Comparison between U.S. GAAP and International ... - Grant Thornton

Comparison between U.S. GAAP and International ... - Grant Thornton

Comparison between U.S. GAAP and International ... - Grant Thornton

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

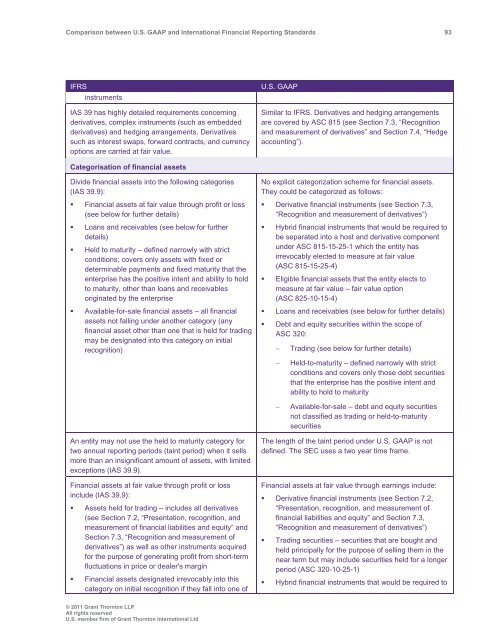

<strong>Comparison</strong> <strong>between</strong> U.S. <strong>GAAP</strong> <strong>and</strong> <strong>International</strong> Financial Reporting St<strong>and</strong>ards 93<br />

IFRS<br />

instruments<br />

IAS 39 has highly detailed requirements concerning<br />

derivatives, complex instruments (such as embedded<br />

derivatives) <strong>and</strong> hedging arrangements. Derivatives<br />

such as interest swaps, forward contracts, <strong>and</strong> currency<br />

options are carried at fair value.<br />

U.S. <strong>GAAP</strong><br />

Similar to IFRS. Derivatives <strong>and</strong> hedging arrangements<br />

are covered by ASC 815 (see Section 7.3, “Recognition<br />

<strong>and</strong> measurement of derivatives” <strong>and</strong> Section 7.4, “Hedge<br />

accounting”).<br />

Categorisation of financial assets<br />

Divide financial assets into the following categories<br />

(IAS 39.9):<br />

• Financial assets at fair value through profit or loss<br />

(see below for further details)<br />

• Loans <strong>and</strong> receivables (see below for further<br />

details)<br />

• Held to maturity – defined narrowly with strict<br />

conditions; covers only assets with fixed or<br />

determinable payments <strong>and</strong> fixed maturity that the<br />

enterprise has the positive intent <strong>and</strong> ability to hold<br />

to maturity, other than loans <strong>and</strong> receivables<br />

originated by the enterprise<br />

• Available-for-sale financial assets – all financial<br />

assets not falling under another category (any<br />

financial asset other than one that is held for trading<br />

may be designated into this category on initial<br />

recognition)<br />

No explicit categorization scheme for financial assets.<br />

They could be categorized as follows:<br />

• Derivative financial instruments (see Section 7.3,<br />

“Recognition <strong>and</strong> measurement of derivatives”)<br />

• Hybrid financial instruments that would be required to<br />

be separated into a host <strong>and</strong> derivative component<br />

under ASC 815-15-25-1 which the entity has<br />

irrevocably elected to measure at fair value<br />

(ASC 815-15-25-4)<br />

• Eligible financial assets that the entity elects to<br />

measure at fair value – fair value option<br />

(ASC 825-10-15-4)<br />

• Loans <strong>and</strong> receivables (see below for further details)<br />

• Debt <strong>and</strong> equity securities within the scope of<br />

ASC 320:<br />

<br />

<br />

Trading (see below for further details)<br />

Held-to-maturity – defined narrowly with strict<br />

conditions <strong>and</strong> covers only those debt securities<br />

that the enterprise has the positive intent <strong>and</strong><br />

ability to hold to maturity<br />

<br />

Available-for-sale – debt <strong>and</strong> equity securities<br />

not classified as trading or held-to-maturity<br />

securities<br />

An entity may not use the held to maturity category for<br />

two annual reporting periods (taint period) when it sells<br />

more than an insignificant amount of assets, with limited<br />

exceptions (IAS 39.9).<br />

Financial assets at fair value through profit or loss<br />

include (IAS 39.9):<br />

• Assets held for trading – includes all derivatives<br />

(see Section 7.2, “Presentation, recognition, <strong>and</strong><br />

measurement of financial liabilities <strong>and</strong> equity” <strong>and</strong><br />

Section 7.3, “Recognition <strong>and</strong> measurement of<br />

derivatives”) as well as other instruments acquired<br />

for the purpose of generating profit from short-term<br />

fluctuations in price or dealer's margin<br />

• Financial assets designated irrevocably into this<br />

category on initial recognition if they fall into one of<br />

The length of the taint period under U.S. <strong>GAAP</strong> is not<br />

defined. The SEC uses a two year time frame.<br />

Financial assets at fair value through earnings include:<br />

• Derivative financial instruments (see Section 7.2,<br />

“Presentation, recognition, <strong>and</strong> measurement of<br />

financial liabilities <strong>and</strong> equity” <strong>and</strong> Section 7.3,<br />

“Recognition <strong>and</strong> measurement of derivatives”)<br />

• Trading securities – securities that are bought <strong>and</strong><br />

held principally for the purpose of selling them in the<br />

near term but may include securities held for a longer<br />

period (ASC 320-10-25-1)<br />

• Hybrid financial instruments that would be required to<br />

© 2011 <strong>Grant</strong> <strong>Thornton</strong> LLP<br />

All rights reserved<br />

U.S. member firm of <strong>Grant</strong> <strong>Thornton</strong> <strong>International</strong> Ltd