Comparison between U.S. GAAP and International ... - Grant Thornton

Comparison between U.S. GAAP and International ... - Grant Thornton

Comparison between U.S. GAAP and International ... - Grant Thornton

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

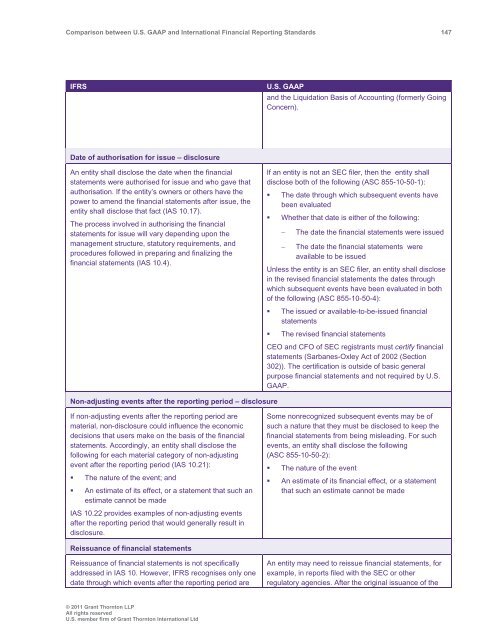

<strong>Comparison</strong> <strong>between</strong> U.S. <strong>GAAP</strong> <strong>and</strong> <strong>International</strong> Financial Reporting St<strong>and</strong>ards 147<br />

IFRS<br />

U.S. <strong>GAAP</strong><br />

<strong>and</strong> the Liquidation Basis of Accounting (formerly Going<br />

Concern).<br />

Date of authorisation for issue – disclosure<br />

An entity shall disclose the date when the financial<br />

statements were authorised for issue <strong>and</strong> who gave that<br />

authorisation. If the entity’s owners or others have the<br />

power to amend the financial statements after issue, the<br />

entity shall disclose that fact (IAS 10.17).<br />

The process involved in authorising the financial<br />

statements for issue will vary depending upon the<br />

management structure, statutory requirements, <strong>and</strong><br />

procedures followed in preparing <strong>and</strong> finalizing the<br />

financial statements (IAS 10.4).<br />

If an entity is not an SEC filer, then the entity shall<br />

disclose both of the following (ASC 855-10-50-1):<br />

• The date through which subsequent events have<br />

been evaluated<br />

• Whether that date is either of the following:<br />

<br />

The date the financial statements were issued<br />

The date the financial statements were<br />

available to be issued<br />

Unless the entity is an SEC filer, an entity shall disclose<br />

in the revised financial statements the dates through<br />

which subsequent events have been evaluated in both<br />

of the following (ASC 855-10-50-4):<br />

• The issued or available-to-be-issued financial<br />

statements<br />

• The revised financial statements<br />

CEO <strong>and</strong> CFO of SEC registrants must certify financial<br />

statements (Sarbanes-Oxley Act of 2002 (Section<br />

302)). The certification is outside of basic general<br />

purpose financial statements <strong>and</strong> not required by U.S.<br />

<strong>GAAP</strong>.<br />

Non-adjusting events after the reporting period – disclosure<br />

If non-adjusting events after the reporting period are<br />

material, non-disclosure could influence the economic<br />

decisions that users make on the basis of the financial<br />

statements. Accordingly, an entity shall disclose the<br />

following for each material category of non-adjusting<br />

event after the reporting period (IAS 10.21):<br />

• The nature of the event; <strong>and</strong><br />

• An estimate of its effect, or a statement that such an<br />

estimate cannot be made<br />

IAS 10.22 provides examples of non-adjusting events<br />

after the reporting period that would generally result in<br />

disclosure.<br />

Some nonrecognized subsequent events may be of<br />

such a nature that they must be disclosed to keep the<br />

financial statements from being misleading. For such<br />

events, an entity shall disclose the following<br />

(ASC 855-10-50-2):<br />

• The nature of the event<br />

• An estimate of its financial effect, or a statement<br />

that such an estimate cannot be made<br />

Reissuance of financial statements<br />

Reissuance of financial statements is not specifically<br />

addressed in IAS 10. However, IFRS recognises only one<br />

date through which events after the reporting period are<br />

An entity may need to reissue financial statements, for<br />

example, in reports filed with the SEC or other<br />

regulatory agencies. After the original issuance of the<br />

© 2011 <strong>Grant</strong> <strong>Thornton</strong> LLP<br />

All rights reserved<br />

U.S. member firm of <strong>Grant</strong> <strong>Thornton</strong> <strong>International</strong> Ltd