Comparison between U.S. GAAP and International ... - Grant Thornton

Comparison between U.S. GAAP and International ... - Grant Thornton

Comparison between U.S. GAAP and International ... - Grant Thornton

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

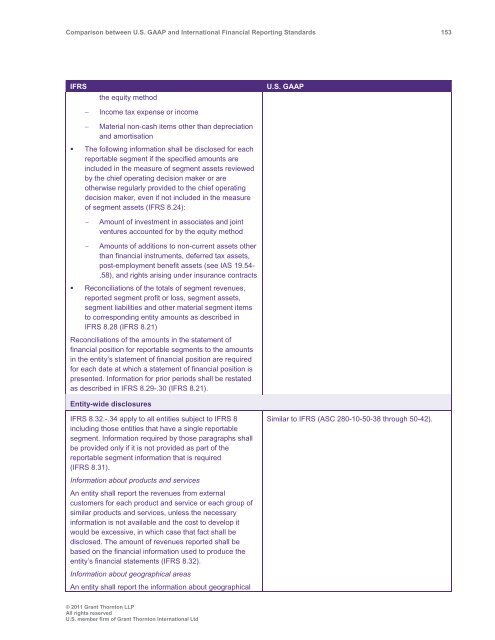

<strong>Comparison</strong> <strong>between</strong> U.S. <strong>GAAP</strong> <strong>and</strong> <strong>International</strong> Financial Reporting St<strong>and</strong>ards 153<br />

IFRS<br />

<br />

the equity method<br />

Income tax expense or income<br />

U.S. <strong>GAAP</strong><br />

Material non-cash items other than depreciation<br />

<strong>and</strong> amortisation<br />

• The following information shall be disclosed for each<br />

reportable segment if the specified amounts are<br />

included in the measure of segment assets reviewed<br />

by the chief operating decision maker or are<br />

otherwise regularly provided to the chief operating<br />

decision maker, even if not included in the measure<br />

of segment assets (IFRS 8.24):<br />

<br />

Amount of investment in associates <strong>and</strong> joint<br />

ventures accounted for by the equity method<br />

Amounts of additions to non-current assets other<br />

than financial instruments, deferred tax assets,<br />

post-employment benefit assets (see IAS 19.54-<br />

.58), <strong>and</strong> rights arising under insurance contracts<br />

• Reconciliations of the totals of segment revenues,<br />

reported segment profit or loss, segment assets,<br />

segment liabilities <strong>and</strong> other material segment items<br />

to corresponding entity amounts as described in<br />

IFRS 8.28 (IFRS 8.21)<br />

Reconciliations of the amounts in the statement of<br />

financial position for reportable segments to the amounts<br />

in the entity’s statement of financial position are required<br />

for each date at which a statement of financial position is<br />

presented. Information for prior periods shall be restated<br />

as described in IFRS 8.29-.30 (IFRS 8.21).<br />

Entity-wide disclosures<br />

IFRS 8.32.-.34 apply to all entities subject to IFRS 8<br />

including those entities that have a single reportable<br />

segment. Information required by those paragraphs shall<br />

be provided only if it is not provided as part of the<br />

reportable segment information that is required<br />

(IFRS 8.31).<br />

Information about products <strong>and</strong> services<br />

An entity shall report the revenues from external<br />

customers for each product <strong>and</strong> service or each group of<br />

similar products <strong>and</strong> services, unless the necessary<br />

information is not available <strong>and</strong> the cost to develop it<br />

would be excessive, in which case that fact shall be<br />

disclosed. The amount of revenues reported shall be<br />

based on the financial information used to produce the<br />

entity’s financial statements (IFRS 8.32).<br />

Information about geographical areas<br />

An entity shall report the information about geographical<br />

Similar to IFRS (ASC 280-10-50-38 through 50-42).<br />

© 2011 <strong>Grant</strong> <strong>Thornton</strong> LLP<br />

All rights reserved<br />

U.S. member firm of <strong>Grant</strong> <strong>Thornton</strong> <strong>International</strong> Ltd