Comparison between U.S. GAAP and International ... - Grant Thornton

Comparison between U.S. GAAP and International ... - Grant Thornton

Comparison between U.S. GAAP and International ... - Grant Thornton

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

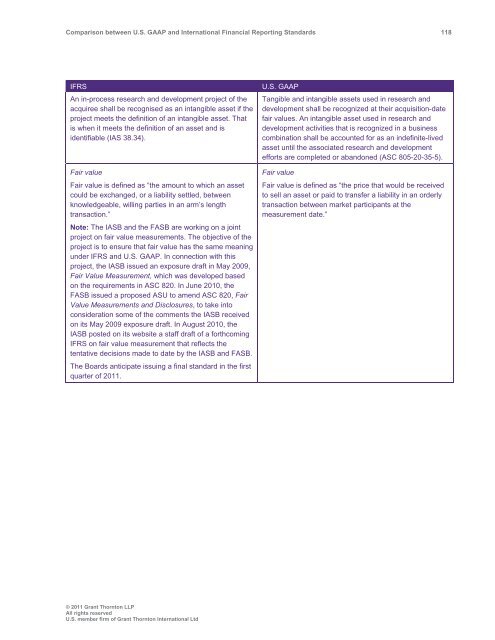

<strong>Comparison</strong> <strong>between</strong> U.S. <strong>GAAP</strong> <strong>and</strong> <strong>International</strong> Financial Reporting St<strong>and</strong>ards 118<br />

IFRS<br />

An in-process research <strong>and</strong> development project of the<br />

acquiree shall be recognised as an intangible asset if the<br />

project meets the definition of an intangible asset. That<br />

is when it meets the definition of an asset <strong>and</strong> is<br />

identifiable (IAS 38.34).<br />

Fair value<br />

Fair value is defined as “the amount to which an asset<br />

could be exchanged, or a liability settled, <strong>between</strong><br />

knowledgeable, willing parties in an arm’s length<br />

transaction.”<br />

Note: The IASB <strong>and</strong> the FASB are working on a joint<br />

project on fair value measurements. The objective of the<br />

project is to ensure that fair value has the same meaning<br />

under IFRS <strong>and</strong> U.S. <strong>GAAP</strong>. In connection with this<br />

project, the IASB issued an exposure draft in May 2009,<br />

Fair Value Measurement, which was developed based<br />

on the requirements in ASC 820. In June 2010, the<br />

FASB issued a proposed ASU to amend ASC 820, Fair<br />

Value Measurements <strong>and</strong> Disclosures, to take into<br />

consideration some of the comments the IASB received<br />

on its May 2009 exposure draft. In August 2010, the<br />

IASB posted on its website a staff draft of a forthcoming<br />

IFRS on fair value measurement that reflects the<br />

tentative decisions made to date by the IASB <strong>and</strong> FASB.<br />

The Boards anticipate issuing a final st<strong>and</strong>ard in the first<br />

quarter of 2011.<br />

U.S. <strong>GAAP</strong><br />

Tangible <strong>and</strong> intangible assets used in research <strong>and</strong><br />

development shall be recognized at their acquisition-date<br />

fair values. An intangible asset used in research <strong>and</strong><br />

development activities that is recognized in a business<br />

combination shall be accounted for as an indefinite-lived<br />

asset until the associated research <strong>and</strong> development<br />

efforts are completed or ab<strong>and</strong>oned (ASC 805-20-35-5).<br />

Fair value<br />

Fair value is defined as “the price that would be received<br />

to sell an asset or paid to transfer a liability in an orderly<br />

transaction <strong>between</strong> market participants at the<br />

measurement date.”<br />

© 2011 <strong>Grant</strong> <strong>Thornton</strong> LLP<br />

All rights reserved<br />

U.S. member firm of <strong>Grant</strong> <strong>Thornton</strong> <strong>International</strong> Ltd