Comparison between U.S. GAAP and International ... - Grant Thornton

Comparison between U.S. GAAP and International ... - Grant Thornton

Comparison between U.S. GAAP and International ... - Grant Thornton

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

<strong>Comparison</strong> <strong>between</strong> U.S. <strong>GAAP</strong> <strong>and</strong> <strong>International</strong> Financial Reporting St<strong>and</strong>ards 13<br />

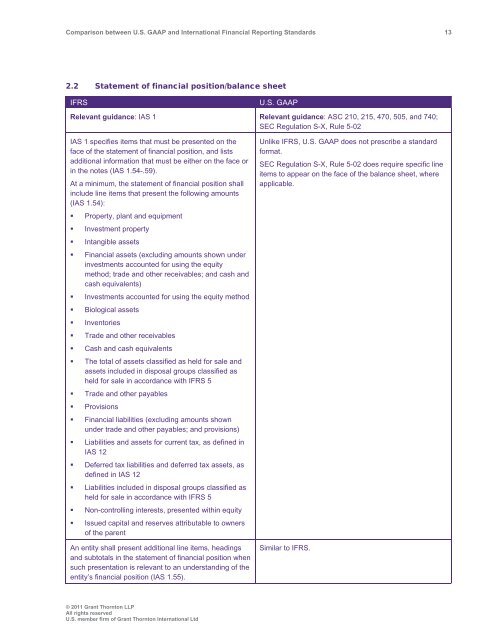

2.2 Statement of financial position/balance sheet<br />

IFRS<br />

U.S. <strong>GAAP</strong><br />

Relevant guidance: IAS 1 Relevant guidance: ASC 210, 215, 470, 505, <strong>and</strong> 740;<br />

SEC Regulation S-X, Rule 5-02<br />

IAS 1 specifies items that must be presented on the<br />

face of the statement of financial position, <strong>and</strong> lists<br />

additional information that must be either on the face or<br />

in the notes (IAS 1.54-.59).<br />

At a minimum, the statement of financial position shall<br />

include line items that present the following amounts<br />

(IAS 1.54):<br />

• Property, plant <strong>and</strong> equipment<br />

• Investment property<br />

• Intangible assets<br />

• Financial assets (excluding amounts shown under<br />

investments accounted for using the equity<br />

method; trade <strong>and</strong> other receivables; <strong>and</strong> cash <strong>and</strong><br />

cash equivalents)<br />

• Investments accounted for using the equity method<br />

• Biological assets<br />

• Inventories<br />

• Trade <strong>and</strong> other receivables<br />

• Cash <strong>and</strong> cash equivalents<br />

• The total of assets classified as held for sale <strong>and</strong><br />

assets included in disposal groups classified as<br />

held for sale in accordance with IFRS 5<br />

• Trade <strong>and</strong> other payables<br />

• Provisions<br />

• Financial liabilities (excluding amounts shown<br />

under trade <strong>and</strong> other payables; <strong>and</strong> provisions)<br />

• Liabilities <strong>and</strong> assets for current tax, as defined in<br />

IAS 12<br />

• Deferred tax liabilities <strong>and</strong> deferred tax assets, as<br />

defined in IAS 12<br />

• Liabilities included in disposal groups classified as<br />

held for sale in accordance with IFRS 5<br />

• Non-controlling interests, presented within equity<br />

• Issued capital <strong>and</strong> reserves attributable to owners<br />

of the parent<br />

An entity shall present additional line items, headings<br />

<strong>and</strong> subtotals in the statement of financial position when<br />

such presentation is relevant to an underst<strong>and</strong>ing of the<br />

entity’s financial position (IAS 1.55).<br />

Unlike IFRS, U.S. <strong>GAAP</strong> does not prescribe a st<strong>and</strong>ard<br />

format.<br />

SEC Regulation S-X, Rule 5-02 does require specific line<br />

items to appear on the face of the balance sheet, where<br />

applicable.<br />

Similar to IFRS.<br />

© 2011 <strong>Grant</strong> <strong>Thornton</strong> LLP<br />

All rights reserved<br />

U.S. member firm of <strong>Grant</strong> <strong>Thornton</strong> <strong>International</strong> Ltd