Comparison between U.S. GAAP and International ... - Grant Thornton

Comparison between U.S. GAAP and International ... - Grant Thornton

Comparison between U.S. GAAP and International ... - Grant Thornton

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

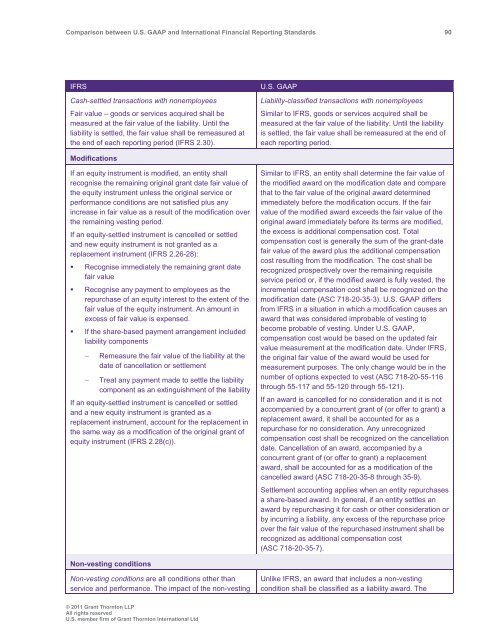

<strong>Comparison</strong> <strong>between</strong> U.S. <strong>GAAP</strong> <strong>and</strong> <strong>International</strong> Financial Reporting St<strong>and</strong>ards 90<br />

IFRS<br />

Cash-settled transactions with nonemployees<br />

Fair value – goods or services acquired shall be<br />

measured at the fair value of the liability. Until the<br />

liability is settled, the fair value shall be remeasured at<br />

the end of each reporting period (IFRS 2.30).<br />

U.S. <strong>GAAP</strong><br />

Liability-classified transactions with nonemployees<br />

Similar to IFRS, goods or services acquired shall be<br />

measured at the fair value of the liability. Until the liability<br />

is settled, the fair value shall be remeasured at the end of<br />

each reporting period.<br />

Modifications<br />

If an equity instrument is modified, an entity shall<br />

recognise the remaining original grant date fair value of<br />

the equity instrument unless the original service or<br />

performance conditions are not satisfied plus any<br />

increase in fair value as a result of the modification over<br />

the remaining vesting period.<br />

If an equity-settled instrument is cancelled or settled<br />

<strong>and</strong> new equity instrument is not granted as a<br />

replacement instrument (IFRS 2.26-28):<br />

• Recognise immediately the remaining grant date<br />

fair value<br />

• Recognise any payment to employees as the<br />

repurchase of an equity interest to the extent of the<br />

fair value of the equity instrument. An amount in<br />

excess of fair value is expensed.<br />

• If the share-based payment arrangement included<br />

liability components<br />

<br />

Remeasure the fair value of the liability at the<br />

date of cancellation or settlement<br />

Treat any payment made to settle the liability<br />

component as an extinguishment of the liability<br />

If an equity-settled instrument is cancelled or settled<br />

<strong>and</strong> a new equity instrument is granted as a<br />

replacement instrument, account for the replacement in<br />

the same way as a modification of the original grant of<br />

equity instrument (IFRS 2.28(c)).<br />

Similar to IFRS, an entity shall determine the fair value of<br />

the modified award on the modification date <strong>and</strong> compare<br />

that to the fair value of the original award determined<br />

immediately before the modification occurs. If the fair<br />

value of the modified award exceeds the fair value of the<br />

original award immediately before its terms are modified,<br />

the excess is additional compensation cost. Total<br />

compensation cost is generally the sum of the grant-date<br />

fair value of the award plus the additional compensation<br />

cost resulting from the modification. The cost shall be<br />

recognized prospectively over the remaining requisite<br />

service period or, if the modified award is fully vested, the<br />

incremental compensation cost shall be recognized on the<br />

modification date (ASC 718-20-35-3). U.S. <strong>GAAP</strong> differs<br />

from IFRS in a situation in which a modification causes an<br />

award that was considered improbable of vesting to<br />

become probable of vesting. Under U.S. <strong>GAAP</strong>,<br />

compensation cost would be based on the updated fair<br />

value measurement at the modification date. Under IFRS,<br />

the original fair value of the award would be used for<br />

measurement purposes. The only change would be in the<br />

number of options expected to vest (ASC 718-20-55-116<br />

through 55-117 <strong>and</strong> 55-120 through 55-121).<br />

If an award is cancelled for no consideration <strong>and</strong> it is not<br />

accompanied by a concurrent grant of (or offer to grant) a<br />

replacement award, it shall be accounted for as a<br />

repurchase for no consideration. Any unrecognized<br />

compensation cost shall be recognized on the cancellation<br />

date. Cancellation of an award, accompanied by a<br />

concurrent grant of (or offer to grant) a replacement<br />

award, shall be accounted for as a modification of the<br />

cancelled award (ASC 718-20-35-8 through 35-9).<br />

Settlement accounting applies when an entity repurchases<br />

a share-based award. In general, if an entity settles an<br />

award by repurchasing it for cash or other consideration or<br />

by incurring a liability, any excess of the repurchase price<br />

over the fair value of the repurchased instrument shall be<br />

recognized as additional compensation cost<br />

(ASC 718-20-35-7).<br />

Non-vesting conditions<br />

Non-vesting conditions are all conditions other than<br />

service <strong>and</strong> performance. The impact of the non-vesting<br />

Unlike IFRS, an award that includes a non-vesting<br />

condition shall be classified as a liability award. The<br />

© 2011 <strong>Grant</strong> <strong>Thornton</strong> LLP<br />

All rights reserved<br />

U.S. member firm of <strong>Grant</strong> <strong>Thornton</strong> <strong>International</strong> Ltd