- Page 1 and 2: Comparison between U.S. GAAP and In

- Page 3 and 4: Comparison between U.S. GAAP and In

- Page 5 and 6: Comparison between U.S. GAAP and In

- Page 7 and 8: Comparison between U.S. GAAP and In

- Page 9 and 10: Comparison between U.S. GAAP and In

- Page 11 and 12: Comparison between U.S. GAAP and In

- Page 13 and 14: Comparison between U.S. GAAP and In

- Page 15 and 16: Comparison between U.S. GAAP and In

- Page 17 and 18: Comparison between U.S. GAAP and In

- Page 19 and 20: Comparison between U.S. GAAP and In

- Page 21 and 22: Comparison between U.S. GAAP and In

- Page 23 and 24: Comparison between U.S. GAAP and In

- Page 25 and 26: Comparison between U.S. GAAP and In

- Page 27 and 28: Comparison between U.S. GAAP and In

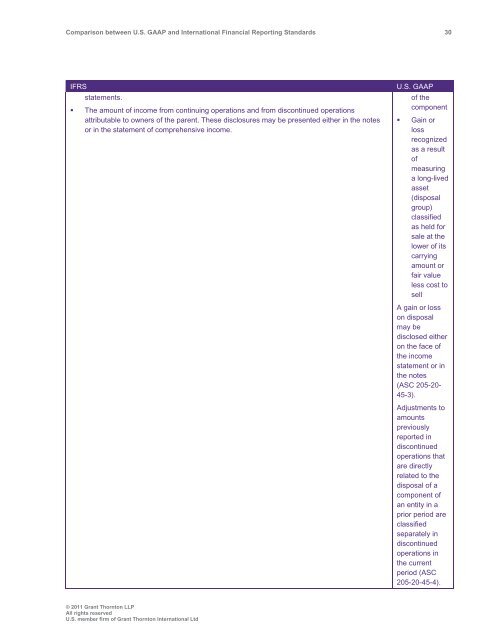

- Page 29: Comparison between U.S. GAAP and In

- Page 33 and 34: Comparison between U.S. GAAP and In

- Page 35 and 36: Comparison between U.S. GAAP and In

- Page 37 and 38: Comparison between U.S. GAAP and In

- Page 39 and 40: Comparison between U.S. GAAP and In

- Page 41 and 42: Comparison between U.S. GAAP and In

- Page 43 and 44: Comparison between U.S. GAAP and In

- Page 45 and 46: Comparison between U.S. GAAP and In

- Page 47 and 48: Comparison between U.S. GAAP and In

- Page 49 and 50: Comparison between U.S. GAAP and In

- Page 51 and 52: Comparison between U.S. GAAP and In

- Page 53 and 54: Comparison between U.S. GAAP and In

- Page 55 and 56: Comparison between U.S. GAAP and In

- Page 57 and 58: Comparison between U.S. GAAP and In

- Page 59 and 60: Comparison between U.S. GAAP and In

- Page 61 and 62: Comparison between U.S. GAAP and In

- Page 63 and 64: Comparison between U.S. GAAP and In

- Page 65 and 66: Comparison between U.S. GAAP and In

- Page 67 and 68: Comparison between U.S. GAAP and In

- Page 69 and 70: Comparison between U.S. GAAP and In

- Page 71 and 72: Comparison between U.S. GAAP and In

- Page 73 and 74: Comparison between U.S. GAAP and In

- Page 75 and 76: Comparison between U.S. GAAP and In

- Page 77 and 78: Comparison between U.S. GAAP and In

- Page 79 and 80: Comparison between U.S. GAAP and In

- Page 81 and 82:

Comparison between U.S. GAAP and In

- Page 83 and 84:

Comparison between U.S. GAAP and In

- Page 85 and 86:

Comparison between U.S. GAAP and In

- Page 87 and 88:

Comparison between U.S. GAAP and In

- Page 89 and 90:

Comparison between U.S. GAAP and In

- Page 91 and 92:

Comparison between U.S. GAAP and In

- Page 93 and 94:

Comparison between U.S. GAAP and In

- Page 95 and 96:

Comparison between U.S. GAAP and In

- Page 97 and 98:

Comparison between U.S. GAAP and In

- Page 99 and 100:

Comparison between U.S. GAAP and In

- Page 101 and 102:

Comparison between U.S. GAAP and In

- Page 103 and 104:

Comparison between U.S. GAAP and In

- Page 105 and 106:

Comparison between U.S. GAAP and In

- Page 107 and 108:

Comparison between U.S. GAAP and In

- Page 109 and 110:

Comparison between U.S. GAAP and In

- Page 111 and 112:

Comparison between U.S. GAAP and In

- Page 113 and 114:

Comparison between U.S. GAAP and In

- Page 115 and 116:

Comparison between U.S. GAAP and In

- Page 117 and 118:

Comparison between U.S. GAAP and In

- Page 119 and 120:

Comparison between U.S. GAAP and In

- Page 121 and 122:

Comparison between U.S. GAAP and In

- Page 123 and 124:

Comparison between U.S. GAAP and In

- Page 125 and 126:

Comparison between U.S. GAAP and In

- Page 127 and 128:

Comparison between U.S. GAAP and In

- Page 129 and 130:

Comparison between U.S. GAAP and In

- Page 131 and 132:

Comparison between U.S. GAAP and In

- Page 133 and 134:

Comparison between U.S. GAAP and In

- Page 135 and 136:

Comparison between U.S. GAAP and In

- Page 137 and 138:

Comparison between U.S. GAAP and In

- Page 139 and 140:

Comparison between U.S. GAAP and In

- Page 141 and 142:

Comparison between U.S. GAAP and In

- Page 143 and 144:

Comparison between U.S. GAAP and In

- Page 145 and 146:

Comparison between U.S. GAAP and In

- Page 147 and 148:

Comparison between U.S. GAAP and In

- Page 149 and 150:

Comparison between U.S. GAAP and In

- Page 151 and 152:

Comparison between U.S. GAAP and In

- Page 153 and 154:

Comparison between U.S. GAAP and In

- Page 155 and 156:

Comparison between U.S. GAAP and In

- Page 157 and 158:

Comparison between U.S. GAAP and In

- Page 159 and 160:

Comparison between U.S. GAAP and In

- Page 161 and 162:

Comparison between U.S. GAAP and In

- Page 163 and 164:

Comparison between U.S. GAAP and In

- Page 165 and 166:

Comparison between U.S. GAAP and In

- Page 167 and 168:

Comparison between U.S. GAAP and In

- Page 169 and 170:

Comparison between U.S. GAAP and In