Comparison between U.S. GAAP and International ... - Grant Thornton

Comparison between U.S. GAAP and International ... - Grant Thornton

Comparison between U.S. GAAP and International ... - Grant Thornton

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

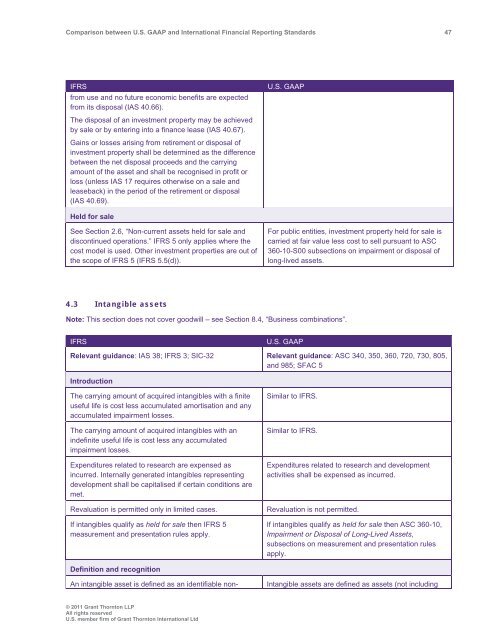

<strong>Comparison</strong> <strong>between</strong> U.S. <strong>GAAP</strong> <strong>and</strong> <strong>International</strong> Financial Reporting St<strong>and</strong>ards 47<br />

IFRS<br />

from use <strong>and</strong> no future economic benefits are expected<br />

from its disposal (IAS 40.66).<br />

The disposal of an investment property may be achieved<br />

by sale or by entering into a finance lease (IAS 40.67).<br />

Gains or losses arising from retirement or disposal of<br />

investment property shall be determined as the difference<br />

<strong>between</strong> the net disposal proceeds <strong>and</strong> the carrying<br />

amount of the asset <strong>and</strong> shall be recognised in profit or<br />

loss (unless IAS 17 requires otherwise on a sale <strong>and</strong><br />

leaseback) in the period of the retirement or disposal<br />

(IAS 40.69).<br />

U.S. <strong>GAAP</strong><br />

Held for sale<br />

See Section 2.6, “Non-current assets held for sale <strong>and</strong><br />

discontinued operations.” IFRS 5 only applies where the<br />

cost model is used. Other investment properties are out of<br />

the scope of IFRS 5 (IFRS 5.5(d)).<br />

For public entities, investment property held for sale is<br />

carried at fair value less cost to sell pursuant to ASC<br />

360-10-S00 subsections on impairment or disposal of<br />

long-lived assets.<br />

4.3 Intangible assets<br />

Note: This section does not cover goodwill – see Section 8.4, “Business combinations”.<br />

IFRS<br />

U.S. <strong>GAAP</strong><br />

Relevant guidance: IAS 38; IFRS 3; SIC-32 Relevant guidance: ASC 340, 350, 360, 720, 730, 805,<br />

<strong>and</strong> 985; SFAC 5<br />

Introduction<br />

The carrying amount of acquired intangibles with a finite<br />

useful life is cost less accumulated amortisation <strong>and</strong> any<br />

accumulated impairment losses.<br />

The carrying amount of acquired intangibles with an<br />

indefinite useful life is cost less any accumulated<br />

impairment losses.<br />

Expenditures related to research are expensed as<br />

incurred. Internally generated intangibles representing<br />

development shall be capitalised if certain conditions are<br />

met.<br />

Revaluation is permitted only in limited cases.<br />

If intangibles qualify as held for sale then IFRS 5<br />

measurement <strong>and</strong> presentation rules apply.<br />

Similar to IFRS.<br />

Similar to IFRS.<br />

Expenditures related to research <strong>and</strong> development<br />

activities shall be expensed as incurred.<br />

Revaluation is not permitted.<br />

If intangibles qualify as held for sale then ASC 360-10,<br />

Impairment or Disposal of Long-Lived Assets,<br />

subsections on measurement <strong>and</strong> presentation rules<br />

apply.<br />

Definition <strong>and</strong> recognition<br />

An intangible asset is defined as an identifiable non-<br />

Intangible assets are defined as assets (not including<br />

© 2011 <strong>Grant</strong> <strong>Thornton</strong> LLP<br />

All rights reserved<br />

U.S. member firm of <strong>Grant</strong> <strong>Thornton</strong> <strong>International</strong> Ltd