Comparison between U.S. GAAP and International ... - Grant Thornton

Comparison between U.S. GAAP and International ... - Grant Thornton

Comparison between U.S. GAAP and International ... - Grant Thornton

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

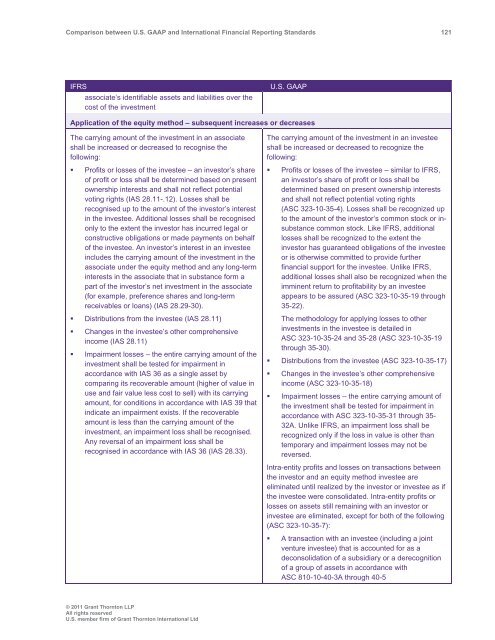

<strong>Comparison</strong> <strong>between</strong> U.S. <strong>GAAP</strong> <strong>and</strong> <strong>International</strong> Financial Reporting St<strong>and</strong>ards 121<br />

IFRS<br />

associate’s identifiable assets <strong>and</strong> liabilities over the<br />

cost of the investment<br />

U.S. <strong>GAAP</strong><br />

Application of the equity method – subsequent increases or decreases<br />

The carrying amount of the investment in an associate<br />

shall be increased or decreased to recognise the<br />

following:<br />

• Profits or losses of the investee – an investor’s share<br />

of profit or loss shall be determined based on present<br />

ownership interests <strong>and</strong> shall not reflect potential<br />

voting rights (IAS 28.11-.12). Losses shall be<br />

recognised up to the amount of the investor’s interest<br />

in the investee. Additional losses shall be recognised<br />

only to the extent the investor has incurred legal or<br />

constructive obligations or made payments on behalf<br />

of the investee. An investor’s interest in an investee<br />

includes the carrying amount of the investment in the<br />

associate under the equity method <strong>and</strong> any long-term<br />

interests in the associate that in substance form a<br />

part of the investor’s net investment in the associate<br />

(for example, preference shares <strong>and</strong> long-term<br />

receivables or loans) (IAS 28.29-30).<br />

• Distributions from the investee (IAS 28.11)<br />

• Changes in the investee’s other comprehensive<br />

income (IAS 28.11)<br />

• Impairment losses – the entire carrying amount of the<br />

investment shall be tested for impairment in<br />

accordance with IAS 36 as a single asset by<br />

comparing its recoverable amount (higher of value in<br />

use <strong>and</strong> fair value less cost to sell) with its carrying<br />

amount, for conditions in accordance with IAS 39 that<br />

indicate an impairment exists. If the recoverable<br />

amount is less than the carrying amount of the<br />

investment, an impairment loss shall be recognised.<br />

Any reversal of an impairment loss shall be<br />

recognised in accordance with IAS 36 (IAS 28.33).<br />

The carrying amount of the investment in an investee<br />

shall be increased or decreased to recognize the<br />

following:<br />

• Profits or losses of the investee – similar to IFRS,<br />

an investor’s share of profit or loss shall be<br />

determined based on present ownership interests<br />

<strong>and</strong> shall not reflect potential voting rights<br />

(ASC 323-10-35-4). Losses shall be recognized up<br />

to the amount of the investor’s common stock or insubstance<br />

common stock. Like IFRS, additional<br />

losses shall be recognized to the extent the<br />

investor has guaranteed obligations of the investee<br />

or is otherwise committed to provide further<br />

financial support for the investee. Unlike IFRS,<br />

additional losses shall also be recognized when the<br />

imminent return to profitability by an investee<br />

appears to be assured (ASC 323-10-35-19 through<br />

35-22).<br />

The methodology for applying losses to other<br />

investments in the investee is detailed in<br />

ASC 323-10-35-24 <strong>and</strong> 35-28 (ASC 323-10-35-19<br />

through 35-30).<br />

• Distributions from the investee (ASC 323-10-35-17)<br />

• Changes in the investee’s other comprehensive<br />

income (ASC 323-10-35-18)<br />

• Impairment losses – the entire carrying amount of<br />

the investment shall be tested for impairment in<br />

accordance with ASC 323-10-35-31 through 35-<br />

32A. Unlike IFRS, an impairment loss shall be<br />

recognized only if the loss in value is other than<br />

temporary <strong>and</strong> impairment losses may not be<br />

reversed.<br />

Intra-entity profits <strong>and</strong> losses on transactions <strong>between</strong><br />

the investor <strong>and</strong> an equity method investee are<br />

eliminated until realized by the investor or investee as if<br />

the investee were consolidated. Intra-entity profits or<br />

losses on assets still remaining with an investor or<br />

investee are eliminated, except for both of the following<br />

(ASC 323-10-35-7):<br />

• A transaction with an investee (including a joint<br />

venture investee) that is accounted for as a<br />

deconsolidation of a subsidiary or a derecognition<br />

of a group of assets in accordance with<br />

ASC 810-10-40-3A through 40-5<br />

© 2011 <strong>Grant</strong> <strong>Thornton</strong> LLP<br />

All rights reserved<br />

U.S. member firm of <strong>Grant</strong> <strong>Thornton</strong> <strong>International</strong> Ltd