Comparison between U.S. GAAP and International ... - Grant Thornton

Comparison between U.S. GAAP and International ... - Grant Thornton

Comparison between U.S. GAAP and International ... - Grant Thornton

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

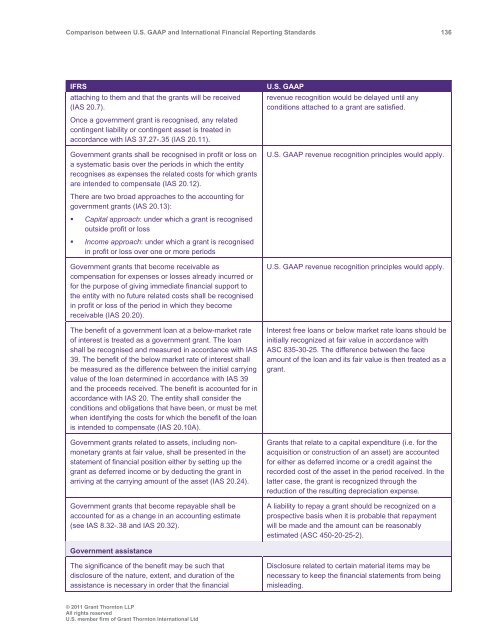

<strong>Comparison</strong> <strong>between</strong> U.S. <strong>GAAP</strong> <strong>and</strong> <strong>International</strong> Financial Reporting St<strong>and</strong>ards 136<br />

IFRS<br />

attaching to them <strong>and</strong> that the grants will be received<br />

(IAS 20.7).<br />

Once a government grant is recognised, any related<br />

contingent liability or contingent asset is treated in<br />

accordance with IAS 37.27-.35 (IAS 20.11).<br />

Government grants shall be recognised in profit or loss on<br />

a systematic basis over the periods in which the entity<br />

recognises as expenses the related costs for which grants<br />

are intended to compensate (IAS 20.12).<br />

U.S. <strong>GAAP</strong><br />

revenue recognition would be delayed until any<br />

conditions attached to a grant are satisfied.<br />

U.S. <strong>GAAP</strong> revenue recognition principles would apply.<br />

There are two broad approaches to the accounting for<br />

government grants (IAS 20.13):<br />

• Capital approach: under which a grant is recognised<br />

outside profit or loss<br />

• Income approach: under which a grant is recognised<br />

in profit or loss over one or more periods<br />

Government grants that become receivable as<br />

compensation for expenses or losses already incurred or<br />

for the purpose of giving immediate financial support to<br />

the entity with no future related costs shall be recognised<br />

in profit or loss of the period in which they become<br />

receivable (IAS 20.20).<br />

The benefit of a government loan at a below-market rate<br />

of interest is treated as a government grant. The loan<br />

shall be recognised <strong>and</strong> measured in accordance with IAS<br />

39. The benefit of the below market rate of interest shall<br />

be measured as the difference <strong>between</strong> the initial carrying<br />

value of the loan determined in accordance with IAS 39<br />

<strong>and</strong> the proceeds received. The benefit is accounted for in<br />

accordance with IAS 20. The entity shall consider the<br />

conditions <strong>and</strong> obligations that have been, or must be met<br />

when identifying the costs for which the benefit of the loan<br />

is intended to compensate (IAS 20.10A).<br />

Government grants related to assets, including nonmonetary<br />

grants at fair value, shall be presented in the<br />

statement of financial position either by setting up the<br />

grant as deferred income or by deducting the grant in<br />

arriving at the carrying amount of the asset (IAS 20.24).<br />

Government grants that become repayable shall be<br />

accounted for as a change in an accounting estimate<br />

(see IAS 8.32-.38 <strong>and</strong> IAS 20.32).<br />

U.S. <strong>GAAP</strong> revenue recognition principles would apply.<br />

Interest free loans or below market rate loans should be<br />

initially recognized at fair value in accordance with<br />

ASC 835-30-25. The difference <strong>between</strong> the face<br />

amount of the loan <strong>and</strong> its fair value is then treated as a<br />

grant.<br />

<strong>Grant</strong>s that relate to a capital expenditure (i.e. for the<br />

acquisition or construction of an asset) are accounted<br />

for either as deferred income or a credit against the<br />

recorded cost of the asset in the period received. In the<br />

latter case, the grant is recognized through the<br />

reduction of the resulting depreciation expense.<br />

A liability to repay a grant should be recognized on a<br />

prospective basis when it is probable that repayment<br />

will be made <strong>and</strong> the amount can be reasonably<br />

estimated (ASC 450-20-25-2).<br />

Government assistance<br />

The significance of the benefit may be such that<br />

disclosure of the nature, extent, <strong>and</strong> duration of the<br />

assistance is necessary in order that the financial<br />

Disclosure related to certain material items may be<br />

necessary to keep the financial statements from being<br />

misleading.<br />

© 2011 <strong>Grant</strong> <strong>Thornton</strong> LLP<br />

All rights reserved<br />

U.S. member firm of <strong>Grant</strong> <strong>Thornton</strong> <strong>International</strong> Ltd