Comparison between U.S. GAAP and International ... - Grant Thornton

Comparison between U.S. GAAP and International ... - Grant Thornton

Comparison between U.S. GAAP and International ... - Grant Thornton

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

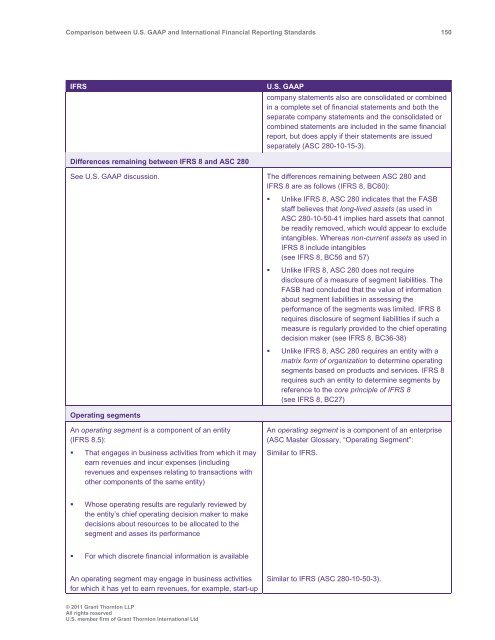

<strong>Comparison</strong> <strong>between</strong> U.S. <strong>GAAP</strong> <strong>and</strong> <strong>International</strong> Financial Reporting St<strong>and</strong>ards 150<br />

IFRS<br />

U.S. <strong>GAAP</strong><br />

company statements also are consolidated or combined<br />

in a complete set of financial statements <strong>and</strong> both the<br />

separate company statements <strong>and</strong> the consolidated or<br />

combined statements are included in the same financial<br />

report, but does apply if their statements are issued<br />

separately (ASC 280-10-15-3).<br />

Differences remaining <strong>between</strong> IFRS 8 <strong>and</strong> ASC 280<br />

See U.S. <strong>GAAP</strong> discussion.<br />

The differences remaining <strong>between</strong> ASC 280 <strong>and</strong><br />

IFRS 8 are as follows (IFRS 8, BC60):<br />

• Unlike IFRS 8, ASC 280 indicates that the FASB<br />

staff believes that long-lived assets (as used in<br />

ASC 280-10-50-41 implies hard assets that cannot<br />

be readily removed, which would appear to exclude<br />

intangibles. Whereas non-current assets as used in<br />

IFRS 8 include intangibles<br />

(see IFRS 8, BC56 <strong>and</strong> 57)<br />

• Unlike IFRS 8, ASC 280 does not require<br />

disclosure of a measure of segment liabilities. The<br />

FASB had concluded that the value of information<br />

about segment liabilities in assessing the<br />

performance of the segments was limited. IFRS 8<br />

requires disclosure of segment liabilities if such a<br />

measure is regularly provided to the chief operating<br />

decision maker (see IFRS 8, BC36-38)<br />

• Unlike IFRS 8, ASC 280 requires an entity with a<br />

matrix form of organization to determine operating<br />

segments based on products <strong>and</strong> services. IFRS 8<br />

requires such an entity to determine segments by<br />

reference to the core principle of IFRS 8<br />

(see IFRS 8, BC27)<br />

Operating segments<br />

An operating segment is a component of an entity<br />

(IFRS 8.5):<br />

• That engages in business activities from which it may<br />

earn revenues <strong>and</strong> incur expenses (including<br />

revenues <strong>and</strong> expenses relating to transactions with<br />

other components of the same entity)<br />

An operating segment is a component of an enterprise<br />

(ASC Master Glossary, “Operating Segment”:<br />

Similar to IFRS.<br />

• Whose operating results are regularly reviewed by<br />

the entity’s chief operating decision maker to make<br />

decisions about resources to be allocated to the<br />

segment <strong>and</strong> asses its performance<br />

• For which discrete financial information is available<br />

An operating segment may engage in business activities<br />

for which it has yet to earn revenues, for example, start-up<br />

Similar to IFRS (ASC 280-10-50-3).<br />

© 2011 <strong>Grant</strong> <strong>Thornton</strong> LLP<br />

All rights reserved<br />

U.S. member firm of <strong>Grant</strong> <strong>Thornton</strong> <strong>International</strong> Ltd