Comparison between U.S. GAAP and International ... - Grant Thornton

Comparison between U.S. GAAP and International ... - Grant Thornton

Comparison between U.S. GAAP and International ... - Grant Thornton

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

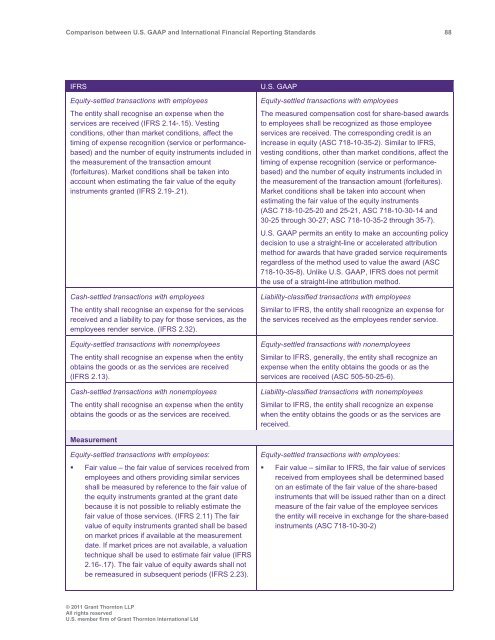

<strong>Comparison</strong> <strong>between</strong> U.S. <strong>GAAP</strong> <strong>and</strong> <strong>International</strong> Financial Reporting St<strong>and</strong>ards 88<br />

IFRS<br />

Equity-settled transactions with employees<br />

The entity shall recognise an expense when the<br />

services are received (IFRS 2.14-.15). Vesting<br />

conditions, other than market conditions, affect the<br />

timing of expense recognition (service or performancebased)<br />

<strong>and</strong> the number of equity instruments included in<br />

the measurement of the transaction amount<br />

(forfeitures). Market conditions shall be taken into<br />

account when estimating the fair value of the equity<br />

instruments granted (IFRS 2.19-.21).<br />

Cash-settled transactions with employees<br />

The entity shall recognise an expense for the services<br />

received <strong>and</strong> a liability to pay for those services, as the<br />

employees render service. (IFRS 2.32).<br />

Equity-settled transactions with nonemployees<br />

The entity shall recognise an expense when the entity<br />

obtains the goods or as the services are received<br />

(IFRS 2.13).<br />

Cash-settled transactions with nonemployees<br />

The entity shall recognise an expense when the entity<br />

obtains the goods or as the services are received.<br />

U.S. <strong>GAAP</strong><br />

Equity-settled transactions with employees<br />

The measured compensation cost for share-based awards<br />

to employees shall be recognized as those employee<br />

services are received. The corresponding credit is an<br />

increase in equity (ASC 718-10-35-2). Similar to IFRS,<br />

vesting conditions, other than market conditions, affect the<br />

timing of expense recognition (service or performancebased)<br />

<strong>and</strong> the number of equity instruments included in<br />

the measurement of the transaction amount (forfeitures).<br />

Market conditions shall be taken into account when<br />

estimating the fair value of the equity instruments<br />

(ASC 718-10-25-20 <strong>and</strong> 25-21, ASC 718-10-30-14 <strong>and</strong><br />

30-25 through 30-27; ASC 718-10-35-2 through 35-7).<br />

U.S. <strong>GAAP</strong> permits an entity to make an accounting policy<br />

decision to use a straight-line or accelerated attribution<br />

method for awards that have graded service requirements<br />

regardless of the method used to value the award (ASC<br />

718-10-35-8). Unlike U.S. <strong>GAAP</strong>, IFRS does not permit<br />

the use of a straight-line attribution method.<br />

Liability-classified transactions with employees<br />

Similar to IFRS, the entity shall recognize an expense for<br />

the services received as the employees render service.<br />

Equity-settled transactions with nonemployees<br />

Similar to IFRS, generally, the entity shall recognize an<br />

expense when the entity obtains the goods or as the<br />

services are received (ASC 505-50-25-6).<br />

Liability-classified transactions with nonemployees<br />

Similar to IFRS, the entity shall recognize an expense<br />

when the entity obtains the goods or as the services are<br />

received.<br />

Measurement<br />

Equity-settled transactions with employees:<br />

• Fair value – the fair value of services received from<br />

employees <strong>and</strong> others providing similar services<br />

shall be measured by reference to the fair value of<br />

the equity instruments granted at the grant date<br />

because it is not possible to reliably estimate the<br />

fair value of those services. (IFRS 2.11) The fair<br />

value of equity instruments granted shall be based<br />

on market prices if available at the measurement<br />

date. If market prices are not available, a valuation<br />

technique shall be used to estimate fair value (IFRS<br />

2.16-.17). The fair value of equity awards shall not<br />

be remeasured in subsequent periods (IFRS 2.23).<br />

Equity-settled transactions with employees:<br />

• Fair value – similar to IFRS, the fair value of services<br />

received from employees shall be determined based<br />

on an estimate of the fair value of the share-based<br />

instruments that will be issued rather than on a direct<br />

measure of the fair value of the employee services<br />

the entity will receive in exchange for the share-based<br />

instruments (ASC 718-10-30-2)<br />

© 2011 <strong>Grant</strong> <strong>Thornton</strong> LLP<br />

All rights reserved<br />

U.S. member firm of <strong>Grant</strong> <strong>Thornton</strong> <strong>International</strong> Ltd