Comparison between U.S. GAAP and International ... - Grant Thornton

Comparison between U.S. GAAP and International ... - Grant Thornton

Comparison between U.S. GAAP and International ... - Grant Thornton

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

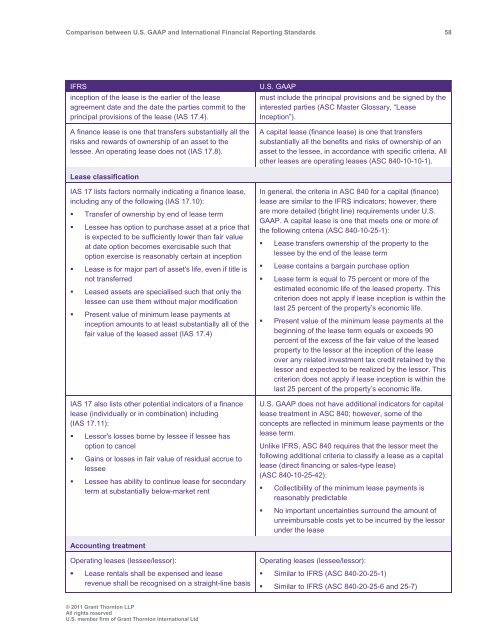

<strong>Comparison</strong> <strong>between</strong> U.S. <strong>GAAP</strong> <strong>and</strong> <strong>International</strong> Financial Reporting St<strong>and</strong>ards 58<br />

IFRS<br />

inception of the lease is the earlier of the lease<br />

agreement date <strong>and</strong> the date the parties commit to the<br />

principal provisions of the lease (IAS 17.4).<br />

A finance lease is one that transfers substantially all the<br />

risks <strong>and</strong> rewards of ownership of an asset to the<br />

lessee. An operating lease does not (IAS 17.8).<br />

U.S. <strong>GAAP</strong><br />

must include the principal provisions <strong>and</strong> be signed by the<br />

interested parties (ASC Master Glossary, “Lease<br />

Inception”).<br />

A capital lease (finance lease) is one that transfers<br />

substantially all the benefits <strong>and</strong> risks of ownership of an<br />

asset to the lessee, in accordance with specific criteria. All<br />

other leases are operating leases (ASC 840-10-10-1).<br />

Lease classification<br />

IAS 17 lists factors normally indicating a finance lease,<br />

including any of the following (IAS 17.10):<br />

• Transfer of ownership by end of lease term<br />

• Lessee has option to purchase asset at a price that<br />

is expected to be sufficiently lower than fair value<br />

at date option becomes exercisable such that<br />

option exercise is reasonably certain at inception<br />

• Lease is for major part of asset's life, even if title is<br />

not transferred<br />

• Leased assets are specialised such that only the<br />

lessee can use them without major modification<br />

• Present value of minimum lease payments at<br />

inception amounts to at least substantially all of the<br />

fair value of the leased asset (IAS 17.4)<br />

IAS 17 also lists other potential indicators of a finance<br />

lease (individually or in combination) including<br />

(IAS 17.11):<br />

• Lessor's losses borne by lessee if lessee has<br />

option to cancel<br />

• Gains or losses in fair value of residual accrue to<br />

lessee<br />

• Lessee has ability to continue lease for secondary<br />

term at substantially below-market rent<br />

In general, the criteria in ASC 840 for a capital (finance)<br />

lease are similar to the IFRS indicators; however, there<br />

are more detailed (bright line) requirements under U.S.<br />

<strong>GAAP</strong>. A capital lease is one that meets one or more of<br />

the following criteria (ASC 840-10-25-1):<br />

• Lease transfers ownership of the property to the<br />

lessee by the end of the lease term<br />

• Lease contains a bargain purchase option<br />

• Lease term is equal to 75 percent or more of the<br />

estimated economic life of the leased property. This<br />

criterion does not apply if lease inception is within the<br />

last 25 percent of the property’s economic life.<br />

• Present value of the minimum lease payments at the<br />

beginning of the lease term equals or exceeds 90<br />

percent of the excess of the fair value of the leased<br />

property to the lessor at the inception of the lease<br />

over any related investment tax credit retained by the<br />

lessor <strong>and</strong> expected to be realized by the lessor. This<br />

criterion does not apply if lease inception is within the<br />

last 25 percent of the property’s economic life.<br />

U.S. <strong>GAAP</strong> does not have additional indicators for capital<br />

lease treatment in ASC 840; however, some of the<br />

concepts are reflected in minimum lease payments or the<br />

lease term.<br />

Unlike IFRS, ASC 840 requires that the lessor meet the<br />

following additional criteria to classify a lease as a capital<br />

lease (direct financing or sales-type lease)<br />

(ASC 840-10-25-42):<br />

• Collectibility of the minimum lease payments is<br />

reasonably predictable<br />

• No important uncertainties surround the amount of<br />

unreimbursable costs yet to be incurred by the lessor<br />

under the lease<br />

Accounting treatment<br />

Operating leases (lessee/lessor):<br />

• Lease rentals shall be expensed <strong>and</strong> lease<br />

revenue shall be recognised on a straight-line basis<br />

Operating leases (lessee/lessor):<br />

• Similar to IFRS (ASC 840-20-25-1)<br />

• Similar to IFRS (ASC 840-20-25-6 <strong>and</strong> 25-7)<br />

© 2011 <strong>Grant</strong> <strong>Thornton</strong> LLP<br />

All rights reserved<br />

U.S. member firm of <strong>Grant</strong> <strong>Thornton</strong> <strong>International</strong> Ltd