Comparison between U.S. GAAP and International ... - Grant Thornton

Comparison between U.S. GAAP and International ... - Grant Thornton

Comparison between U.S. GAAP and International ... - Grant Thornton

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

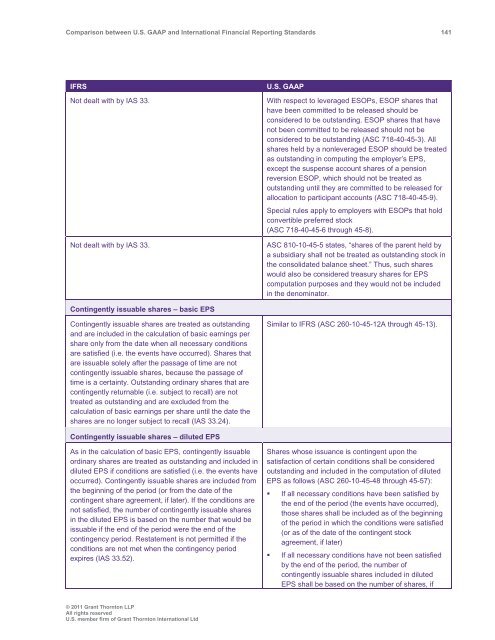

<strong>Comparison</strong> <strong>between</strong> U.S. <strong>GAAP</strong> <strong>and</strong> <strong>International</strong> Financial Reporting St<strong>and</strong>ards 141<br />

IFRS<br />

Not dealt with by IAS 33.<br />

Not dealt with by IAS 33.<br />

U.S. <strong>GAAP</strong><br />

With respect to leveraged ESOPs, ESOP shares that<br />

have been committed to be released should be<br />

considered to be outst<strong>and</strong>ing. ESOP shares that have<br />

not been committed to be released should not be<br />

considered to be outst<strong>and</strong>ing (ASC 718-40-45-3). All<br />

shares held by a nonleveraged ESOP should be treated<br />

as outst<strong>and</strong>ing in computing the employer’s EPS,<br />

except the suspense account shares of a pension<br />

reversion ESOP, which should not be treated as<br />

outst<strong>and</strong>ing until they are committed to be released for<br />

allocation to participant accounts (ASC 718-40-45-9).<br />

Special rules apply to employers with ESOPs that hold<br />

convertible preferred stock<br />

(ASC 718-40-45-6 through 45-8).<br />

ASC 810-10-45-5 states, “shares of the parent held by<br />

a subsidiary shall not be treated as outst<strong>and</strong>ing stock in<br />

the consolidated balance sheet.” Thus, such shares<br />

would also be considered treasury shares for EPS<br />

computation purposes <strong>and</strong> they would not be included<br />

in the denominator.<br />

Contingently issuable shares – basic EPS<br />

Contingently issuable shares are treated as outst<strong>and</strong>ing<br />

<strong>and</strong> are included in the calculation of basic earnings per<br />

share only from the date when all necessary conditions<br />

are satisfied (i.e. the events have occurred). Shares that<br />

are issuable solely after the passage of time are not<br />

contingently issuable shares, because the passage of<br />

time is a certainty. Outst<strong>and</strong>ing ordinary shares that are<br />

contingently returnable (i.e. subject to recall) are not<br />

treated as outst<strong>and</strong>ing <strong>and</strong> are excluded from the<br />

calculation of basic earnings per share until the date the<br />

shares are no longer subject to recall (IAS 33.24).<br />

Similar to IFRS (ASC 260-10-45-12A through 45-13).<br />

Contingently issuable shares – diluted EPS<br />

As in the calculation of basic EPS, contingently issuable<br />

ordinary shares are treated as outst<strong>and</strong>ing <strong>and</strong> included in<br />

diluted EPS if conditions are satisfied (i.e. the events have<br />

occurred). Contingently issuable shares are included from<br />

the beginning of the period (or from the date of the<br />

contingent share agreement, if later). If the conditions are<br />

not satisfied, the number of contingently issuable shares<br />

in the diluted EPS is based on the number that would be<br />

issuable if the end of the period were the end of the<br />

contingency period. Restatement is not permitted if the<br />

conditions are not met when the contingency period<br />

expires (IAS 33.52).<br />

Shares whose issuance is contingent upon the<br />

satisfaction of certain conditions shall be considered<br />

outst<strong>and</strong>ing <strong>and</strong> included in the computation of diluted<br />

EPS as follows (ASC 260-10-45-48 through 45-57):<br />

• If all necessary conditions have been satisfied by<br />

the end of the period (the events have occurred),<br />

those shares shall be included as of the beginning<br />

of the period in which the conditions were satisfied<br />

(or as of the date of the contingent stock<br />

agreement, if later)<br />

• If all necessary conditions have not been satisfied<br />

by the end of the period, the number of<br />

contingently issuable shares included in diluted<br />

EPS shall be based on the number of shares, if<br />

© 2011 <strong>Grant</strong> <strong>Thornton</strong> LLP<br />

All rights reserved<br />

U.S. member firm of <strong>Grant</strong> <strong>Thornton</strong> <strong>International</strong> Ltd