Comparison between U.S. GAAP and International ... - Grant Thornton

Comparison between U.S. GAAP and International ... - Grant Thornton

Comparison between U.S. GAAP and International ... - Grant Thornton

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

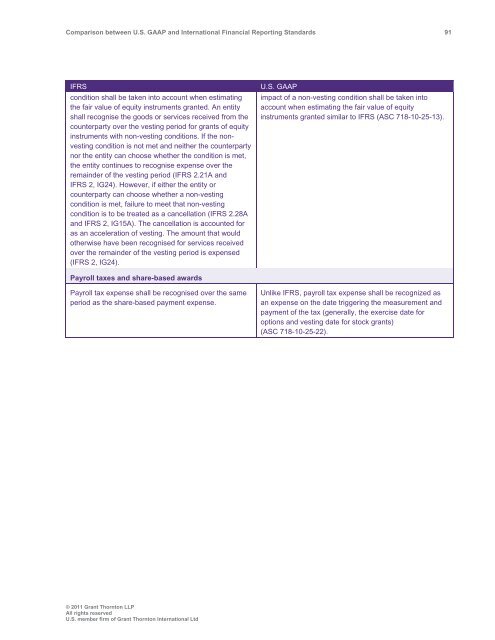

<strong>Comparison</strong> <strong>between</strong> U.S. <strong>GAAP</strong> <strong>and</strong> <strong>International</strong> Financial Reporting St<strong>and</strong>ards 91<br />

IFRS<br />

condition shall be taken into account when estimating<br />

the fair value of equity instruments granted. An entity<br />

shall recognise the goods or services received from the<br />

counterparty over the vesting period for grants of equity<br />

instruments with non-vesting conditions. If the nonvesting<br />

condition is not met <strong>and</strong> neither the counterparty<br />

nor the entity can choose whether the condition is met,<br />

the entity continues to recognise expense over the<br />

remainder of the vesting period (IFRS 2.21A <strong>and</strong><br />

IFRS 2, IG24). However, if either the entity or<br />

counterparty can choose whether a non-vesting<br />

condition is met, failure to meet that non-vesting<br />

condition is to be treated as a cancellation (IFRS 2.28A<br />

<strong>and</strong> IFRS 2, IG15A). The cancellation is accounted for<br />

as an acceleration of vesting. The amount that would<br />

otherwise have been recognised for services received<br />

over the remainder of the vesting period is expensed<br />

(IFRS 2, IG24).<br />

U.S. <strong>GAAP</strong><br />

impact of a non-vesting condition shall be taken into<br />

account when estimating the fair value of equity<br />

instruments granted similar to IFRS (ASC 718-10-25-13).<br />

Payroll taxes <strong>and</strong> share-based awards<br />

Payroll tax expense shall be recognised over the same<br />

period as the share-based payment expense.<br />

Unlike IFRS, payroll tax expense shall be recognized as<br />

an expense on the date triggering the measurement <strong>and</strong><br />

payment of the tax (generally, the exercise date for<br />

options <strong>and</strong> vesting date for stock grants)<br />

(ASC 718-10-25-22).<br />

© 2011 <strong>Grant</strong> <strong>Thornton</strong> LLP<br />

All rights reserved<br />

U.S. member firm of <strong>Grant</strong> <strong>Thornton</strong> <strong>International</strong> Ltd