Comparison between U.S. GAAP and International ... - Grant Thornton

Comparison between U.S. GAAP and International ... - Grant Thornton

Comparison between U.S. GAAP and International ... - Grant Thornton

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

<strong>Comparison</strong> <strong>between</strong> U.S. <strong>GAAP</strong> <strong>and</strong> <strong>International</strong> Financial Reporting St<strong>and</strong>ards 103<br />

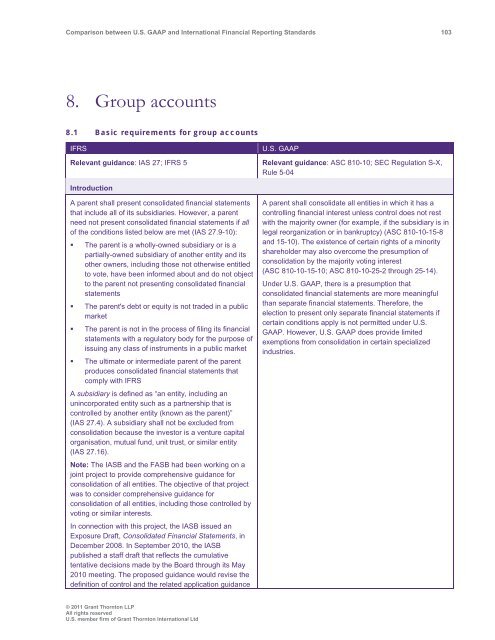

8. Group accounts<br />

8.1 Basic requirements for group accounts<br />

IFRS<br />

Relevant guidance: IAS 27; IFRS 5<br />

U.S. <strong>GAAP</strong><br />

Relevant guidance: ASC 810-10; SEC Regulation S-X,<br />

Rule 5-04<br />

Introduction<br />

A parent shall present consolidated financial statements<br />

that include all of its subsidiaries. However, a parent<br />

need not present consolidated financial statements if all<br />

of the conditions listed below are met (IAS 27.9-10):<br />

• The parent is a wholly-owned subsidiary or is a<br />

partially-owned subsidiary of another entity <strong>and</strong> its<br />

other owners, including those not otherwise entitled<br />

to vote, have been informed about <strong>and</strong> do not object<br />

to the parent not presenting consolidated financial<br />

statements<br />

• The parent's debt or equity is not traded in a public<br />

market<br />

• The parent is not in the process of filing its financial<br />

statements with a regulatory body for the purpose of<br />

issuing any class of instruments in a public market<br />

• The ultimate or intermediate parent of the parent<br />

produces consolidated financial statements that<br />

comply with IFRS<br />

A subsidiary is defined as “an entity, including an<br />

unincorporated entity such as a partnership that is<br />

controlled by another entity (known as the parent)”<br />

(IAS 27.4). A subsidiary shall not be excluded from<br />

consolidation because the investor is a venture capital<br />

organisation, mutual fund, unit trust, or similar entity<br />

(IAS 27.16).<br />

Note: The IASB <strong>and</strong> the FASB had been working on a<br />

joint project to provide comprehensive guidance for<br />

consolidation of all entities. The objective of that project<br />

was to consider comprehensive guidance for<br />

consolidation of all entities, including those controlled by<br />

voting or similar interests.<br />

In connection with this project, the IASB issued an<br />

Exposure Draft, Consolidated Financial Statements, in<br />

December 2008. In September 2010, the IASB<br />

published a staff draft that reflects the cumulative<br />

tentative decisions made by the Board through its May<br />

2010 meeting. The proposed guidance would revise the<br />

definition of control <strong>and</strong> the related application guidance<br />

A parent shall consolidate all entities in which it has a<br />

controlling financial interest unless control does not rest<br />

with the majority owner (for example, if the subsidiary is in<br />

legal reorganization or in bankruptcy) (ASC 810-10-15-8<br />

<strong>and</strong> 15-10). The existence of certain rights of a minority<br />

shareholder may also overcome the presumption of<br />

consolidation by the majority voting interest<br />

(ASC 810-10-15-10; ASC 810-10-25-2 through 25-14).<br />

Under U.S. <strong>GAAP</strong>, there is a presumption that<br />

consolidated financial statements are more meaningful<br />

than separate financial statements. Therefore, the<br />

election to present only separate financial statements if<br />

certain conditions apply is not permitted under U.S.<br />

<strong>GAAP</strong>. However, U.S. <strong>GAAP</strong> does provide limited<br />

exemptions from consolidation in certain specialized<br />

industries.<br />

© 2011 <strong>Grant</strong> <strong>Thornton</strong> LLP<br />

All rights reserved<br />

U.S. member firm of <strong>Grant</strong> <strong>Thornton</strong> <strong>International</strong> Ltd