Comparison between U.S. GAAP and International ... - Grant Thornton

Comparison between U.S. GAAP and International ... - Grant Thornton

Comparison between U.S. GAAP and International ... - Grant Thornton

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

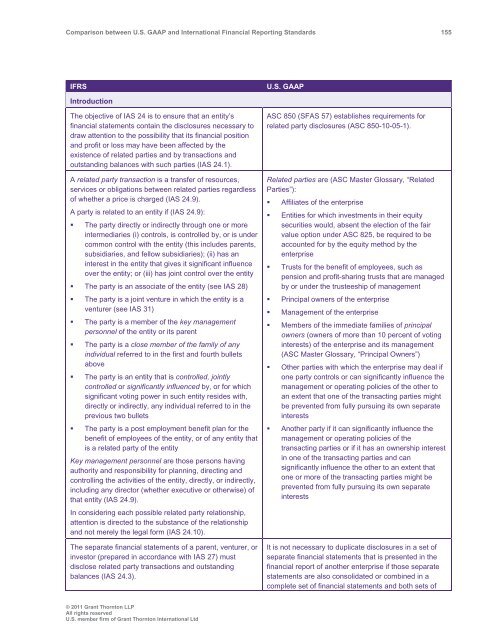

<strong>Comparison</strong> <strong>between</strong> U.S. <strong>GAAP</strong> <strong>and</strong> <strong>International</strong> Financial Reporting St<strong>and</strong>ards 155<br />

IFRS<br />

U.S. <strong>GAAP</strong><br />

Introduction<br />

The objective of IAS 24 is to ensure that an entity’s<br />

financial statements contain the disclosures necessary to<br />

draw attention to the possibility that its financial position<br />

<strong>and</strong> profit or loss may have been affected by the<br />

existence of related parties <strong>and</strong> by transactions <strong>and</strong><br />

outst<strong>and</strong>ing balances with such parties (IAS 24.1).<br />

A related party transaction is a transfer of resources,<br />

services or obligations <strong>between</strong> related parties regardless<br />

of whether a price is charged (IAS 24.9).<br />

A party is related to an entity if (IAS 24.9):<br />

• The party directly or indirectly through one or more<br />

intermediaries (i) controls, is controlled by, or is under<br />

common control with the entity (this includes parents,<br />

subsidiaries, <strong>and</strong> fellow subsidiaries); (ii) has an<br />

interest in the entity that gives it significant influence<br />

over the entity; or (iii) has joint control over the entity<br />

• The party is an associate of the entity (see IAS 28)<br />

• The party is a joint venture in which the entity is a<br />

venturer (see IAS 31)<br />

• The party is a member of the key management<br />

personnel of the entity or its parent<br />

• The party is a close member of the family of any<br />

individual referred to in the first <strong>and</strong> fourth bullets<br />

above<br />

• The party is an entity that is controlled, jointly<br />

controlled or significantly influenced by, or for which<br />

significant voting power in such entity resides with,<br />

directly or indirectly, any individual referred to in the<br />

previous two bullets<br />

• The party is a post employment benefit plan for the<br />

benefit of employees of the entity, or of any entity that<br />

is a related party of the entity<br />

Key management personnel are those persons having<br />

authority <strong>and</strong> responsibility for planning, directing <strong>and</strong><br />

controlling the activities of the entity, directly, or indirectly,<br />

including any director (whether executive or otherwise) of<br />

that entity (IAS 24.9).<br />

In considering each possible related party relationship,<br />

attention is directed to the substance of the relationship<br />

<strong>and</strong> not merely the legal form (IAS 24.10).<br />

The separate financial statements of a parent, venturer, or<br />

investor (prepared in accordance with IAS 27) must<br />

disclose related party transactions <strong>and</strong> outst<strong>and</strong>ing<br />

balances (IAS 24.3).<br />

ASC 850 (SFAS 57) establishes requirements for<br />

related party disclosures (ASC 850-10-05-1).<br />

Related parties are (ASC Master Glossary, “Related<br />

Parties”):<br />

• Affiliates of the enterprise<br />

• Entities for which investments in their equity<br />

securities would, absent the election of the fair<br />

value option under ASC 825, be required to be<br />

accounted for by the equity method by the<br />

enterprise<br />

• Trusts for the benefit of employees, such as<br />

pension <strong>and</strong> profit-sharing trusts that are managed<br />

by or under the trusteeship of management<br />

• Principal owners of the enterprise<br />

• Management of the enterprise<br />

• Members of the immediate families of principal<br />

owners (owners of more than 10 percent of voting<br />

interests) of the enterprise <strong>and</strong> its management<br />

(ASC Master Glossary, “Principal Owners”)<br />

• Other parties with which the enterprise may deal if<br />

one party controls or can significantly influence the<br />

management or operating policies of the other to<br />

an extent that one of the transacting parties might<br />

be prevented from fully pursuing its own separate<br />

interests<br />

• Another party if it can significantly influence the<br />

management or operating policies of the<br />

transacting parties or if it has an ownership interest<br />

in one of the transacting parties <strong>and</strong> can<br />

significantly influence the other to an extent that<br />

one or more of the transacting parties might be<br />

prevented from fully pursuing its own separate<br />

interests<br />

It is not necessary to duplicate disclosures in a set of<br />

separate financial statements that is presented in the<br />

financial report of another enterprise if those separate<br />

statements are also consolidated or combined in a<br />

complete set of financial statements <strong>and</strong> both sets of<br />

© 2011 <strong>Grant</strong> <strong>Thornton</strong> LLP<br />

All rights reserved<br />

U.S. member firm of <strong>Grant</strong> <strong>Thornton</strong> <strong>International</strong> Ltd