011 <strong>Grant</strong> <strong>Thornton</strong> LLP<br />

All rights reserved<br />

U.S. member firm of <strong>Grant</strong> <strong>Thornton</strong> <strong>International</strong> Ltd