Comparison between U.S. GAAP and International ... - Grant Thornton

Comparison between U.S. GAAP and International ... - Grant Thornton

Comparison between U.S. GAAP and International ... - Grant Thornton

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

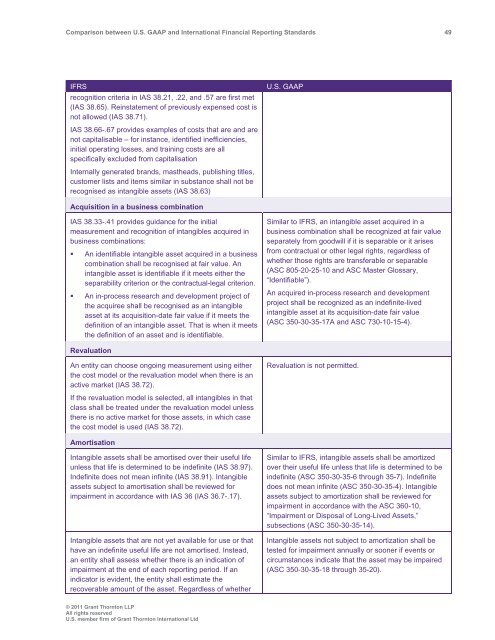

<strong>Comparison</strong> <strong>between</strong> U.S. <strong>GAAP</strong> <strong>and</strong> <strong>International</strong> Financial Reporting St<strong>and</strong>ards 49<br />

IFRS<br />

recognition criteria in IAS 38.21, .22, <strong>and</strong> .57 are first met<br />

(IAS 38.65). Reinstatement of previously expensed cost is<br />

not allowed (IAS 38.71).<br />

IAS 38.66-.67 provides examples of costs that are <strong>and</strong> are<br />

not capitalisable – for instance, identified inefficiencies,<br />

initial operating losses, <strong>and</strong> training costs are all<br />

specifically excluded from capitalisation<br />

Internally generated br<strong>and</strong>s, mastheads, publishing titles,<br />

customer lists <strong>and</strong> items similar in substance shall not be<br />

recognised as intangible assets (IAS 38.63)<br />

U.S. <strong>GAAP</strong><br />

Acquisition in a business combination<br />

IAS 38.33-.41 provides guidance for the initial<br />

measurement <strong>and</strong> recognition of intangibles acquired in<br />

business combinations:<br />

• An identifiable intangible asset acquired in a business<br />

combination shall be recognised at fair value. An<br />

intangible asset is identifiable if it meets either the<br />

separability criterion or the contractual-legal criterion.<br />

• An in-process research <strong>and</strong> development project of<br />

the acquiree shall be recognised as an intangible<br />

asset at its acquisition-date fair value if it meets the<br />

definition of an intangible asset. That is when it meets<br />

the definition of an asset <strong>and</strong> is identifiable.<br />

Similar to IFRS, an intangible asset acquired in a<br />

business combination shall be recognized at fair value<br />

separately from goodwill if it is separable or it arises<br />

from contractual or other legal rights, regardless of<br />

whether those rights are transferable or separable<br />

(ASC 805-20-25-10 <strong>and</strong> ASC Master Glossary,<br />

“Identifiable”).<br />

An acquired in-process research <strong>and</strong> development<br />

project shall be recognized as an indefinite-lived<br />

intangible asset at its acquisition-date fair value<br />

(ASC 350-30-35-17A <strong>and</strong> ASC 730-10-15-4).<br />

Revaluation<br />

An entity can choose ongoing measurement using either<br />

the cost model or the revaluation model when there is an<br />

active market (IAS 38.72).<br />

Revaluation is not permitted.<br />

If the revaluation model is selected, all intangibles in that<br />

class shall be treated under the revaluation model unless<br />

there is no active market for those assets, in which case<br />

the cost model is used (IAS 38.72).<br />

Amortisation<br />

Intangible assets shall be amortised over their useful life<br />

unless that life is determined to be indefinite (IAS 38.97).<br />

Indefinite does not mean infinite (IAS 38.91). Intangible<br />

assets subject to amortisation shall be reviewed for<br />

impairment in accordance with IAS 36 (IAS 36.7-.17).<br />

Intangible assets that are not yet available for use or that<br />

have an indefinite useful life are not amortised. Instead,<br />

an entity shall assess whether there is an indication of<br />

impairment at the end of each reporting period. If an<br />

indicator is evident, the entity shall estimate the<br />

recoverable amount of the asset. Regardless of whether<br />

Similar to IFRS, intangible assets shall be amortized<br />

over their useful life unless that life is determined to be<br />

indefinite (ASC 350-30-35-6 through 35-7). Indefinite<br />

does not mean infinite (ASC 350-30-35-4). Intangible<br />

assets subject to amortization shall be reviewed for<br />

impairment in accordance with the ASC 360-10,<br />

“Impairment or Disposal of Long-Lived Assets,”<br />

subsections (ASC 350-30-35-14).<br />

Intangible assets not subject to amortization shall be<br />

tested for impairment annually or sooner if events or<br />

circumstances indicate that the asset may be impaired<br />

(ASC 350-30-35-18 through 35-20).<br />

© 2011 <strong>Grant</strong> <strong>Thornton</strong> LLP<br />

All rights reserved<br />

U.S. member firm of <strong>Grant</strong> <strong>Thornton</strong> <strong>International</strong> Ltd