Comparison between U.S. GAAP and International ... - Grant Thornton

Comparison between U.S. GAAP and International ... - Grant Thornton

Comparison between U.S. GAAP and International ... - Grant Thornton

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

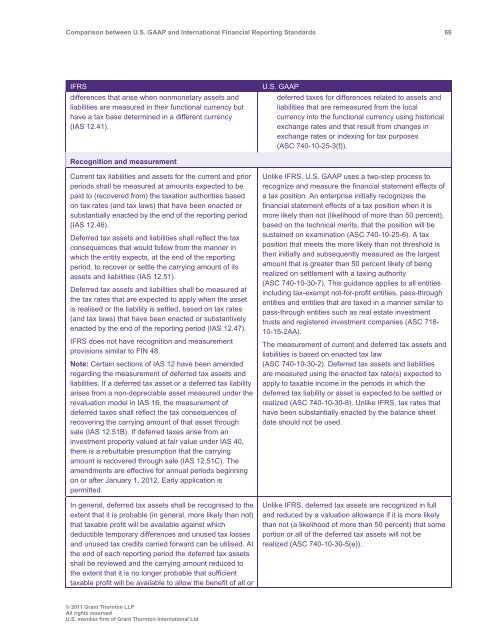

<strong>Comparison</strong> <strong>between</strong> U.S. <strong>GAAP</strong> <strong>and</strong> <strong>International</strong> Financial Reporting St<strong>and</strong>ards 66<br />

IFRS<br />

differences that arise when nonmonetary assets <strong>and</strong><br />

liabilities are measured in their functional currency but<br />

have a tax base determined in a different currency<br />

(IAS 12.41).<br />

U.S. <strong>GAAP</strong><br />

deferred taxes for differences related to assets <strong>and</strong><br />

liabilities that are remeasured from the local<br />

currency into the functional currency using historical<br />

exchange rates <strong>and</strong> that result from changes in<br />

exchange rates or indexing for tax purposes<br />

(ASC 740-10-25-3(f)).<br />

Recognition <strong>and</strong> measurement<br />

Current tax liabilities <strong>and</strong> assets for the current <strong>and</strong> prior<br />

periods shall be measured at amounts expected to be<br />

paid to (recovered from) the taxation authorities based<br />

on tax rates (<strong>and</strong> tax laws) that have been enacted or<br />

substantially enacted by the end of the reporting period<br />

(IAS 12.46).<br />

Deferred tax assets <strong>and</strong> liabilities shall reflect the tax<br />

consequences that would follow from the manner in<br />

which the entity expects, at the end of the reporting<br />

period, to recover or settle the carrying amount of its<br />

assets <strong>and</strong> liabilities (IAS 12.51).<br />

Deferred tax assets <strong>and</strong> liabilities shall be measured at<br />

the tax rates that are expected to apply when the asset<br />

is realised or the liability is settled, based on tax rates<br />

(<strong>and</strong> tax laws) that have been enacted or substantively<br />

enacted by the end of the reporting period (IAS 12.47).<br />

IFRS does not have recognition <strong>and</strong> measurement<br />

provisions similar to FIN 48.<br />

Note: Certain sections of IAS 12 have been amended<br />

regarding the measurement of deferred tax assets <strong>and</strong><br />

liabilities. If a deferred tax asset or a deferred tax liability<br />

arises from a non-depreciable asset measured under the<br />

revaluation model in IAS 16, the measurement of<br />

deferred taxes shall reflect the tax consequences of<br />

recovering the carrying amount of that asset through<br />

sale (IAS 12.51B). If deferred taxes arise from an<br />

investment property valued at fair value under IAS 40,<br />

there is a rebuttable presumption that the carrying<br />

amount is recovered through sale (IAS 12.51C). The<br />

amendments are effective for annual periods beginning<br />

on or after January 1, 2012. Early application is<br />

permitted.<br />

In general, deferred tax assets shall be recognised to the<br />

extent that it is probable (in general, more likely than not)<br />

that taxable profit will be available against which<br />

deductible temporary differences <strong>and</strong> unused tax losses<br />

<strong>and</strong> unused tax credits carried forward can be utilised. At<br />

the end of each reporting period the deferred tax assets<br />

shall be reviewed <strong>and</strong> the carrying amount reduced to<br />

the extent that it is no longer probable that sufficient<br />

taxable profit will be available to allow the benefit of all or<br />

Unlike IFRS, U.S. <strong>GAAP</strong> uses a two-step process to<br />

recognize <strong>and</strong> measure the financial statement effects of<br />

a tax position. An enterprise initially recognizes the<br />

financial statement effects of a tax position when it is<br />

more likely than not (likelihood of more than 50 percent),<br />

based on the technical merits, that the position will be<br />

sustained on examination (ASC 740-10-25-6). A tax<br />

position that meets the more likely than not threshold is<br />

then initially <strong>and</strong> subsequently measured as the largest<br />

amount that is greater than 50 percent likely of being<br />

realized on settlement with a taxing authority<br />

(ASC 740-10-30-7). This guidance applies to all entities<br />

including tax-exempt not-for-profit entities, pass-through<br />

entities <strong>and</strong> entities that are taxed in a manner similar to<br />

pass-through entities such as real estate investment<br />

trusts <strong>and</strong> registered investment companies (ASC 718-<br />

10-15-2AA).<br />

The measurement of current <strong>and</strong> deferred tax assets <strong>and</strong><br />

liabilities is based on enacted tax law<br />

(ASC 740-10-30-2). Deferred tax assets <strong>and</strong> liabilities<br />

are measured using the enacted tax rate(s) expected to<br />

apply to taxable income in the periods in which the<br />

deferred tax liability or asset is expected to be settled or<br />

realized (ASC 740-10-30-8). Unlike IFRS, tax rates that<br />

have been substantially enacted by the balance sheet<br />

date should not be used.<br />

Unlike IFRS, deferred tax assets are recognized in full<br />

<strong>and</strong> reduced by a valuation allowance if it is more likely<br />

than not (a likelihood of more than 50 percent) that some<br />

portion or all of the deferred tax assets will not be<br />

realized (ASC 740-10-30-5(e)).<br />

© 2011 <strong>Grant</strong> <strong>Thornton</strong> LLP<br />

All rights reserved<br />

U.S. member firm of <strong>Grant</strong> <strong>Thornton</strong> <strong>International</strong> Ltd