Comparison between U.S. GAAP and International ... - Grant Thornton

Comparison between U.S. GAAP and International ... - Grant Thornton

Comparison between U.S. GAAP and International ... - Grant Thornton

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

<strong>Comparison</strong> <strong>between</strong> U.S. <strong>GAAP</strong> <strong>and</strong> <strong>International</strong> Financial Reporting St<strong>and</strong>ards 38<br />

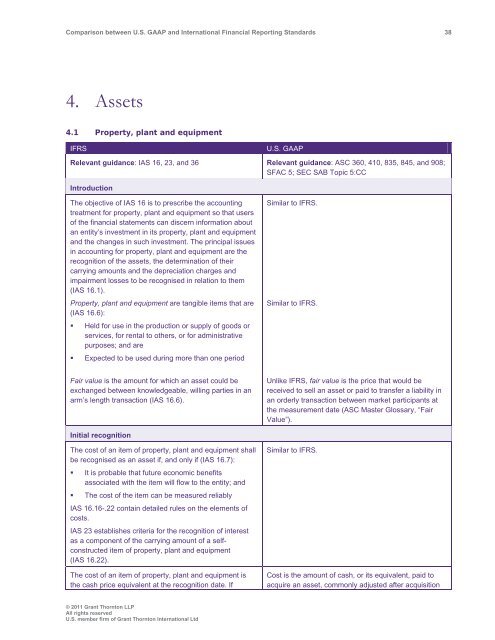

4. Assets<br />

4.1 Property, plant <strong>and</strong> equipment<br />

IFRS<br />

U.S. <strong>GAAP</strong><br />

Relevant guidance: IAS 16, 23, <strong>and</strong> 36 Relevant guidance: ASC 360, 410, 835, 845, <strong>and</strong> 908;<br />

SFAC 5; SEC SAB Topic 5:CC<br />

Introduction<br />

The objective of IAS 16 is to prescribe the accounting<br />

treatment for property, plant <strong>and</strong> equipment so that users<br />

of the financial statements can discern information about<br />

an entity’s investment in its property, plant <strong>and</strong> equipment<br />

<strong>and</strong> the changes in such investment. The principal issues<br />

in accounting for property, plant <strong>and</strong> equipment are the<br />

recognition of the assets, the determination of their<br />

carrying amounts <strong>and</strong> the depreciation charges <strong>and</strong><br />

impairment losses to be recognised in relation to them<br />

(IAS 16.1).<br />

Property, plant <strong>and</strong> equipment are tangible items that are<br />

(IAS 16.6):<br />

• Held for use in the production or supply of goods or<br />

services, for rental to others, or for administrative<br />

purposes; <strong>and</strong> are<br />

• Expected to be used during more than one period<br />

Similar to IFRS.<br />

Similar to IFRS.<br />

Fair value is the amount for which an asset could be<br />

exchanged <strong>between</strong> knowledgeable, willing parties in an<br />

arm’s length transaction (IAS 16.6).<br />

Unlike IFRS, fair value is the price that would be<br />

received to sell an asset or paid to transfer a liability in<br />

an orderly transaction <strong>between</strong> market participants at<br />

the measurement date (ASC Master Glossary, “Fair<br />

Value”).<br />

Initial recognition<br />

The cost of an item of property, plant <strong>and</strong> equipment shall<br />

be recognised as an asset if, <strong>and</strong> only if (IAS 16.7):<br />

• It is probable that future economic benefits<br />

associated with the item will flow to the entity; <strong>and</strong><br />

• The cost of the item can be measured reliably<br />

IAS 16.16-.22 contain detailed rules on the elements of<br />

costs.<br />

IAS 23 establishes criteria for the recognition of interest<br />

as a component of the carrying amount of a selfconstructed<br />

item of property, plant <strong>and</strong> equipment<br />

(IAS 16.22).<br />

The cost of an item of property, plant <strong>and</strong> equipment is<br />

the cash price equivalent at the recognition date. If<br />

Similar to IFRS.<br />

Cost is the amount of cash, or its equivalent, paid to<br />

acquire an asset, commonly adjusted after acquisition<br />

© 2011 <strong>Grant</strong> <strong>Thornton</strong> LLP<br />

All rights reserved<br />

U.S. member firm of <strong>Grant</strong> <strong>Thornton</strong> <strong>International</strong> Ltd