Comparison between U.S. GAAP and International ... - Grant Thornton

Comparison between U.S. GAAP and International ... - Grant Thornton

Comparison between U.S. GAAP and International ... - Grant Thornton

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

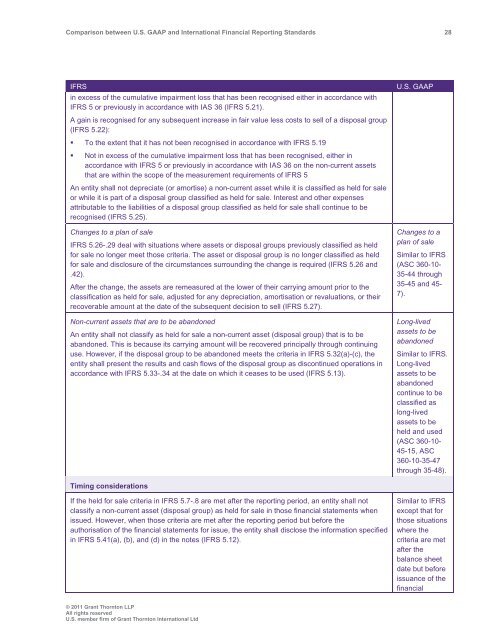

<strong>Comparison</strong> <strong>between</strong> U.S. <strong>GAAP</strong> <strong>and</strong> <strong>International</strong> Financial Reporting St<strong>and</strong>ards 28<br />

IFRS<br />

in excess of the cumulative impairment loss that has been recognised either in accordance with<br />

IFRS 5 or previously in accordance with IAS 36 (IFRS 5.21).<br />

A gain is recognised for any subsequent increase in fair value less costs to sell of a disposal group<br />

(IFRS 5.22):<br />

• To the extent that it has not been recognised in accordance with IFRS 5.19<br />

• Not in excess of the cumulative impairment loss that has been recognised, either in<br />

accordance with IFRS 5 or previously in accordance with IAS 36 on the non-current assets<br />

that are within the scope of the measurement requirements of IFRS 5<br />

An entity shall not depreciate (or amortise) a non-current asset while it is classified as held for sale<br />

or while it is part of a disposal group classified as held for sale. Interest <strong>and</strong> other expenses<br />

attributable to the liabilities of a disposal group classified as held for sale shall continue to be<br />

recognised (IFRS 5.25).<br />

Changes to a plan of sale<br />

IFRS 5.26-.29 deal with situations where assets or disposal groups previously classified as held<br />

for sale no longer meet those criteria. The asset or disposal group is no longer classified as held<br />

for sale <strong>and</strong> disclosure of the circumstances surrounding the change is required (IFRS 5.26 <strong>and</strong><br />

.42).<br />

After the change, the assets are remeasured at the lower of their carrying amount prior to the<br />

classification as held for sale, adjusted for any depreciation, amortisation or revaluations, or their<br />

recoverable amount at the date of the subsequent decision to sell (IFRS 5.27).<br />

Non-current assets that are to be ab<strong>and</strong>oned<br />

An entity shall not classify as held for sale a non-current asset (disposal group) that is to be<br />

ab<strong>and</strong>oned. This is because its carrying amount will be recovered principally through continuing<br />

use. However, if the disposal group to be ab<strong>and</strong>oned meets the criteria in IFRS 5.32(a)-(c), the<br />

entity shall present the results <strong>and</strong> cash flows of the disposal group as discontinued operations in<br />

accordance with IFRS 5.33-.34 at the date on which it ceases to be used (IFRS 5.13).<br />

U.S. <strong>GAAP</strong><br />

Changes to a<br />

plan of sale<br />

Similar to IFRS<br />

(ASC 360-10-<br />

35-44 through<br />

35-45 <strong>and</strong> 45-<br />

7).<br />

Long-lived<br />

assets to be<br />

ab<strong>and</strong>oned<br />

Similar to IFRS.<br />

Long-lived<br />

assets to be<br />

ab<strong>and</strong>oned<br />

continue to be<br />

classified as<br />

long-lived<br />

assets to be<br />

held <strong>and</strong> used<br />

(ASC 360-10-<br />

45-15, ASC<br />

360-10-35-47<br />

through 35-48).<br />

Timing considerations<br />

If the held for sale criteria in IFRS 5.7-.8 are met after the reporting period, an entity shall not<br />

classify a non-current asset (disposal group) as held for sale in those financial statements when<br />

issued. However, when those criteria are met after the reporting period but before the<br />

authorisation of the financial statements for issue, the entity shall disclose the information specified<br />

in IFRS 5.41(a), (b), <strong>and</strong> (d) in the notes (IFRS 5.12).<br />

Similar to IFRS<br />

except that for<br />

those situations<br />

where the<br />

criteria are met<br />

after the<br />

balance sheet<br />

date but before<br />

issuance of the<br />

financial<br />

© 2011 <strong>Grant</strong> <strong>Thornton</strong> LLP<br />

All rights reserved<br />

U.S. member firm of <strong>Grant</strong> <strong>Thornton</strong> <strong>International</strong> Ltd