Comparison between U.S. GAAP and International ... - Grant Thornton

Comparison between U.S. GAAP and International ... - Grant Thornton

Comparison between U.S. GAAP and International ... - Grant Thornton

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

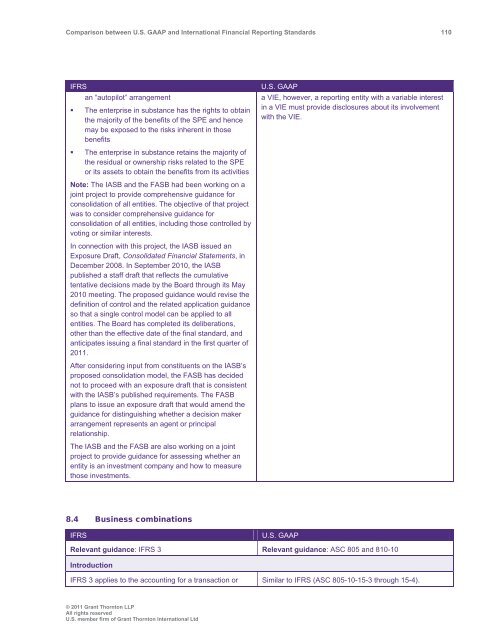

<strong>Comparison</strong> <strong>between</strong> U.S. <strong>GAAP</strong> <strong>and</strong> <strong>International</strong> Financial Reporting St<strong>and</strong>ards 110<br />

IFRS<br />

an “autopilot” arrangement<br />

• The enterprise in substance has the rights to obtain<br />

the majority of the benefits of the SPE <strong>and</strong> hence<br />

may be exposed to the risks inherent in those<br />

benefits<br />

• The enterprise in substance retains the majority of<br />

the residual or ownership risks related to the SPE<br />

or its assets to obtain the benefits from its activities<br />

Note: The IASB <strong>and</strong> the FASB had been working on a<br />

joint project to provide comprehensive guidance for<br />

consolidation of all entities. The objective of that project<br />

was to consider comprehensive guidance for<br />

consolidation of all entities, including those controlled by<br />

voting or similar interests.<br />

In connection with this project, the IASB issued an<br />

Exposure Draft, Consolidated Financial Statements, in<br />

December 2008. In September 2010, the IASB<br />

published a staff draft that reflects the cumulative<br />

tentative decisions made by the Board through its May<br />

2010 meeting. The proposed guidance would revise the<br />

definition of control <strong>and</strong> the related application guidance<br />

so that a single control model can be applied to all<br />

entities. The Board has completed its deliberations,<br />

other than the effective date of the final st<strong>and</strong>ard, <strong>and</strong><br />

anticipates issuing a final st<strong>and</strong>ard in the first quarter of<br />

2011.<br />

After considering input from constituents on the IASB’s<br />

proposed consolidation model, the FASB has decided<br />

not to proceed with an exposure draft that is consistent<br />

with the IASB’s published requirements. The FASB<br />

plans to issue an exposure draft that would amend the<br />

guidance for distinguishing whether a decision maker<br />

arrangement represents an agent or principal<br />

relationship.<br />

The IASB <strong>and</strong> the FASB are also working on a joint<br />

project to provide guidance for assessing whether an<br />

entity is an investment company <strong>and</strong> how to measure<br />

those investments.<br />

U.S. <strong>GAAP</strong><br />

a VIE, however, a reporting entity with a variable interest<br />

in a VIE must provide disclosures about its involvement<br />

with the VIE.<br />

8.4 Business combinations<br />

IFRS<br />

U.S. <strong>GAAP</strong><br />

Relevant guidance: IFRS 3 Relevant guidance: ASC 805 <strong>and</strong> 810-10<br />

Introduction<br />

IFRS 3 applies to the accounting for a transaction or Similar to IFRS (ASC 805-10-15-3 through 15-4).<br />

© 2011 <strong>Grant</strong> <strong>Thornton</strong> LLP<br />

All rights reserved<br />

U.S. member firm of <strong>Grant</strong> <strong>Thornton</strong> <strong>International</strong> Ltd