Comparison between U.S. GAAP and International ... - Grant Thornton

Comparison between U.S. GAAP and International ... - Grant Thornton

Comparison between U.S. GAAP and International ... - Grant Thornton

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

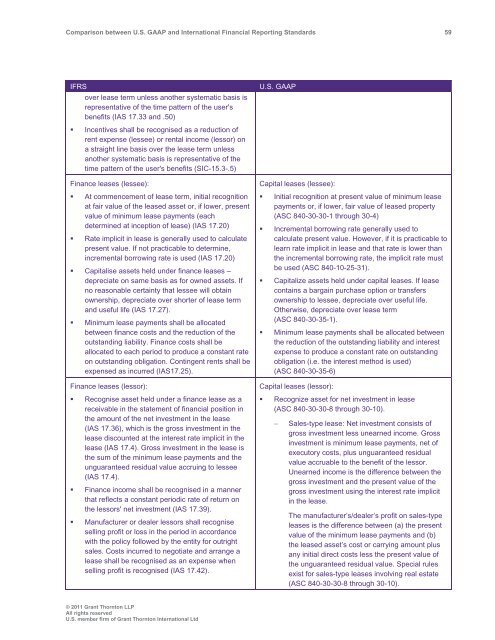

<strong>Comparison</strong> <strong>between</strong> U.S. <strong>GAAP</strong> <strong>and</strong> <strong>International</strong> Financial Reporting St<strong>and</strong>ards 59<br />

IFRS<br />

over lease term unless another systematic basis is<br />

representative of the time pattern of the user's<br />

benefits (IAS 17.33 <strong>and</strong> .50)<br />

• Incentives shall be recognised as a reduction of<br />

rent expense (lessee) or rental income (lessor) on<br />

a straight line basis over the lease term unless<br />

another systematic basis is representative of the<br />

time pattern of the user's benefits (SIC-15.3-.5)<br />

Finance leases (lessee):<br />

• At commencement of lease term, initial recognition<br />

at fair value of the leased asset or, if lower, present<br />

value of minimum lease payments (each<br />

determined at inception of lease) (IAS 17.20)<br />

• Rate implicit in lease is generally used to calculate<br />

present value. If not practicable to determine,<br />

incremental borrowing rate is used (IAS 17.20)<br />

• Capitalise assets held under finance leases –<br />

depreciate on same basis as for owned assets. If<br />

no reasonable certainty that lessee will obtain<br />

ownership, depreciate over shorter of lease term<br />

<strong>and</strong> useful life (IAS 17.27).<br />

• Minimum lease payments shall be allocated<br />

<strong>between</strong> finance costs <strong>and</strong> the reduction of the<br />

outst<strong>and</strong>ing liability. Finance costs shall be<br />

allocated to each period to produce a constant rate<br />

on outst<strong>and</strong>ing obligation. Contingent rents shall be<br />

expensed as incurred (IAS17.25).<br />

Finance leases (lessor):<br />

• Recognise asset held under a finance lease as a<br />

receivable in the statement of financial position in<br />

the amount of the net investment in the lease<br />

(IAS 17.36), which is the gross investment in the<br />

lease discounted at the interest rate implicit in the<br />

lease (IAS 17.4). Gross investment in the lease is<br />

the sum of the minimum lease payments <strong>and</strong> the<br />

unguaranteed residual value accruing to lessee<br />

(IAS 17.4).<br />

• Finance income shall be recognised in a manner<br />

that reflects a constant periodic rate of return on<br />

the lessors' net investment (IAS 17.39).<br />

• Manufacturer or dealer lessors shall recognise<br />

selling profit or loss in the period in accordance<br />

with the policy followed by the entity for outright<br />

sales. Costs incurred to negotiate <strong>and</strong> arrange a<br />

lease shall be recognised as an expense when<br />

selling profit is recognised (IAS 17.42).<br />

U.S. <strong>GAAP</strong><br />

Capital leases (lessee):<br />

• Initial recognition at present value of minimum lease<br />

payments or, if lower, fair value of leased property<br />

(ASC 840-30-30-1 through 30-4)<br />

• Incremental borrowing rate generally used to<br />

calculate present value. However, if it is practicable to<br />

learn rate implicit in lease <strong>and</strong> that rate is lower than<br />

the incremental borrowing rate, the implicit rate must<br />

be used (ASC 840-10-25-31).<br />

• Capitalize assets held under capital leases. If lease<br />

contains a bargain purchase option or transfers<br />

ownership to lessee, depreciate over useful life.<br />

Otherwise, depreciate over lease term<br />

(ASC 840-30-35-1).<br />

• Minimum lease payments shall be allocated <strong>between</strong><br />

the reduction of the outst<strong>and</strong>ing liability <strong>and</strong> interest<br />

expense to produce a constant rate on outst<strong>and</strong>ing<br />

obligation (i.e. the interest method is used)<br />

(ASC 840-30-35-6)<br />

Capital leases (lessor):<br />

• Recognize asset for net investment in lease<br />

(ASC 840-30-30-8 through 30-10).<br />

<br />

Sales-type lease: Net investment consists of<br />

gross investment less unearned income. Gross<br />

investment is minimum lease payments, net of<br />

executory costs, plus unguaranteed residual<br />

value accruable to the benefit of the lessor.<br />

Unearned income is the difference <strong>between</strong> the<br />

gross investment <strong>and</strong> the present value of the<br />

gross investment using the interest rate implicit<br />

in the lease.<br />

The manufacturer’s/dealer’s profit on sales-type<br />

leases is the difference <strong>between</strong> (a) the present<br />

value of the minimum lease payments <strong>and</strong> (b)<br />

the leased asset’s cost or carrying amount plus<br />

any initial direct costs less the present value of<br />

the unguaranteed residual value. Special rules<br />

exist for sales-type leases involving real estate<br />

(ASC 840-30-30-8 through 30-10).<br />

© 2011 <strong>Grant</strong> <strong>Thornton</strong> LLP<br />

All rights reserved<br />

U.S. member firm of <strong>Grant</strong> <strong>Thornton</strong> <strong>International</strong> Ltd